Risk should be at the heart of all decisions a company makes when it considers entering international markets. The more the risk, the more value a qualified advisor brings to the project. This article takes a look at the country selection process, timing, size of entry and the different methods you may choose.

Making the decision to sell your products or services in another country can introduce your company to enormous markets, increase revenues and profits, build brand recognition, extend your product’s life and potentially even reduce some risks of future success (adding new markets reduces risk associated with economic or seasonal downturns).

Which country to enter?

You may already have done some on-the-ground due diligence and have a country selected (or many), or you may simply have the idea of exporting but no idea where to go. Trade Horizons get asked this question a lot and its rarely an easy decision without the proper research.

You could start by making a list of countries of interest and start investigating whether your product is suitable for any of the countries on your list? The culture, religion and law of each country are extremely important to consider here. Some countries are very conservative in comparison to the western countries. Trying to export items such as clothes or alcohol may not be easy at all. Dietary requirements can be a tricky proposition to overcome in countries like India.

Once you have started narrowing down your list, consider international business laws in each country. You may need to consult locals to research regional laws and customs to ensure that you are able to take your product or service into that country. You will also need to undertake the usual market research, to ensure that people in your target market will definitely want to buy your product or service! We advise against making assumptions that your product will succeed. Focus groups, for example, don’t give you a clear picture of the competitive landscape, the regulatory barriers or the market challenges you may face with the supply chain, sales channels and so forth.

Growing revenue, customer share, and product reach only happens when you expand into the right markets. What seems like an attractive country has to be investigated on-the-ground to ensure choices being made about market entry are informed decisions and that they minimize the risk around the entry decision?

When to enter?

If you know that your competitors are considering entering the same market as you, there are two options: be ‘first to market’ or wait and see how successful your competitors are and follow them into the market. It comes back to your risk appetite.

By aiming to be ‘first to market’, you will be taking several risks. Firstly, regardless of how thorough your market research is, you cannot guarantee that people will buy what you are selling. Secondly, depending on your market entry method, you may have to invest high capital or meet resistance from potential local partners who are unsure that the product will succeed. This is especially true if you have something previously unavailable to the target market and you will be ‘trailblazing’.

By following your competitors should they succeed, you will know that there is a market for your business and it is much more likely that local companies will be willing to partner with you. However, you run the risk that local customers will have become loyal to your competitors’ brand and will not want to buy from another company.

Scale of entry?

The obvious issue here is cost. Entering a market on a large scale will require significant resources. Although this is more likely to make an impression on a new market as it will attract the attention of customers and local businesses alike, it may be risky financially if your company does not take off. We have advised certain clients to avoid some of the seemingly more attractive (and thus competitive) markets like China and focus on smaller, less competitive countries such as Thailand, avoiding Germany and maybe heading for Turkey. There are many reasons for this advice and it is closely related to the company and products stage in life, barriers of entry and other risk and cost factors. Again, don’t make the assumption that the largest opportunity is the best one for your company at this very moment in time.

Entering on a smaller scale can offer a business the chance to learn about the new region and limit risks – however, you are much less likely to gain significant amounts of attention. Quietly entering export markets is sometimes the best plan.

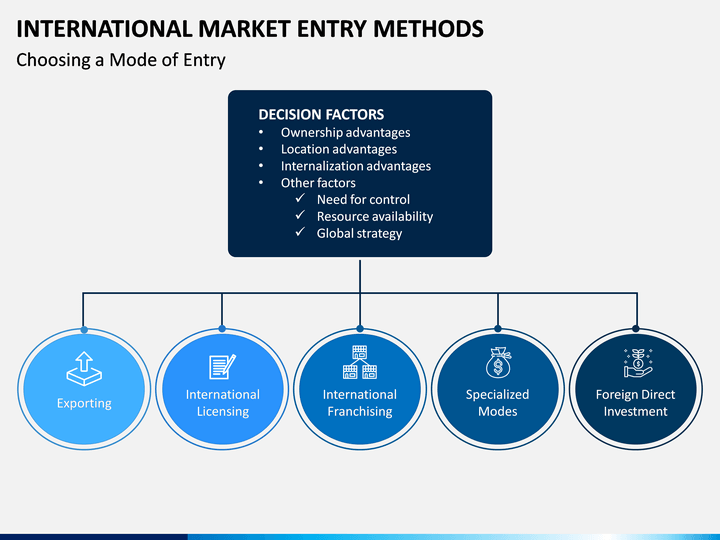

Methods of market entry

Once you know where you are going and the scale of your market entry, you will need to work out how to take your business abroad. This will require careful consideration as your decision could significantly impact your results. There are several market entry methods that can be used. This decision is often made hastily because a local distributor is pressuring you to get started or you may have met an attractive company that is a ‘must buy’. Again, do your in-country due diligence and don’t rush into this decision. Here is a brief overview of the methods applicable to international market entry.

1. Exporting

Exporting is the direct sale of goods and / or services in another country. It is possibly the best-known method of entering a foreign market, as well as the lowest risk. It may also be cost-effective as you will not need to invest in production facilities in your chosen country – all goods are still produced in your home country then sent to foreign countries for sale. However, rising transportation costs are likely to increase the cost of exporting in the near future.

Some companies use direct exporting, in which they sell the product they manufacture in international markets without third-party involvement. Companies that sell luxury products or have sold their goods in global markets in the past often choose this method.

Alternatively, a company may export indirectly by using the services of agents, such as international distributors. Businesses often choose indirect exporting if they’re just beginning to distribute internationally. While companies pay agents for their services, indirect exporting often results in a return on investment (ROI) because the agents know what it takes to succeed in the markets in which they work and they have local networks.

2. Licensing

Licensing allows another company in your target country to use your property. The property in question is normally intangible – for example, trademarks, production techniques or patents. The licensee will pay a fee in order to be allowed the right to use the property.

Licensing requires very little investment and can provide a high return on investment. The licensee will also take care of any manufacturing and marketing costs in the foreign market. A company may choose this method if it has a product that’s in demand and the company to which it plans to license the product has a large market.

3. Piggybacking

Piggybacking can be a cost effective and rapid market entry method. It involves two non-competing companies working together to cross-sell the other’s products or services in their home country. Although it is a low-risk method involving little capital, some companies may not be comfortable with this method as it involves a high degree of trust as well as allowing the partner company to take a large degree of control over how your product is marketed abroad.

If your company has contacts who work for organizations that currently sell products overseas, you may want to consider piggybacking. This market entry strategy involves asking other businesses whether you can add your product to their overseas inventory. If your company and an international company agree to this arrangement, both parties share the profit for each sale. Your company can also manage the risk of selling overseas by allowing its partner to handle international marketing while your company focuses on domestic retail.

Bundling two or more non-competitive but complimentary products can be attractive to both the incumbent vendor and the market entrant, especially if their product range is limited and maybe their products have reached a mature stage in their lifecycle (but not always).

4. Franchising

Franchising is somewhat similar to licensing in that intellectual property rights are sold to a franchisee. However, the rules for how the franchisee carries out business are usually very strict – for example, any processes must be followed, or specific components must be used in manufacturing.

Franchising typically requires strong brand recognition, as consumers in your target market should know what you offer and have a desire to purchase it. For well-known brands, franchising offers companies a way to earn a profit while taking an indirect management approach.

5. Countertrade

Countertrade is a less widespread method of international market entry that can be viewed as a form of indirect international marketing. Countertrading functions as a barter system in which companies trade each other’s goods instead of offering their products for purchase. While we believe this is legal around the globe, we do urge companies to seek advice from logistics, legal and accounting specialist for a particular country.

This entry method my not have specific legal regulations like other forms of market entry. This means companies may solve problems like ensuring other companies understand the value of their products and attempting to acquire goods at a similar level of quality. Countertrading is a cost-effective choice for many businesses because the practice may exempt them from import quotas.

6. Foreign direct investment

Foreign direct investment (FDI) involves a company directly investing in facilities in a foreign market. It often requires sizeable levels of capital to cover costs such as premises, technology and staff. FDI can be performed either by establishing a new venture in the overseas country or acquiring an existing company.

There is often a wide range of support in-country for those companies participating in FDI. Government incentives vary by location but items such as talent attraction, R&D and capital investment incentives, tax credit programs and so forth are normally available.

Greenfield investments are complex market entry strategies that some companies choose to use. These investments involve buying the land and resources to build a facility internationally and hiring a staff to run it. Greenfield investments may subject a company to high risks and significant costs, but they can also help companies comply with government regulations in a new market. These investments typically benefit large, established organizations.

7. Joint venture

Some companies attempt to minimize the risk of entering an international market by creating joint ventures with other companies that plan to sell in the global marketplace. Since joint ventures often function like large, independent companies rather than a combination of two smaller companies, they have the potential to earn more revenue than individual companies. This market entry strategy carries the risk of an imbalance in company involvement, but both parties can work together to establish fair processes and help prevent this issue.

A joint venture consists of two or more different entities (companies) establishing a jointly-owned business. One of the owners will be a local business (local to the foreign market). The companies would then provide the new business with a management team and share control of the joint venture. The term “consortium” may sometimes be used to describe a joint venture. However, a consortium is a more informal agreement between a group of different businesses, rather than creating a new one.

There are several benefits to this type of market entry method. Most importantly are the access and benefit of local knowledge of a foreign market and the sharing of costs/risk. However, there are certain hurdles to overcome such as deciding on who invests what and how to split profits.

8. Wholly owned subsidiary

A wholly owned subsidiary is somewhat similar to foreign direct investment in that money goes into a foreign company but instead of money being invested into another company, with a WOS the foreign business is bought outright. It is then up to the owners whether it continues to run as before or they take more control of the WOS.

If your company plans to sell a product internationally without managing the shipment and distribution of the goods you produce, a wholly owned subsidiary is a good option. Owning a company established in your international market gives your organization credibility as a local business, which can help boost sales. Company ownership costs more than most market entry strategies, but it has the potential to lead to a high return on investment.

9. Outsourcing

Outsourcing involves hiring another company to manage certain aspects of business operations for your company. As a market entry strategy, it refers to making an agreement with another company to handle international product sales on your company’s behalf. Companies that choose to outsource may relinquish a certain amount of control over the sale of their products, but they may justify this risk with the revenue they save on employment costs.

Outsourcing certain operational aspects of a business is not limited to just the selling. Trade Horizons has successfully implemented a ‘build, operate, transfer’ method where we have built up a company to an agreed upon level (size, revenue, profit) and transferred the company. Outsourcing sales and marketing can be effective and low risk. There are also ways to outsource the hiring and management of the HR function – even before an entity has been established.

An employer of record is an organization that serves as the employer for tax purposes while the employee performs work at a different company. The employer of record takes on the responsibility of traditional employment tasks and liabilities. A professional employer organization (PEO) is an organization that enters into a joint-employment relationship with an employer by leasing employees to the employer, thereby allowing the PEO to share and manage many employee-related responsibilities and liabilities. This allows employers to outsource their human resource functions, such as employee benefits, compensation and payroll administration, workers’ compensation, and employment taxes. Depending on the PEO and the contract, a few or all of the HR functions can be outsourced. An administrative services outsourcing (ASO) agreement provides options for companies that are not interested in co-employment but want some of the outsourcing benefits.

There can be significant advantages of engaging with a PEO, especially for a small employer that may not have the breadth of HR expertise or systems capabilities for functions such as payroll, recruitment or compliance. This type of outsourcing does have risks associated with it. Some of the disadvantages might include the following: Loss of control of essential processes and people, an outside company’s influence on your culture, a loss of institutional knowledge and resistance from employees.