1. Australia India form closer ties with new trade deal

Australia and India have signed an historic trade deal in a special virtual ceremony witnessed by the two nations’ respective Prime Ministers Scott Morrison and Narendra Modhi.

The deal signifies a new strategy for Australia to become less reliant on its biggest trading partner China after recent disagreements about COVID, the Belt and Road initiative and the banning of Huawei by Australia.

The new deal will remove Indian tariffs on 85% of Australian imported goods worth AUD$12.6bn including sheep meat, wool, copper, coal, alumina, fresh Australian rock lobster, and some critical minerals and non-ferrous metals.

96% of Indian imported goods will be tariff free.

India is Australia’s 7th largest trading partner and hopes that the new deal will signigy the start of even closer ties.

Scott Morrison is expected to call a general election soon.

2. New IMF Database shows SPE true foreign direct investment cross border flows & positions

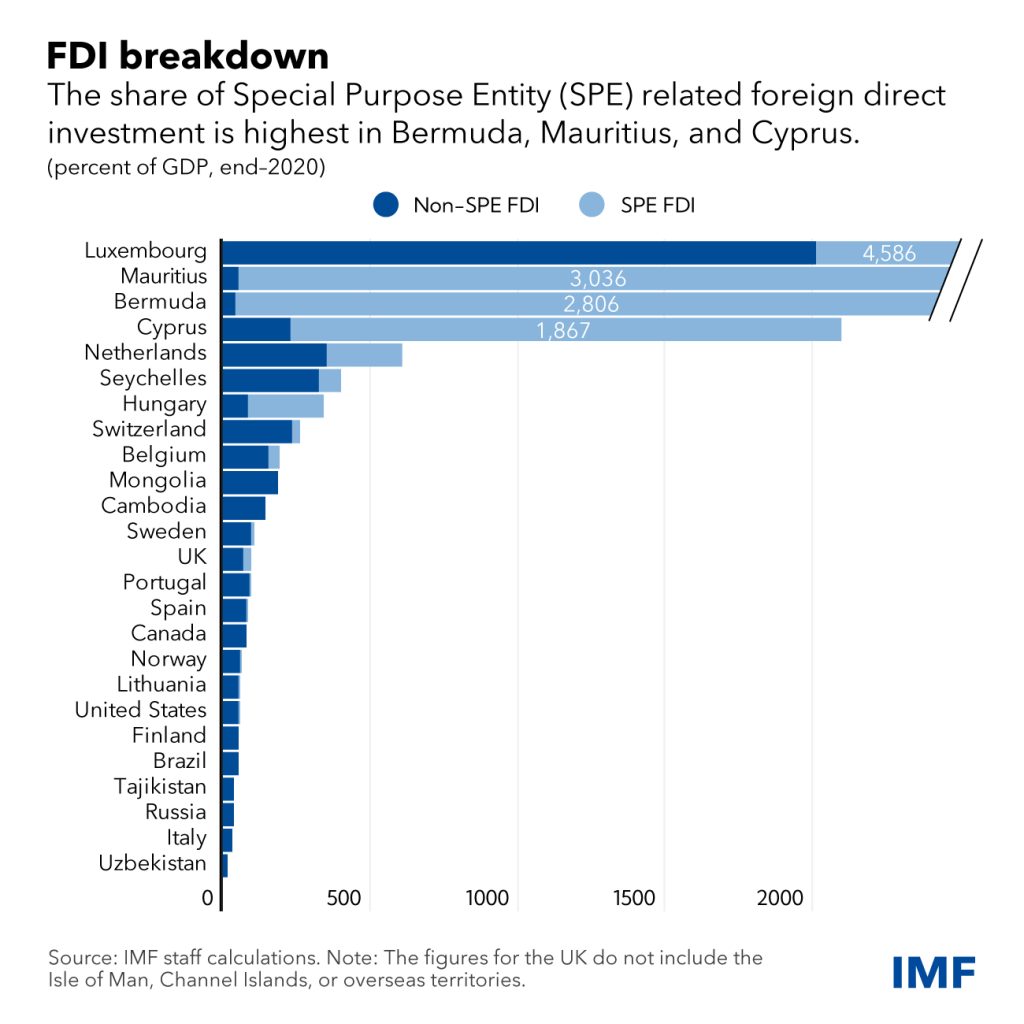

Bermuda, Mauritius and Cyprus are the top 3 countries in terms of foreign direct investment through special purpose entities (SPEs). A new IMF database shows the cross-border flows in 26 countries. It is the first of its kind and gives a clearer picture regarding foreign direct investment positions: origin and destination rather than counting each investment wherever it lands, when it might end up somewhere else. It is expected to be used by policy makers and analysts and the data will be available quarterly and annually.

Trade Horizons

Trade Horizons is an award-winning market entry company, assisting ambitious companies to identify, develop and grow sustainable revenues in new geographic markets. We offer support to clients in international strategy development for their global business growth, and throughout the key phases of market entry execution – Preparation, Launch and Growth. Click here to find out more.

3. Turkey places all bets on Green Finance

The recent Turkey Green Finance Conference at Mansion House was just one initiative in Turkey’s plan to go green. It is encouraging green investment by encouraging investors to focus on renewables and carbon free energy solutions. The Turkish Government has set a net zero target for 2053 and is setting the agenda by publishing a report and road map to net zero this year. The recent DIT UK-Turkey Green Finance Conference featured ministers and experts from both countries planned combatting climate change using green bonds, renewable energy and infrastructure, green finance and carbon emission minimising initiatives.

A follow-on evening panel event with drinks and canapes is planned for 13 July run by the IoD International Trade Group where Trade Horizons CEO Nick Jordan is on the steering committee, register your interest here www.linkedin.com/events/6917063270155628544

3. Foreign direct investments in Italy under scrutiny: the revised Golden Power regime

In 2012 Italy passed the ‘Golden Power’ regime law that granted allowances for the Government to scrutinise company transactions during COVID to prevent predatory purchasers swooping in and buying Italian companies for less when they are in distress. Similar to Spain and the UK’s laws which we’ve been writing about recently, the Golden Power regime is an added level of state scrutiny regarding sales of shares or companies. Originally when first incorporated in 2012 the power only concerned companies dealing in defense, national security, and infrastructure (transportation / energy / communications) but this recently been expanded again to include companies in high technology, fintech, AI, 5G and various other categories. The additional level of state surveillance was originally expanded due to ‘COVID-19’ however the new expansion has no deadline, no limitations and apparently applied equally to all investors no matter the nationality.