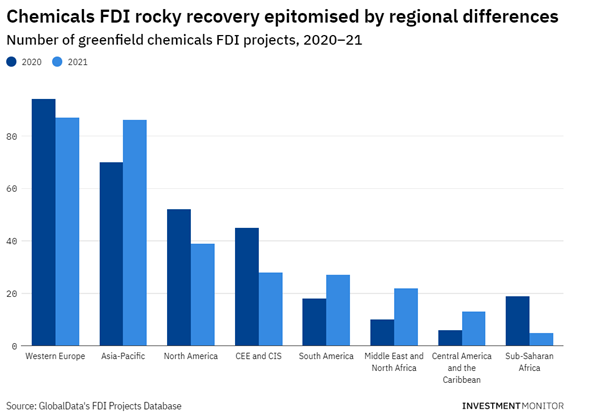

1. Global FDI in chemicals lagging

Investment Monitor says that FDI in the chemical sector is slow to recover after the pandemic with other sectors gaining pace back to pre-pandemic levels faster.

The number of chemical projects in Asia Pacific dropped by 27% in 2020 compared to 2019 but regained in 2021, still slightly down on 2019 pre-pandemic levels.

Western Europe and Asia-Pacific account for half of global chemical FDI. China overtook US as the leading country to attract inbound investment into chemical projects but UAE is the fastest growing region.

Manufacturing sector accounts for two thirds of operations for chemical use.

Trade Horizons

Trade Horizons is an award-winning market entry company, assisting ambitious companies to identify, develop and grow sustainable revenues in new geographic markets. We offer support to clients in international strategy development for their global business growth, and throughout the key phases of market entry execution – Preparation, Launch and Growth. Click here to find out more.

2. Analysis on Algeria’s protectionist Finance Law

Algeria implemented the protectionist Finance Law in 2019 which restricted foreign investment in sensitive industries and limited foreign investor holdings to 29%.

2 years on Algeria has suffered a decline in FDI somewhat due to COVID and the legislation. With a recent relaxing of the 49/51 rule and rise in hydrocarbon production & exports. During the pandemic social unrest spurred the acceleration of a change in rules to attract foreign investment.

Oil & gas is Algeria’s most popular export, but the country is challenged with the need to diversify faced with the climate crisis and shifting global goals.

The 49/51 rule still applies to some strategic sectors one of which being the controversial automotive sector where foreign ownership of car importation & dealing is restricted; also mining / natural resources sector (excluding renewable energy), hydrocarbons being the dominant export; and pharma sector.

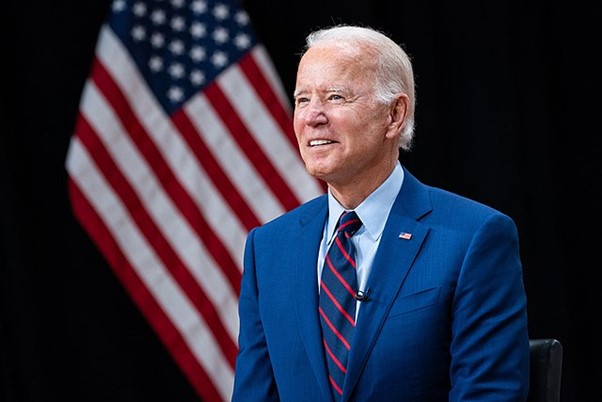

3. Biden’s tax changes to damage US

The tax foundation says a combination of the OECD’s Pillar 2 Global Corporate Minimum Tax and Biden’s proposal of a minimum tax would adversely affect inbound foreign direct investment into the US. Although the OECD rule only applies a minimum tax rate of 15% on large multi-national corporations which have a turnover of more than €750m. A paper by the United Nations Conference on Trade and Development (UNCTAD) predicts that it would have the effect of reducing FDI into the US by 4%.

Some are warning that the measures Biden has proposed in an effort to reduce inflation will in fact lower economic output and constrict the economy over the long term.

4. Incorporating a company in London

London tops many lists as the number 1 city to do and run a business in. It attracted the highest number of financial and professional services FDI in 2021 and is home to 40% of total UK FDI and produces 20% of the UK’s GDP. In addition, London is the top city globally after San Francisco for tech projects.

Recently London is rising to the top of FDI and international attractiveness surveys and lists as the most attractive city to do business in. As the UK’s capital, it’s the beating heart of Britain. Many of the world’s largest companies are headquartered here. Due to its global reputation, there is access to top companies and people in the capital.

- The UK’s business incorporation processes and systems are easy, cheap and fast. You can set up a company in as little as a day with no minimum capital requirement and only 1 director who can be foreign.

- London is an airport hub with links to most cities globally. With 3 airports, travel in and out of London is frequent and economical.

- Access to many of the world’s largest companies. Many prominent companies are headquartered here opening up to the top end of business.

- The English language is the most widely spoken language in the world. In addition many top academic institutions in the UK and culture of education gives access to skilled workers.

- Tax incentives, grants and benefits exist for R&D and startups as the UK values entrepreneurship, business and foreign enterprise doing business in the UK.

- London was founded on international trade and the UK’s legal system is the oldest in the world and widely respected as robust, reliable and fair.

- A central timezone located between Asia and America gives easy access to both major markets.

- The UK has the largest network of double tax treaties in the world numbering 120.

London remains an excellent place for business incorporation.

5. UK International Trade Week!

Department for International Trade is hosting International Trade Week from 31 October – 4 November 2022 and will include workshops hosted by government ministers, MPs and trade advisors if last year is anything to go by.

Key themes this year will include:

- How to trade internationally

- Using trade agreements to finding markets to trade with

- Discover green trade & investment content

- Diversity & inclusion opportunities

Register here https://www.events.great.gov.uk/website/8822/