-

Indianapolis: growth on the horizon

Indianapolis is America’s 14th largest city by population and 18th largest by size. Indiana itself is growing at 1.8% over the past 5 years with the largest export being transportation equipment followed by chemicals and then other machinery. Its largest customer is Canada. Some sources say exports have grown by 16% since 2020. Indiana is known as the ‘logistics state.’ It is also known as the ‘Crossroads of America’

According to a recent Investment Monitor Report the Indianapolis strategy for economic development includes tax breaks, land strategy and community impact network. It lists a number of pillars of ethics or values it tries to adhere to whilst achieving growth including eliminating racial disparities & improving access to education.

The report says that during the past three years the top sectors attracting FDI in Indianapolis are life sciences and sports. Indeed, a Google search for ‘Indianapolis trade’ returns a plethora of sports team players swaps (pages) being Hoops, Pacers and Colts.

It’s home to 11 sports teams and is the home of the famous Indianapolis 500 indy car race.

Germany is the largest investor followed by Switzerland and then Ireland.

A £1billion regeneration project is planned for downtown Indianapolis – looks like growth is on the horizon for the

-

Investment 2030: retreat to localisation

Reports say that energy independence and change of strategy from offshoring to onshoring with national security legislation driving a retreat to localisation from globalisation could be on the horizon for 2030 in the FDI landscape.

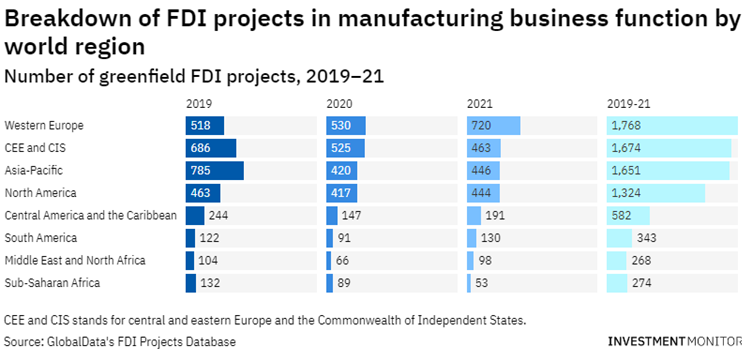

Asia has already suffered a decline in manufacturing projects over the past few tragic years whilst Europe experienced an uptick. As US & Europe seek to secure supply chains we will see more reliance on local supply and legislation to support local made goods as opposed to the heavy reliance on China.

Economic governance will shift the focus from outward looking multinational cooperation to national & regional solutions with enhanced protectionism.

Automation and technology will advance efficiencies in sectors such as manufacturing, logistics and construction, encouraging foreign investment in these areas.

Sustainable Development Goals and the pressure to reverse climate change will impact the prioritisation of ideas and new technologies.

Overall we may see deglobalisation and a shift of focus from global to local especially regarding goods.

-

How Colombia’s new Tax Reform will affect Free Trade Zones

leandro-loureiro-via-unsplash

Colombia has 122 free trade zones (FTZ’s) the first of which was implemented in 1958 to spur trade between regions. The zones have reduced tax, no customs or duties, VAT exemption and reduced paperwork facilitating fast easy cheaper trade between regions.

Companies inside the FTZs pay 20% tax whilst companies outside the zones pay 35%. Tax in Colombia is extremely high. The current president has forced the company to adopt 21 new tax laws every 18 months since taking office in 1990. Colombia still has lower tax than other Latin American countries.

The Colombian Government aims to raise an additional 25.9 billion per year and has decided to increase taxes the free trade zones to 35% except companies that comply with an ‘internationalization plan.’

-

Focus on Indian healthcare sector

Recent policies and legislation in India aim to encourage foreign investors to contribute to healthcare projects. Currently training courses and services are exempt from GST (Goods and Services Tax) and there was a tax holiday for rural hospitals.

The Indian Government currently spends 2.1% of GDP on healthcare and plans to increase this to 2.5% by 2025.

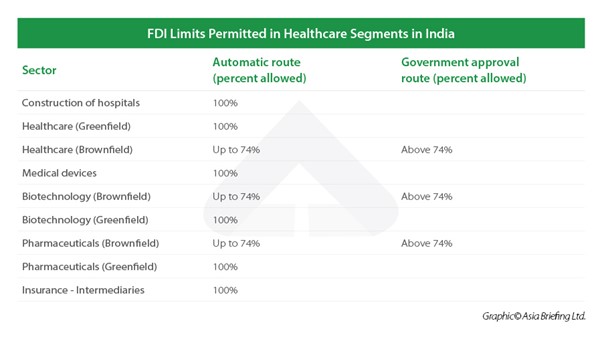

Foreign investors do not need approval from the Government to invest in hospitals or medical devices.

The Government has recently announced it seeks to setup a national healthcare system which would share data between institutions. Given the recent ransomware attack on the largest medical institution in India this week with personally identifiable patient (sensitive) data being leaked onto the dark web, we would think nationalising data would be subject to tighter security than current standard practice. The institution’s servers have been shut down and are still down today Monday 28 November 2022. On cyber security agency says that in the first 4 months of 2022 cyber attacks in the healthcare sector rose by 95% compared to 2021. According to another global agency of 1 million global attacks on healthcare organisations, 278,000 of these were in India.

-

Australia India FTA

Australia and India have signed a free trade agreement only two months after negotiations begun. The Australian Prime Minister plans to visit India next March. It is India’s first free trade agreement with a developed country.

Australia India bilateral trade is currently valued at $27.5 billion and this is expected to rise to $50 billion in the coming years due to increased trade.

Australia is seeking to diversify exports away from troubled China and taxes on 90% of Australian export duties will be removed on goods such as meat, wool, cotton, seafood, nuts and avocados.

The Indian IT sector will benefit along with healthcare and pharmaceuticals, and visas for chefs & yoga instructors.

-

India FDI to grow

Bangra Beat via Flickr

In our third India article this week we’re going to cover FDI. India was the world’s fifth largest recipient of FDI in 2020 with main sectors being manufacturing, communication and financial services. FDI grew at 10% in 2021 with IT sector topping the other sectors. The largest investor is Singapore followed by the US and then Mauritius.

There are 2 types of investment processes being the Automatic route in sectors where no Government approval is required, and Government approval route in sectors such as banking, mining and other sensitive sectors. Most sectors fall under the automatic route.

FDI is expected to increase in India along with GDP. Projections are rapid growth through 2025 due to economic development and value opportunities in the growth period.