1. India’s carmakers agree to 0% on limited number

The Society of Indian Automobile Manufacturers (SIAM) has proposed eliminating import tariffs on British cars imported into India.

Currently India levies a tax of 125% on all imported vehicles. The tax structure is designed to encourage local assembly as the tax on parts is only 10%. India’s car market is highly protected with Tesla opting not to start facilities there last year.

The current proposal reduces taxes to 10% by year five and an option to reduce to 0%, but crucially only up to a maximum of only 46,000 vehicles. This would have relatively less impact on the local car market. It’s the first-time car manufacturers have agreed to such cuts.

India’s automotive industry is the fourth largest in the world by value and the third largest by sales. Cars account for 8% of India’s exports and 7% of GDP. However, there are only 22 vehicles per 1,000 people so this sector is an opportunity for growth.

Chennai, Mumbai and Gurgaon are the three main automotive production localities with Gujarat growing.

The UK India free trade deal deadline was October 2022, but agreement has been delayed due to inability to reach agreement on duties.

2. Ecuador China FTA

Image Adrian Dascalvia Unsplash

In China’s latest move to expand its influence in Latin America it has signed a free trade agreement with Ecuador. The agreement still needs to pass through legislation in both countries.

In 2021 the value of China-Ecuador trade was US$10.95 billion which was up 44.5% on the year before.

Ecuador said the new agreement eliminates tariffs on 99.6% of goods exported to China.

According to the COMTRADE database Ecuador exports $4.03 billion of goods in total including $2.3 billion in fish & fish products followed by $946 million of mineral products (ores slag & ash) then $451 million of oil, $128 million in wood & $96 million of fruit. Ecuador is a net importer of Chinese goods.

China exports $5.94 billion of goods to Ecuador consisting of $1.05 billion of vehicles, $829 million of machinery, $687 million in electronics and $424 million in iron.

In 2022 Ecuador’s debt to China was a massive $5.1 billion which it restructured to give relief of $1.4 billion until 2025. The debt has accrued because of poor conditions on long-term oil sales, to Ecuador’s detriment and China’s gain.

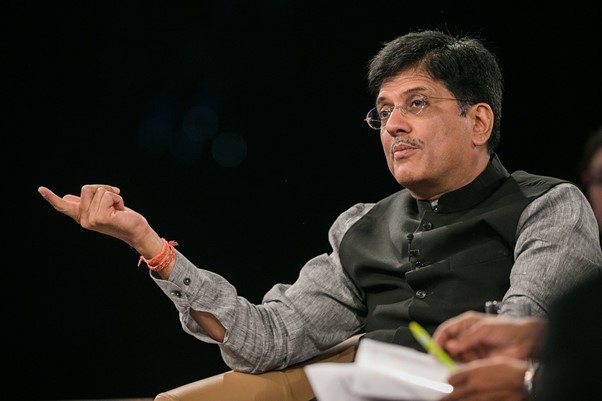

3. FTA negotiation between India and EU is in progress: Goyal

Piyush Goyal by Benedikt von Loebell Flickr

India and the EU restarted free trade negotiations in May 2021. The EU is India’s third largest trading partner and exported €88 billion of goods in 2021. India is the EU’s tenth largest trading partner. In 2018 India was in trade deficit with the EU but that turned into a surplus in 2023.

India and the EU first started negotiating a trade agreement back in 2007 but paused in 2013 as they could not reach agreement on cars, immigration, and alcohol.

4. Foreign investors swoop up British bargains

Image Steve Smith Unsplash

A weak pound and flagging economy makes undervalued British companies rich pickings for cash rich venture capital and private equity backed US acquisitive companies.

Since Q1 foreign firms have been taking a greater interest in British firms with £13bn in M&A value reported to date against £9bn in the same timeline last year. Center Parcs, Reward Gateway and Dechra Pharmaceuticals are all up for grabs or been acquired this year.

During the point last year when the pound was weakest, a high percentage of M&A was internal – UK business buying UK businesses. In 2023 however foreign firms are pricing UK acquirers out of the market as they can afford to bid higher due to their stronger currency.

Trade Horizons advisors are market entry experts: our team of in-country experts assist companies to export, import and enter new locations by using strategies that have stood the test of time and evidence-based advice. Trade Horizons assists companies to plan to distribute and deliver goods or services to a new target market. Contact one of our experts today.

5. Qatar FDI

Image Trade Arabia

Qatar recorded 25 times more projects in 2022 than 2021 to the value of almost £30 billion.

Qatar hosted the FIFA World Cup last year which it is estimated brought in £20 billion. Qatar is thought to have spend around $220 billion on hosting the event in the twelve years leading up to 2022 from the time it was chosen.

Qatar’s main exports are LNG, petrol, gas, ethylene and fertilisers. Its top trading partners are the US, China, Germany and UAE. Top imports are cars, turbines, jewellery and broadcasting equipment. The World Bank ranks Qatar as 77 on the Ease of Doing Business Report (2019).

6. Thailand FDI

Image Pleamir Wikimedia Commons

Thailand reported almost £20 billion in FDI in 2022, spread across 2,000 projects.

Thailand’s top exports are machine parts, circuits, cars, and trucks. It is the world’s largest exporter of rubber. Top imports are petrol, circuits, and gold. Thailand’s top trading partners are the US, China, Japan, Vietnam, and Malaysia.

In 2022, China was the biggest foreign investor in Thailand. Thailand has implemented special tariffs, tax breaks and subsidies for electric vehicle manufacturing.

Applications for inward investment increased 39% in 2022 due to applications by BYD auto (China), Foxconn (Taiwan) and Amazon Web Services (USA).

Credit Biswarup Ganguly via Wikimedia Commons