1. Strengthening Economic Ties: The Texas-UK Trade Agreement

In a significant milestone, the United Kingdom and the state of Texas have formalised a trade pact aimed at enhancing investment and cooperation. On Wednesday, March 13, 2024, Trade Secretary Kemi Badenoch and Texas Governor Greg Abbott gathered in Westminster to sign this historic agreement. Texas, with its robust economy, becomes the eighth U.S. state to forge such a pact with the UK, marking a quarter of the entire U.S. GDP. This strategic partnership focuses on key sectors, including energy, life sciences, and professional services, fostering growth and facilitating business between the two regions. Let’s delve into the details of this exciting collaboration that promises to unlock new opportunities and drive economic prosperity.

Benefits

- Strengthened Economic Ties: By formalising this pact, the UK and Texas aim to enhance investment and cooperation. Texas becomes the eighth U.S. state to forge such an agreement with the UK, contributing to a combined GDP of £5.3 trillion—equivalent to a quarter of the entire U.S. economy.

- Sector-Specific Focus: The agreement targets key sectors, including:

- Energy: Collaboration on new energy solutions such as hydrogen and carbon capture, utilisation, and storage.

- Life Sciences: Building upon existing ties and fostering growth in this critical sector.

- Professional Services: Facilitating business and recognition of professional qualifications.

- Trade Facilitation: The pact aims to make it quicker, easier, and cheaper for UK and Texas firms to do business by:

- Addressing trade barriers.

- Encouraging investment.

- Driving commerce between the two regions.

- Historic Milestone: Texas, with its robust economy, is the second-largest U.S. state and has a GDP larger than Italy. This trade agreement marks the UK’s most economically significant pact with a U.S. state to date.

- Previous Agreements: The signing follows the UK-Florida Memorandum of Understanding (MoU), bringing the total number of agreements with U.S. states to eight, surpassing Japan’s GDP and representing a quarter of the U.S. economy.

Small business

- Enhanced Trade Opportunities: Small businesses in Texas and the UK will gain improved access to each other’s markets. The pact aims to make it quicker, easier, and cheaper for firms to do business by addressing trade barriers and encouraging investment.

- Sector-Specific Advantages:

- Energy Sector: Collaboration on new energy solutions, including hydrogen and carbon capture, utilisation, and storage, can open doors for small businesses in this field.

- Life Sciences: The agreement will deepen economic ties in life sciences, benefiting companies engaged in pharmaceuticals, medical research, and related areas.

- Professional Services: Recognition of professional qualifications will facilitate cross-border business services.

- Increased Export Opportunities: The UK is Texas’ 8th largest international goods export market. Small businesses can tap into this market, especially in sectors like nuclear equipment, aircraft, and pharmaceutical products.

- Historic Milestone: This trade pact represents the UK’s most economically significant agreement with a U.S. state to date. Small businesses can leverage this historic collaboration to expand their reach and explore new avenues.

In summary, the Texas-UK trade agreement creates an environment conducive to growth, collaboration, and increased trade for small businesses on both sides of the Atlantic.

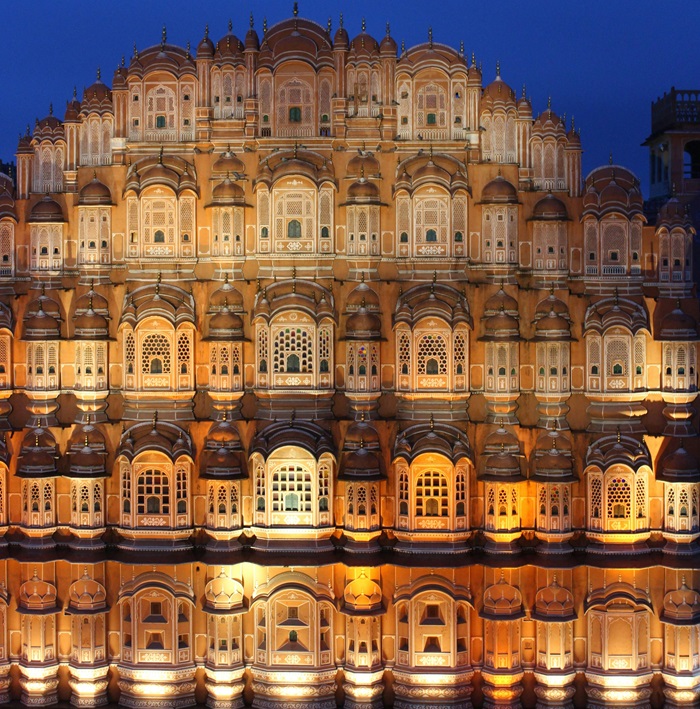

2. India Signs $100 Billion Trade Deal with Four European Countries

Sylwia Bartyzel via Unsplash

After sixteen years of negotiations, India has achieved a significant milestone by signing a landmark free-trade agreement (FTA) with a group of four European countries. The European Free Trade Association (EFTA), comprising Norway, Switzerland, Iceland, and Liechtenstein, has committed to investments in India totalling $100 billion (£77.8 billion) over the next 15 years.

This historic pact underscores India’s commitment to boosting economic progress and creating opportunities for its youth. Prime Minister Narendra Modi expressed optimism about the future, stating, “The times ahead will bring more prosperity and mutual growth as we strengthen our bonds with EFTA nations” . Under the terms of the agreement, India will lift most import tariffs on industrial goods from the four European countries in exchange for their long-term investments. These investments are expected to span various industries, including pharmaceuticals, machinery, and manufacturing.

The deal enhances market access and simplifies customs procedures, making it easier for Indian and EFTA businesses to expand their operations in each other’s markets. While the agreement has been reached, both India and the four EFTA nations must now ratify the deal before it takes effect. Switzerland, for instance, plans to do so by next year.

As India gears up for general elections this year, this trade deal signifies a significant achievement. Meanwhile, the UK, which has been in negotiations with India over an FTA for the past two years, faces its own challenges in reaching a similar agreement. Trade Minister Kemi Badenoch recently acknowledged the possibility of a UK-India trade deal before India’s elections but emphasised the complexity of the task.

In summary, India’s collaboration with these four European nations opens up new avenues for economic growth, investment, and cooperation. It is a testament to the power of international partnerships in shaping global trade dynamics.

Benefits

- Foreign Investment: The agreement involves a commitment of $100 billion in investments from the four European countries—Norway, Switzerland, Iceland, and Liechtenstein—over the next 15 years. This infusion of capital is expected to stimulate economic growth, create jobs, and enhance India’s industrial landscape.

- Market Access: By lifting most import tariffs on industrial goods from the EFTA nations, India gains improved access to their markets. This facilitates the expansion of Indian businesses in areas such as pharmaceuticals, machinery, and manufacturing.

- Simplified Customs Procedures: The deal streamlines customs processes, making it easier for Indian and EFTA companies to operate across borders. This reduction in trade barriers encourages bilateral trade and fosters collaboration.

- Resilient Supply Chains: Closer integration with EFTA economies enhances supply chain resilience. India can benefit from diversified sourcing and more robust production networks.

- Mutual Growth: Prime Minister Narendra Modi emphasised that the pact strengthens bonds with EFTA nations, leading to mutual prosperity. It opens up avenues for collaboration, technology transfer, and knowledge exchange.

- Job Creation: The substantial investments are expected to create one million direct jobs within India, providing employment opportunities for its youth.

- Strategic Positioning: Amidst global economic shifts, this deal positions India as an attractive investment destination and reinforces its commitment to open markets and international cooperation.

In summary, the trade agreement represents a win-win scenario, fostering economic ties, boosting investment, and promoting shared growth between India and the four European countries. However, both India and the EFTA nations must now ratify the agreement for it to take effect.

The India-European Free Trade Association (EFTA) trade agreement has been signed by the parties, but it will come into effect post-ratification by the governments of the respective countries. This ratification process is expected to occur in early 2025. Once ratified, the provisions of the agreement will be legally binding, and the benefits outlined earlier will begin to materialise for India and the EFTA nations.

3. India’s Rise in the Global Supply Chain: A New Manufacturing Frontier

In recent years, India has been quietly positioning itself as a formidable contender in the global supply chain landscape. As companies seek alternatives to China, India has stepped into the spotlight, offering a compelling proposition for multinational manufacturers. Let’s delve into how India is capitalising on this shift and what it means for the world economy.

The China-Plus-One Strategy

The Covid-19 pandemic exposed vulnerabilities in global supply chains, prompting companies to rethink their reliance on a single manufacturing giant. Enter the “China-plus-one” strategy, where businesses diversify their production bases beyond China. India, with its vast population and youthful workforce, is emerging as a prime candidate for this diversification.

The Demographic Dividend

India’s demographic dividend is a key asset. Over 65% of its population falls within the productive age group (under 35 years). These young workers offer competitive labour costs, making India an attractive destination for manufacturing. As companies seek to reduce dependence on China, they’re eyeing India’s potential.

The Gold Rush 2.0

Multinational manufacturers are flocking to India, drawn by its promise of cost-effective production. Companies like South Korea’s Hyundai, Japan’s Toyota, and Taiwan’s Foxconn are setting up shop in India. JLK Automation, an electronics testing equipment maker, recently established its first factory outside China and Singapore in Tamil Nadu. The state’s industrial ecosystem, proximity to other manufacturers, and skilled workforce were decisive factors.

Challenges and Opportunities

While India’s ascent is promising, challenges remain. Insufficient labor quality, infrastructure gaps, market restrictions, and trade protectionism hinder its progress. However, India’s government is actively promoting initiatives like “Make in India,” aiming to boost electronics output to $100 billion by 2025. The state of Tamil Nadu, home to 38,837 factories, contributes significantly to India’s GDP.

In this dynamic landscape, India isn’t seeking to dethrone China outright. Instead, it aims to lead in digitally connected manufacturing, warehousing, logistics, and transportation services. As the world watches, India’s journey from “Made in China” to “Made in India” unfolds, promising exciting opportunities and challenges ahead.

India’s infrastructure is undergoing significant improvements, positioning the country as an economic powerhouse. Here are some notable developments:

Infrastructure improvements

- Delhi-Mumbai Expressway: The recently inaugurated 246 km stretch connecting Delhi to Lalsot in Rajasthan is part of the ambitious Delhi-Mumbai Expressway project. When completed in 2024, this expressway will span 1,386 km, reducing travel time between the two cities from 24 hours to just 12 hours. The improved connectivity benefits not only travellers but also local businesses along the route.

- Highway Expansion: By 2025, the Indian government aims to add 38,650 km of highways to the existing 161,350 km network. These expanded roadways enhance transportation efficiency and facilitate economic growth.

- Railways: India is investing in semi-high-speed trains known as Vande Bharat. The goal is to build 400 of these trains, improving rail connectivity across the country.

- Airports: The plan includes constructing 220 new airports, enhancing air travel accessibility and boosting regional development.

- Ports: Doubling port capacity to 3,000 million tonnes per annum (mtpa) is a priority. Upgraded ports facilitate international trade and contribute to economic growth.

- Digital Infrastructure: India is tapping into its digital masterplan to streamline infrastructure planning and reduce delays. Digital highways and smart cities are part of this vision.

Despite these positive strides, challenges remain, including historical underinvestment and land acquisition issues. However, India’s commitment to infrastructure development is unprecedented, and it aims to catch up with China’s infrastructure prowess. As the country continues its journey, the world watches with anticipation for further advancements.

4. Mipim: Nearshoring Drives Europe’s Logistics Investment Boom

The world of logistics is undergoing a seismic shift, and at the heart of this transformation lies the concept of nearshoring. As manufacturers recalibrate their global supply chains, the movement of production closer to end-consumers is propelling Europe’s logistics sector to record highs. The recent Mipim conference in Cannes, France, served as a vibrant stage for industry leaders to discuss and dissect this pivotal trend.

The Rise of Nearshoring

In the wake of geopolitical tensions, supply chain disruptions, and the pandemic-induced e-commerce surge, manufacturers are reevaluating their production strategies. The allure of nearshoring—bringing manufacturing operations closer to European markets—has become irresistible. John Harcourt, managing director of Japanese-owned Kajima Properties Europe, succinctly captured the zeitgeist: “Nearshoring will be a constant theme [in logistics] for the next five years or so.”

Record Investment Inflows

Data from fDi Markets reveals an impressive trajectory: foreign direct investment into European logistics has consistently exceeded $30 billion annually since 2021. While the e-commerce boom initially fuelled this surge, property developers and investors now recognise that nearshoring is the true engine behind the asset class’s expansion. Gustavo Lupi, managing director of Panattoni’s Spain and Portugal business, concurs: “After 2022, there was a decline in demand from e-commerce. But then demand picked up from relocation or nearshoring of industrial activity.”

Warehousing and Distribution Demands

As more manufacturing operations set up shop on the continent, the need for warehousing and efficient logistics infrastructure intensifies. Businesses, scarred by pandemic-related supply chain disruptions, are opting to maintain larger stockpiles close to their facilities. The hyper-efficient supply chains of yesteryears have given way to a more resilient approach—one that values proximity and preparedness.

Hotspots for Nearshoring

Cost considerations play a pivotal role in location choices. Poland, Hungary, and other central and eastern European countries emerge as popular nearshoring destinations. However, the Netherlands and Germany, with their strategic access to the colossal Port of Rotterdam, also benefit from logistics investment driven by business relocations. Even Iberia is part of this unfolding narrative; Panattoni’s €36 million distribution center for tiremaker Bridgestone in Burgos, Spain, exemplifies the trend.

In this dynamic landscape, logistics professionals converge at Mipim, where ideas collide, partnerships form, and the future of logistics takes shape. As the sun-kissed shores of Cannes witnessed these discussions, the logistics investment boom fuelled by nearshoring promises to reshape Europe’s economic landscape.

Four successful examples of companies that have embraced nearshoring:

- Inditex: This Spanish apparel company, known for being the parent company of Zara—one of the world’s largest fashion brands—has nearshored about 10% of its production to Morocco and Turkey. As the apparel industry increasingly recognises the benefits of nearshoring, more companies are following suit.

- Whirlpool: An American multinational manufacturer and marketer of home appliances, Whirlpool made a strategic move by nearshoring operations to Mexico in 1987. The Mexican facility exports 80% of its machines (including refrigerators, washing machines, compact refrigerators, and stoves) to the USA and Canada. Following Whirlpool’s success, other electronics giants like Samsung and LG have also established nearshoring manufacturing units in Mexico.

- Boeing: The American aerospace company Boeing, which designs, manufactures, and sells airplanes, satellites, rockets, telecommunication equipment, and missiles, has opted for nearshoring. Boeing outsources its wiring to the French multinational company Safran, the world’s third-largest aerospace provider. Safran has been operating in Mexico for 25 years and inaugurated a new facility in Chihuahua in 2020. As of 2020, the Safran plant in Mexico produces 95% of the wiring on the Boeing 787 Dreamliner, along with wiring for other aerospace companies like Airbus.

- Toyota Motor: The Japanese automotive manufacturer Toyota, with a global presence, nearshored its second production unit to Thailand in 1996. Today, Toyota runs three plants in Thailand and has manufacturing operations in several other countries. The company’s strategic nearshoring decisions have contributed to its success in different parts of the world.

These examples highlight how nearshoring can enhance efficiency, reduce costs, and strengthen supply chains. As businesses continue to adapt to changing global dynamics, nearshoring remains a powerful strategy for growth and resilience.

5. Top 10 countries by outward FDI

Maarten Van Den Heuvel via Unsplash

Outward FDI stock represents the cumulative investment made overseas by a country at a specific point in time. These investments have a significant impact on global trade and economic relations.

- United States (US):

The US boasts the largest outward FDI stock, having accumulated more than $8 trillion by the end of 2022. This impressive figure reflects the global reach of American multinational companies.

- Netherlands:

The Netherlands follows closely, with substantial outward FDI stock. Dutch companies have made significant investments abroad, contributing to their strong position in the global economy.

- China:

China’s outward FDI stock has been steadily growing. As the world’s second-largest economy, Chinese companies are increasingly expanding their presence internationally.

- United Kingdom (UK):

The UK maintains a robust outward FDI stock, driven by its multinational corporations. Despite economic uncertainties, British companies continue to invest globally.

- France:

French companies have a considerable presence abroad, contributing to France’s outward FDI stock. Sectors like finance, energy, and telecommunications play a vital role.

- Switzerland:

Switzerland’s strong financial sector and multinational companies contribute to its outward FDI stock. Swiss firms invest across various industries worldwide.

- Ireland:

Ireland’s favourable business environment has attracted significant foreign investment. Irish companies also invest abroad, resulting in substantial outward FDI stock.

- Japan:

Japan’s outward FDI stock reflects the global expansion of Japanese corporations. Industries like automotive, electronics, and pharmaceuticals drive these investments.

- Germany:

German companies are active investors abroad, contributing to Germany’s outward FDI stock. The automotive and machinery sectors play a crucial role.

- Singapore:

Singapore ranks 10th overall, with an outward FDI stock valued at $1.59 trillion. Its strategic location and business-friendly policies attract multinational companies.

Remember, outward FDI stock provides insights into a country’s external economic relations. These top 10 countries shape global investment trends and influence the interconnectedness of economies worldwide.

Top recipients of foreign direct investment (FDI) worldwide

Inward FDI represents the investments made by foreign entities into a country. Here are the countries that attract significant inward FDI:

- United States (US):

-

- The US remains the largest recipient of inward FDI. Its robust economy, diverse industries, and favourable business environment attract substantial foreign investments.

- Ireland:

-

- Ireland ranks high due to its attractive tax policies, skilled workforce, and strategic location within the European Union. Many multinational corporations establish their European headquarters in Ireland.

- Canada:

-

- Canada’s stable economy, natural resources, and strong financial sector make it an appealing destination for foreign investors.

- Brazil:

-

- Brazil’s vast market, rich natural resources, and growing consumer base attract FDI from various sectors, including energy, agriculture, and manufacturing.

- United Kingdom (UK):

-

- Despite uncertainties related to Brexit, the UK continues to receive significant inward FDI. London remains a global financial hub.

- China:

-

- China’s rapid economic growth and market potential draw substantial foreign investments. The Chinese government actively encourages FDI through various policies.

- India:

-

- India’s large population, expanding middle class, and diverse economy make it an attractive FDI destination. Sectors like technology, manufacturing, and services see substantial inflows.

- Germany:

-

- Germany’s strong industrial base, skilled workforce, and export-oriented economy contribute to its position as an FDI magnet.

- France:

-

- French infrastructure, innovation, and strategic location in Europe appeal to foreign investors. Paris is a key financial centre.

- Netherlands:

-

- The Netherlands serves as a gateway to Europe due to its well-developed logistics, favourable tax regime, and open economy.

Remember, these rankings can vary over time based on economic conditions, policy changes, and global trends. Each country’s ability to attract FDI depends on factors such as stability, infrastructure, and investor-friendly policies.

6. Unlocking Quantum Horizons: UK and Germany Forge Research Collaboration

IBM Quantum Computer

In a groundbreaking move, the United Kingdom and Germany have joined forces to accelerate advancements in quantum computing. The recently signed Joint Declaration of Intent signifies a commitment to deepen science and research collaboration, with a particular focus on quantum technology, artificial intelligence (AI), and clean tech.

A Quantum Leap in Collaboration

Germany stands as the UK’s second-largest research collaborator globally, and this partnership aims to elevate their existing relationship even further. The collaboration brings together leading science organisations from both nations, including the Max-Planck Society, the Royal Society, Universities UK, and the Helmholtz Association. These luminaries will explore joint opportunities in various domains, from quantum computing to AI and clean energy.

Shared Ambitions and Concrete Plans

The UK Science and Technology Secretary, Michelle Donelan, and German Federal Minister of Education and Research, Bettina Stark-Watzinger, unveiled these ambitious plans in London. Their vision extends beyond theoretical discussions; it involves practical implementation. To achieve this, the UK and German governments will establish a Strategic Working Group to ensure that high ambitions translate into tangible outcomes.

Unlocking Potential

Both nations recognise the critical role of science and technology in shaping the future. By fostering collaboration, they aim to:

- Create New Jobs: By supporting brilliant minds and institutions, this partnership will generate employment opportunities.

- Foster Innovation: Joint research efforts will pave the way for groundbreaking discoveries, benefiting society as a whole.

- Enhance Quality of Life: Ultimately, the fruits of this collaboration will enhance our daily lives, from cleaner energy solutions to more efficient computing systems.

Minister Stark-Watzinger aptly summarised the spirit of this endeavour: “Our Joint Declaration of Intent provides the basis for good and close cooperation to strengthen science and research.” Together, the UK and Germany are poised to unlock quantum horizons and redefine the boundaries of scientific exploration.

The UK and Germany’s Quantum Computing Partnership holds immense promise for both nations, fostering collaboration in cutting-edge fields. Here are the key benefits:

- Scientific Advancements: By pooling their expertise, the UK and Germany can accelerate scientific breakthroughs. Joint research efforts in quantum computing, artificial intelligence (AI), and clean technology will lead to novel discoveries and innovations.

- Economic Growth: This partnership creates a fertile ground for economic growth. By supporting brilliant minds and institutions, both countries can generate new jobs and build new businesses. The collaboration will drive economic prosperity and stability.

- Technological Leadership: Quantum technologies are poised to revolutionise various industries, from healthcare to finance. By working together, the UK and Germany can maintain their competitive edge globally. They’ll prevent falling behind countries like China and the USA, ensuring sovereignty and security.

- Practical Applications: Concrete projects are already underway. For instance, a UK government-supported initiative led by Universal Quantum aims to develop a quantum computer that enhances fuel efficiency in aviation turbines. This directly impacts fuel consumption and emissions, benefiting both countries.

- Shared Challenges: The partnership addresses shared challenges. As the UK’s second-largest trading partner, Germany collaborates through initiatives like Horizon Europe and CERN. By deepening bilateral cooperation, they can tackle global issues more effectively.

In summary, this collaboration transcends theoretical discussions, aiming to unlock quantum horizons and redefine scientific exploration. Together, the UK and Germany stand at the forefront of quantum advancements, shaping a brighter future for both nations and beyond.