1. US manufacturing FDI at 10 year low

Introduction

In a significant development, foreign direct investment (FDI) in the US manufacturing sector has plummeted to its lowest level in a decade. This decline raises concerns about the effectiveness of recent US industrial policies aimed at boosting foreign investment.

Key Statistics

According to the latest data from the US Bureau of Economic Analysis (BEA), new FDI in US manufacturing fell to $42.9 billion in 2023, marking a one-third drop from the previous year. This is the lowest level recorded over the past ten years. Additionally, manufacturing’s share of new FDI expenditure also hit a decade-low of 28.8%.

Factors Contributing to the Decline

Several factors have contributed to this sharp decline:

- Economic Uncertainty: The global economic landscape has been fraught with uncertainty, impacting investment decisions. Issues such as geopolitical tensions, trade policies, and economic slowdowns in key markets have played a role.

- Policy Gaps: Despite the introduction of policies like the Inflation Reduction Act and the Chips and Science Act, which collectively offered over $400 billion in incentives for companies investing in US cleantech and semiconductor supply chains, the actual capital expenditure has not matched the initial project announcements.

- European Investment Drop: FDI by European investors, who have traditionally been significant contributors, fell to $27.2 billion in 2023, a 43% decrease from the previous year. This drop is particularly notable given that Europe-based producers accounted for almost two-thirds of new manufacturing FDI in the US in 2023.

Implications

The decline in manufacturing FDI highlights a gap between initial investment announcements and actual capital expenditure. This trend raises questions about the long-term sustainability of foreign investment in the US manufacturing sector and the effectiveness of recent industrial policies.

Conclusion

While the US continues to attract foreign investment, the significant drop in manufacturing FDI underscores the need for a reassessment of current policies and strategies. Ensuring that initial investment commitments translate into tangible capital expenditure will be crucial for the future growth and stability of the US manufacturing sector.

2. Graphjet establishing in Nevada

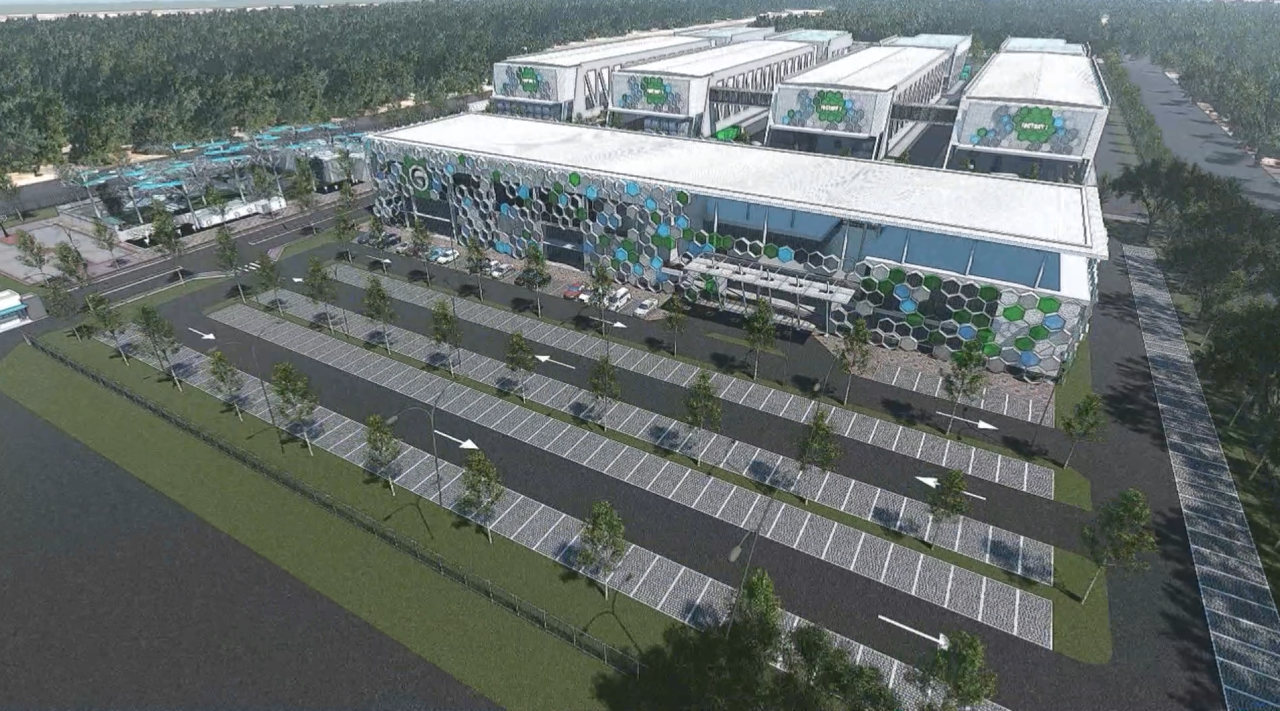

In a significant move that underscores the shifting dynamics of global supply chains, Malaysian firm Graphjet Technology has announced plans to establish a $200 million artificial graphite plant in Nevada. This decision comes in the wake of China’s stringent export restrictions on graphite, a critical component in electric vehicle (EV) batteries and semiconductors.

A Strategic Opportunity

China’s unexpected announcement in December 2023 to limit graphite exports has created a unique opportunity for Graphjet. The company, which specialises in converting biomass into artificial graphite, saw this as the perfect moment to accelerate its expansion into the US market. “The December announcement was a real surprise. We thought they might introduce the ban, but not until the end of this year or next year,” said Graphjet’s CEO, Aiden Lee.

Nevada: The Ideal Location

Nevada was chosen for its burgeoning EV value chain, anchored by Tesla’s gigafactory and a $5 billion battery joint venture with Panasonic. Additionally, the Thacker Pass mine’s large lithium deposit further strengthens the state’s appeal as a hub for EV battery production. Graphjet’s facility aims to come online in 2026, creating around 500 jobs and producing 10,000 tons of graphite annually, enough to power 100,000 EVs.

Sustainable and Cost-Effective Production

Graphjet’s technology, which converts palm kernel shells into artificial graphite, boasts an 80% lower carbon footprint and cost compared to traditional graphite mining. This not only aligns with global sustainability goals but also positions Graphjet as a key player in the US’s efforts to reduce dependency on Chinese graphite.

Challenges and Solutions

One of the challenges Graphjet faces is sourcing sufficient biomass locally. Due to trade restrictions on shipping unprocessed palm shell kernels from Malaysia to the US, the company will perform the initial conversion stage in Malaysia before refining the product in Nevada. This two-stage process ensures a steady supply of high-quality graphite while navigating logistical hurdles.

Conclusion

Graphjet’s investment in Nevada is a strategic response to geopolitical shifts and a testament to the company’s innovative approach to sustainable production. As the US continues to bolster its critical mineral industries, Graphjet’s presence in Nevada could play a pivotal role in securing the supply chain for EV batteries and beyond.

3. Yamaha’s new Dutch marine engineering centre

Yamaha Motor Europe has recently inaugurated the Yamaha Marine European Engineering Centre (YMEEC) in Rotterdam, Netherlands. This state-of-the-art facility is set to revolutionise the marine engineering landscape in Europe, offering unparalleled testing and development capabilities for boat builders.

A Hub for Innovation and Sustainability

The YMEEC is designed to provide optimal conditions for year-round testing, a feature that Yamaha claims is unique in the European marine industry. This centralisation of services not only enhances efficiency but also significantly reduces transportation needs and carbon emissions, aligning with Yamaha’s commitment to sustainability.

Advanced Testing Capabilities

Equipped with cutting-edge testing equipment and data recording technologies, the YMEEC offers a standardised testing protocol that ensures reliable and comparable results. This allows boat builders to extensively test various marine engines, mounting, and propeller configurations, ultimately leading to more efficient product development.

Supporting Electric Motor Development

In addition to traditional marine engines, the YMEEC will play a crucial role in Yamaha’s efforts to develop electric motors. This initiative is part of Yamaha’s broader strategy to meet market demands and adhere to best sustainability practices.

A Collaborative Effort

Fabrice Lacoume, Marine Director of Yamaha Motor Europe, expressed his enthusiasm about the new centre: “It is with great sense of commitment and joy that we open this one-of-its-kind engineering centre to support collaboration with boat builders, through boat testing and homologation. We believe this centre will truly make a difference to boat builders, at the same time contributing to our global marine sustainability goals”.

Conclusion

The Yamaha Marine European Engineering Centre stands as a testament to Yamaha’s dedication to innovation, sustainability, and collaboration. By providing a centralised hub for advanced marine engineering, Yamaha is not only setting new industry standards but also paving the way for a more sustainable future in marine technology.

4. Canadian shipbuilders urge Government to protect from Chinese rivals

In a bold move to safeguard the domestic shipbuilding industry, the Canadian Marine Industries and Shipbuilding Association (CMISA) has called on the Canadian government to impose a 100% surtax on all Chinese-built ships imported into the country. This call to action comes amid growing concerns over the competitive threat posed by China’s rapidly expanding shipbuilding sector.

A Strategic and Ethical Threat

CMISA President and CEO Colin Cooke has described the Chinese shipbuilding market as a “strategic and ethical threat” to Canada’s domestic industry. He emphasised the need for decisive measures to ensure that Canada’s critical shipping infrastructure is built and maintained domestically. “We owe it to Canadians to ensure that our critical infrastructure is built and maintained domestically, especially in light of the issues that global supply chains have been facing of late,” Cooke stated.

Poor Working Conditions and Environmental Standards

One of the key issues highlighted by CMISA is the poor working conditions and environmental standards at Chinese shipyards. Cooke pointed out that Canada’s shipbuilding workforce is highly skilled and capable of producing high-quality ships. He expressed disappointment over a leasing contract signed by Marine Atlantic, a state-owned ferry operator, with Stena for a ferry built in Weihai, China. Cooke urged the crown corporation to collaborate with the local industry to develop a new ferry to replace the existing ship when its lease ends in five years.

Global Context and National Security

The call for protectionist measures is not unique to Canada. The United States has also been scrutinising China’s shipbuilding practices, with President Joe Biden recently indicating a “real hard look” at the sector. China’s shipbuilding industry, which now accounts for 50% of all merchant tonnage produced annually, has been accused of using nonmarket practices to undermine international competition.

A Call for Decisive Action

CMISA’s appeal includes a recommendation for a 100% surtax on all Chinese-built ships imported into Canada and a prohibition on any government entity or Crown corporation from acquiring or leasing Chinese-built vessels. The association argues that such measures are imperative to protect Canadian industries and national security.

Conclusion

As global competition intensifies, the Canadian shipbuilding industry is urging the government to take decisive action to protect its interests. The proposed measures aim to ensure that Canada’s shipbuilding capabilities remain robust and that the industry can continue to contribute to the nation’s economic and strategic goals.

5. Africa to sign $3.5B in Indonesian trade deals

In a significant move to bolster economic ties, African nations are set to sign trade deals worth $3.5 billion with Indonesia at the ongoing Indonesia-Africa Forum in Bali. This marks a substantial increase from the $600 million in agreements secured at the forum’s inaugural meeting in 2018.

Key Partnerships and Agreements

The forum has facilitated several key partnerships. One notable collaboration is between Indonesia’s state power utility, PT Perusahaan Listrik Negara, and Tanzania Electric Supply Co. Ltd. to develop geothermal energy. Additionally, a health technology transfer agreement has been established between PT Bio Farma and Ghana’s Atlantic Lifesciences Ltd. Furthermore, Congo and Senegal are expected to purchase aircraft from PT Dirgantara Indonesia.

Strategic Importance

Indonesia’s President Joko Widodo emphasised the importance of these deals in diversifying Indonesia’s trade beyond traditional partners like China, the US, and Japan. With Africa’s rapidly growing markets, countries such as Kenya, Nigeria, South Africa, and Egypt present promising opportunities for Indonesian exports.

Economic Impact

Vice Foreign Affairs Minister Pahala Mansury highlighted that these agreements are not only about increasing trade volumes but also about fostering long-term economic partnerships. The deals are expected to enhance infrastructure, energy, and healthcare sectors across the participating African nations.

Conclusion

The $3.5 billion trade deals signify a new era of economic cooperation between Indonesia and Africa. As both regions continue to grow and develop, such partnerships will play a crucial role in shaping their economic futures.

6. UK Government will not re enter Europe

The UK government has announced its intention to prioritise securing global trade deals over seeking formal re-entry into the European Union. This decision follows the UK’s departure from the EU and aims to establish new trade relationships worldwide.

Background

Following Brexit, the UK has pursued trade agreements with several non-EU countries. Notable agreements include deals with Japan, Canada, and Australia. These efforts are part of a broader strategy to diversify the UK’s trade relationships and reduce economic dependence on the EU.

Government’s Stance

Government officials, including the Prime Minister and the Secretary of State for International Trade, have stated that global trade deals are crucial for opening new markets for British goods and services. They argue that re-entering the EU would limit the UK’s ability to negotiate independently with other countries.

Potential Benefits

Potential benefits of global trade deals include access to new markets, increased exports, and job creation. The UK is targeting major economies such as the United States, India, and China for these agreements. Diversifying trade partners is also seen as a way to mitigate risks associated with economic downturns in any single region.

Challenges and Criticisms

Challenges include potential trade barriers and regulatory divergences from the EU. Businesses and economists have expressed concerns about the UK’s ability to secure favorable terms in negotiations with larger economies. Critics also highlight the risks of losing frictionless trade with the EU.

Public Opinion

Public opinion on this issue is mixed. Some citizens support the government’s focus on global trade, while others are concerned about potential economic risks. Recent polls reflect this division, indicating uncertainty about the UK’s post-Brexit future.

Conclusion

The UK government’s decision to prioritise global trade deals over formal EU re-entry is a significant strategic move. The approach aims to secure new trade agreements and diversify the UK’s economic relationships, while also addressing the challenges and criticisms associated with this strategy.

7. Giorgia Meloni: Celebrating Two Years of Leadership

Giorgia Meloni by Governo italiano CC BY 3.0 IT https://creativecommons.org/licenses/by/3.0/it/legalcode

Giorgia Meloni marks her second anniversary as Italy’s Prime Minister, having achieved several milestones during her tenure. Meloni is the first woman to hold this position in Italy.

Achievements in Office

Economic Stability and Growth: Under Meloni’s leadership, Italy has experienced economic recovery following the COVID-19 pandemic. Her government has utilised the EU’s NextGenerationEU funds to support infrastructure projects and small and medium-sized enterprises.

Foreign Policy and International Relations: Meloni has maintained a pro-US and pro-NATO stance, ensuring Italy’s participation in global security matters. Her administration has supported Ukraine during the ongoing conflict and has worked closely with Western allies. Additionally, Meloni has fostered a cooperative relationship with the European Union to manage Italy’s debt and secure financial stability.

Social and Cultural Policies: Domestically, Meloni’s government has been active in cultural and social areas. Her policies have included debates on adoption rights for same-sex couples and promoting traditional Italian culture and heritage.

Goals for the Future

Economic Reforms: Meloni aims to implement further economic reforms to enhance Italy’s global competitiveness. This includes tax reforms to attract foreign investment and support for innovation and digital transformation.

Meloni plans to address migration and asylum challenges at Italy’s borders. She advocates for a more significant role for the EU in managing these issues, aiming for a balanced approach that ensures security and respects human rights.

Environmental Sustainability: Meloni’s administration plans to advance Italy’s environmental sustainability efforts. This involves investing in renewable energy sources, promoting green technologies, and ensuring Italy meets its climate targets in line with EU directives.

Strengthening National Unity: Meloni is focused on fostering national unity and social cohesion. She aims to bridge regional disparities and ensure that all Italians benefit from the country’s economic progress and social policies.

Conclusion

Giorgia Meloni’s two years in office have been marked by significant achievements and a clear roadmap for the future. Her administration’s focus on economic stability, international cooperation, and social policies will shape Italy’s trajectory in the coming years.