1. Hyundai and BAIC $1.1 Billion China JV

In a strategic move to strengthen their presence in the world’s largest electric vehicle (EV) market, Hyundai Motor and its Chinese partner BAIC Motor have announced a significant investment of $1.1 billion into their joint venture, Beijing Hyundai. This investment aims to revitalise their operations in China, where Hyundai has faced declining sales and increased competition from local manufacturers.

Background and Context

Hyundai and BAIC’s joint venture, Beijing Hyundai, has been operational for over two decades. However, recent years have seen a sharp decline in sales, with figures dropping to around 240,000 units in 2023, a stark contrast to the peak performance of 1.14 million units in 2016 This downturn has been attributed to various factors, including geopolitical tensions and the rapid rise of domestic EV manufacturers.

Investment Details

The $1.1 billion investment will be equally shared between Hyundai and BAIC, with each company contributing approximately $548 million. The funds will be used to enhance the production capabilities of Beijing Hyundai, focusing on the development and launch of new EV models tailored to the Chinese market.

Strategic Goals

Hyundai plans to introduce its first EV in China through Beijing Hyundai next year, with a broader goal of launching five eco-friendly models, including hybrids, by 2026. This move is part of Hyundai’s broader strategy to regain market share and establish a strong foothold in the Chinese EV market. The company aims to begin mass production of 30,000 extended-range electric vehicles (EREVs) annually in China by late 2026.

Market Implications

This investment underscores the importance of the Chinese market for global automakers. Despite recent challenges, China remains a critical market due to its size and the rapid growth of its EV sector. By bolstering their joint venture, Hyundai and BAIC are positioning themselves to better compete with local manufacturers and meet the growing demand for electric vehicles.

Conclusion

The $1.1 billion investment by Hyundai and BAIC in their China joint venture represents a significant step towards revitalising their presence in the Chinese market. With a focus on electric vehicles and technological advancements, Beijing Hyundai is poised to play a crucial role in the future of the automotive industry in China.

2. Northern Ireland votes to keep post-Brexit trade deal

In a significant political development, Northern Ireland’s lawmakers have voted to maintain the region’s special post-Brexit trade rules with Britain. This decision comes despite strong opposition from unionist parties, highlighting the ongoing divisions within the region.

The Vote and Its Implications

On December 10, 2024, the Northern Ireland Assembly held a crucial vote on whether to continue the post-Brexit trade arrangements, known as the Windsor Framework. The motion passed with a 48-36 majority. This framework, agreed upon by the UK and EU in 2023, effectively keeps Northern Ireland within the EU’s single market for goods, creating a unique trading status compared to the rest of the UK.

Unionist Opposition

Unionist parties, including the Democratic Unionist Party (DUP), have vehemently opposed the Windsor Framework. They argue that it creates economic barriers between Northern Ireland and Great Britain, undermining the region’s position within the UK. During the debate, DUP Deputy First Minister Emma Little-Pengelly criticised the vote, stating it “tears asunder” the principles of the Good Friday Agreement by not requiring cross-community support.

Support from Nationalists and Neutrals

In contrast, Irish nationalist parties such as Sinn Féin, along with neutral parties like the Alliance and the Social Democratic and Labour Party (SDLP), supported the motion. They believe the Windsor Framework provides stability and economic benefits by maintaining seamless trade with the EU.

Looking Ahead

As Northern Ireland navigates its post-Brexit future, the continuation of the Windsor Framework will likely remain a contentious issue. The outcome of this vote reflects the complex and often polarised nature of Northern Irish politics, where historical grievances and contemporary challenges intersect.

3. JDR Cables Secures £30 Million UKEF Support for Global Renewable Growth

In a significant boost to the renewable energy sector, JDR Cable Systems (JDR), a leading global subsea cable supplier, has secured £30 million in financing, backed by UK Export Finance (UKEF). This support is set to propel JDR’s global expansion, particularly in the floating wind sector, reinforcing the UK’s leadership in offshore wind manufacturing.

Empowering Global Growth

The £30 million bond support from UKEF, guaranteed at 80%, has enabled JDR to win major contracts in Europe and the US. This financing will allow JDR to deliver new projects that are crucial for the global transition to net-zero emissions. The company’s enhanced market presence in these regions underscores its pivotal role in the renewable energy landscape.

Strategic Investments and Job Creation

This latest support builds on previous UKEF financing from 2022, which facilitated the construction of a state-of-the-art submarine cable production facility in Northumberland. This facility is expected to create 171 skilled jobs, bolstering the local economy and supporting the broader UK supply chain.

Leadership and Innovation

Monika Cupiał-Zgryzek, CEO of JDR and TELE-FONIKA Kable, highlighted the importance of this investment: “The support from UK Export Finance is pivotal in enabling us to expand our operations and meet the growing demand for high-quality, high-voltage subsea and land cables. This investment not only strengthens our market position but also underscores our commitment to innovation, job creation, and the decarbonisation of the energy sector.”

A Collaborative Effort

The financing was facilitated by a consortium of lenders, including HSBC UK, Societe Generale, and Bank Gospodarstwa Krajowego (BGK). Craig Norbury, Business Development Manager at HSBC UK Global Trade Solutions, emphasised the collaborative nature of this achievement: “The fusion of JDR’s sector capability, UK Export Finance’s guarantee, and HSBC’s global reach has proved a winning combination, supporting JDR in bringing their ambitions to fruition.”

Future Prospects

As the UK expands its floating wind capacity, JDR is well-positioned to tap into the growing demand from countries with deeper waters requiring floating wind turbines. This strategic positioning not only enhances JDR’s market presence but also contributes significantly to the global renewable energy market.

Conclusion

The £30 million UKEF support marks a significant milestone for JDR Cables, enabling the company to expand its global operations and reinforce the UK’s leadership in the renewable energy sector. This investment is a testament to the collaborative efforts of industry leaders and government support, driving innovation and job creation in the pursuit of a sustainable future.

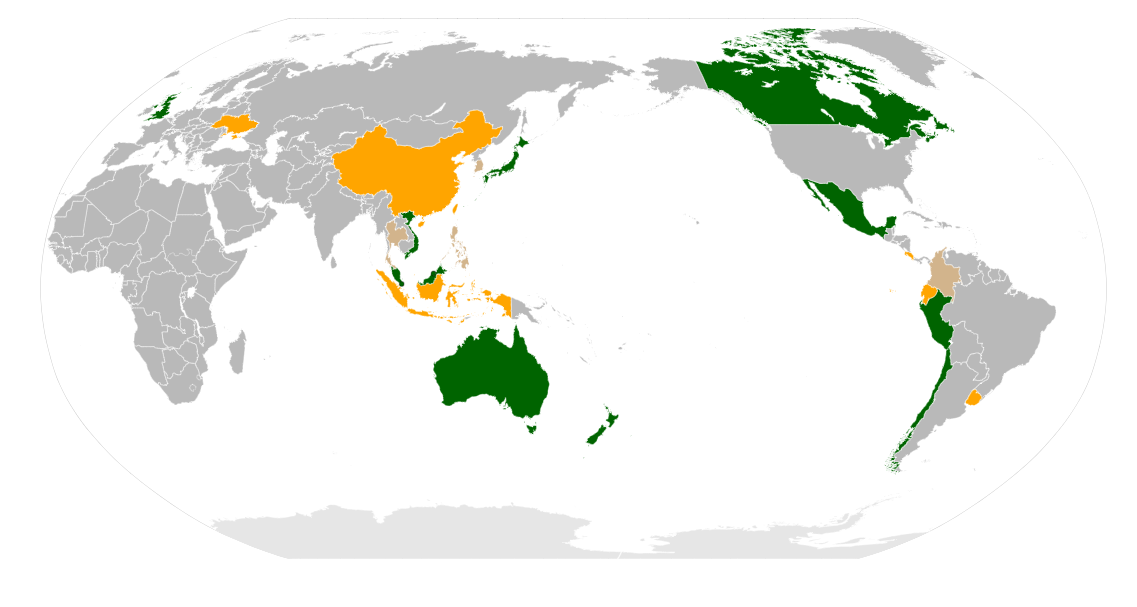

4. UK Joins Indo-Pacific Trade Bloc as First European Member

In a historic move, the United Kingdom has officially joined the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), becoming the first European nation to do so. This significant step marks the UK’s most substantial trade deal since Brexit, promising a substantial boost to the nation’s economy.

A Landmark Trade Agreement

The UK’s membership in the CPTPP came into effect on December 15, 2024. This trade bloc, which includes major economies such as Japan, Canada, and Australia, represents a combined GDP of approximately £11 trillion. The inclusion of the UK is expected to enhance trade relations and economic growth, with estimates suggesting a potential £2 billion boost to the UK’s economy annually.

Economic Benefits and Opportunities

Joining the CPTPP opens up new markets for British businesses, particularly in sectors such as food, drink, automotive, and services. Over 99% of UK goods exports to CPTPP countries will now be eligible for zero tariffs, providing a significant competitive advantage. This move is anticipated to support job creation and economic growth across the UK, with every region expected to benefit.

Strategic Positioning Post-Brexit

The decision to join the CPTPP underscores the UK’s strategy to forge new trade relationships post-Brexit. With EU member states still accounting for a significant portion of UK trade, diversifying trade partnerships is crucial. The CPTPP membership not only strengthens the UK’s presence in the Indo-Pacific region but also positions it as a key player in global trade dynamics.

Looking Ahead

As the UK navigates its post-Brexit economic landscape, joining the CPTPP is a strategic move to leverage new opportunities and drive growth. The government’s commitment to expanding trade horizons is evident, and this membership is a testament to the UK’s ambition to remain a global trading powerhouse.

5. UK Legaltech Lawhive Secures $40M for US Expansion

In a significant move to expand its footprint, UK-based legaltech startup Lawhive has successfully raised $40 million in a Series A funding round. This funding will accelerate its entry into the US market, aiming to revolutionise the legal services landscape with its innovative technology.

Funding and Investors

The Series A round was co-led by GV (Google Ventures) and TQ Ventures, with participation from Balderton Capital, Jigsaw, Episode 1, and notable Premier League footballers Harry Maguire and Reece James[1](https://legaltechnology.com/2024/12/05/online-legal-network-lawhive-raises-40m-series-a-to-disrupt-the-us-market/)[2](https://techcrunch.com/2024/12/04/lawhive-raises-40m-to-go-after-main-street-us-lawyers/). This diverse group of investors underscores the broad appeal and potential impact of Lawhive’s platform.

Lawhive’s Mission and Technology

Founded in 2019 by Pierre Proner (CEO), Jaime Van Oers (CTO), and Flinn Dolman, Lawhive offers an all-in-one technology platform designed to streamline legal processes for solicitors. The platform includes features for client onboarding, secure file-sharing, invoicing, and billing. It also provides a marketplace where lawyers can connect with consumers and small businesses.

Lawhive’s mission is to make legal services more accessible and affordable, particularly in the US market, where a significant portion of consumer legal needs remain unmet. CEO Pierre Proner emphasised the importance of this mission, stating, “Our goal is to make legal services accessible for everyone while helping consumer lawyers and small firms rediscover the joy of practicing law.”

Innovative AI Integration

A standout feature of Lawhive’s platform is its AI paralegal, Lawrence, which automates routine legal tasks. Lawrence has already passed part one of the Solicitors Qualifying Examination (SQE), showcasing its potential to significantly reduce the workload for lawyers and improve efficiency.

Market Potential and Future Plans

The US legal market, valued at approximately $1 trillion annually, presents a vast opportunity for Lawhive. The company aims to address the justice gap, where 80% of consumer legal needs are currently unmet. By leveraging its advanced technology, Lawhive plans to offer faster, more affordable legal services, thereby unlocking new opportunities for millions of US attorneys.

Vidu Shanmugarajah, a partner at GV, expressed confidence in Lawhive’s potential, saying, “Lawhive’s rapid growth shows that the demand for affordable, tech-driven legal services is both real and scaling fast. We’re excited to double down on our investment as Lawhive brings its model to the US and beyond.

Conclusion

With its recent funding and ambitious plans, Lawhive is poised to make a significant impact on the US legal market. By combining cutting-edge technology with a mission to improve access to legal services, Lawhive is set to transform the way legal services are delivered and consumed.