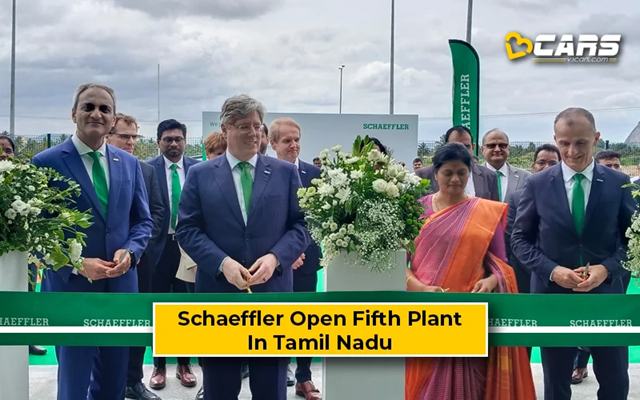

1. Schaeffler India opens new Tamil Nadu plant

Schaeffler India Opens New Manufacturing Facility in Tamil Nadu to Boost Powertrain and E-Mobility Capabilities

Shoolagiri, Tamil Nadu – May 28, 2025 — Schaeffler India, a leading manufacturer of automotive and industrial components, has inaugurated its fifth manufacturing facility in India, located in Shoolagiri, Tamil Nadu. This strategic expansion marks a significant milestone in the company’s commitment to strengthening its local manufacturing footprint and supporting India’s growing demand for advanced mobility solutions.

The new facility spans a total plot of 108,000 square meters, with the first phase covering 16,500 square meters. This phase is expected to reach full operational capacity by the fourth quarter of 2025. The plant will focus on producing powertrain and chassis components, including technologies for both conventional and hybrid vehicles.

Strategic Investment and Localisation

From 2022 to 2024, Schaeffler India invested ₹1,700 crore to expand its local capabilities, surpassing its original commitment of ₹1,500 crore. This investment supports the development of powertrain and e-mobility solutions, as well as industrial bearings, aligning with the company’s long-term localisation strategy.

Matthias Zink, CEO of Powertrain & Chassis at Schaeffler AG, emphasised the importance of the Indian market:

“India is a key market for Schaeffler. The new facility is a significant step in our efforts to expand our global manufacturing footprint and further localisation in the region. It supports our long-term growth vision and positions us to better cater to the rising market demands.”

Supporting ‘Make in India’ and Sustainability

Harsha Kadam, Managing Director and CEO of Schaeffler India, highlighted the company’s alignment with national initiatives:

“The inauguration at Shoolagiri exemplifies our commitment to expanding our capacities and competencies in India. We remain committed to the country’s ‘Make In India’ initiative, while embracing sustainable practices.”

The facility will manufacture planetary gear systems, hybrid transmission components, and other emerging automotive technologies, primarily for the Indian market.

Expanding Presence in India

With this new plant, Schaeffler India now operates five manufacturing facilities across the country—in Pune, Savli, Maneja, Hosur, and Shoolagiri—alongside three R&D centers. The company employs over 3,700 people in India and has maintained a presence in the country for more than six decades.

This expansion not only reinforces Schaeffler’s commitment to India but also positions the company to play a pivotal role in the country’s transition toward sustainable and electrified mobility.

2. EU-Thailand FTA: Global Trade Rules

As global trade faces mounting uncertainty and the erosion of multilateral norms, Sweden’s top trade official has underscored the strategic importance of the European Union-Thailand Free Trade Agreement (FTA) in preserving a rules-based international trading system.

Speaking on the 30th anniversary of Thailand and Sweden’s joint membership in the World Trade Organisation (WTO), Anders Ahnlid, Director-General of the Swedish National Board of Trade, emphasised that the EU-Thailand FTA is not just a bilateral economic initiative — it is a cornerstone for reinforcing global trade governance.

“Hopefully, this critical situation will serve to clarify minds and priorities when we enter the final phase of EU-Thailand FTA negotiations. We should never let a good crisis go to waste,” Ahnlid remarked.

Ahnlid’s comments come amid growing concerns over the retreat of major economies — notably the United States — from WTO principles, a trend he warns could destabilise the global trade order. He pointed to the success of the EU-Vietnam FTA as a model, noting that Vietnam’s exports to the EU surged by nearly 50%, while imports from the EU rose by over 40% following the agreement.

“The EU-Thailand FTA would be an important pillar in that work,” he said, adding that deeper integration with frameworks like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) could further strengthen the global trade fabric.

Thailand, with its strategic location and long-standing commitment to open trade, is well-positioned to benefit from such agreements. For Sweden and the broader EU, the FTA represents a chance to build resilient, cooperative trade relationships in a time of geopolitical flux.

Ahnlid envisions a future where like-minded nations form a new “centre of gravity” in global trade — one anchored in transparency, fairness, and mutual benefit.

“Collaborative efforts like the EU-Thailand FTA are crucial for maintaining open, fair, and sustainable trade practices,” he concluded.

As negotiations enter their final stages, the EU-Thailand FTA stands as a litmus test for the international community’s commitment to a stable, rules-based trading system — one that can weather the storms of protectionism and economic nationalism.

3. Scottish Salmon Gains Access to India

UK Flags New Indian Market for Scottish Salmon Trade After Landmark FTA

London, June 2, 2025 — The United Kingdom has officially announced the opening of a significant new export market for Scottish salmon in India, following the finalisation of a landmark Free Trade Agreement (FTA) between the two nations. The deal, agreed earlier this month and expected to be formally signed in the coming weeks, eliminates the 33% tariff previously imposed on Scottish salmon exports to India.

This move is being hailed as a major win for Scotland’s aquaculture sector, particularly for coastal communities that rely heavily on salmon farming.

Tavish Scott, Chief Executive of Salmon Scotland, described the development as

“crucial to protect our producers from unnecessary barriers like tariffs and red tape,” adding that salmon remains “the jewel in the crown of our world-class produce.”

The UK government has been actively promoting the benefits of the India-UK FTA, alongside other recent trade agreements with the US and EU, as part of a broader strategy to boost economic growth and secure long-term trade stability. Prime Minister Keir Starmer emphasised that these deals “deliver long-term security for people in Scotland,” promising lower food prices, greater consumer choice, and improved living standards.

The Indian market, with its growing middle class and increasing appetite for premium imported foods, represents a lucrative opportunity for Scottish salmon producers. The removal of tariffs is expected to significantly enhance the competitiveness of Scottish salmon in India, potentially leading to a surge in exports and investment in the sector.

While the spotlight has also been on the whisky industry—set to benefit from a phased reduction in tariffs from 150% to 40% over the next decade—the salmon trade breakthrough is seen as a more immediate and impactful gain for Scotland’s economy.

Trade Secretary Jonathan Reynolds noted that the FTA is part of a trio of “landmark deals” secured this month, showcasing the UK’s commitment to expanding global trade ties post-Brexit. “For Scottish businesses, these deals will mean stability and jobs protected as they seize new opportunities to sell to some of our biggest trading partners,” he said.

As the UK prepares to formalise the agreement, industry stakeholders are optimistic that this new chapter in UK-India trade relations will not only strengthen economic ties but also reinforce Scotland’s position as a global leader in sustainable seafood.

4. Payments: Transcard partners with Thredd

Transcard Partners with Thredd to Accelerate Global Expansion of SMART Suite

Chattanooga, TN – May 27, 2025 — Transcard, a leading provider of embedded payment solutions, has announced a strategic partnership with global payments processor Thredd to support the rapid international expansion of its SMART Suite platform. This collaboration marks a significant step in Transcard’s mission to deliver seamless, localised payment experiences across borders.

The SMART Suite is an AI-powered, fully embedded payment orchestration platform designed to streamline B2B and B2C transactions. With Thredd’s global issuance capabilities and extensive partner network, Transcard aims to bring its innovative payment solutions to new markets at an accelerated pace. The platform is already live in Canada and is set to launch in the UK soon.

“Many of our multi-national customers want the same end-user experience in other countries as we provide in the U.S.,” said Greg Bloh, CEO of Transcard. “Thredd’s global issuance and partner network allows us to enhance the number of payment methods available on greatly accelerated timelines.”

The partnership enables a wide range of use cases, including virtual card issuance for supplier payments, employee reimbursements, gig economy payouts, and Buy Now, Pay Later (BNPL) services. In BNPL scenarios, virtual cards can be dynamically issued, offering instant financing and streamlined settlement.

Jim McCarthy, CEO of Thredd, emphasised the synergy between the two companies: “Innovation is the lifeblood of any payments business, and Transcard’s SMART Suite is a great example of how an embedded payment solution can deliver real value. Together, we’ll support Transcard’s expansion plans and enable seamless, localised payment experiences that scale across borders.”

The SMART Suite integrates agnostically with customers’ ERP or core systems and connects to existing bank accounts. It supports a variety of payment methods and offers features such as disbursements, receivables, account-to-account payments, cross-border transactions, AI-driven insights, and supply chain financing.

This partnership not only enhances Transcard’s global reach but also reinforces its commitment to delivering flexible, secure, and efficient payment solutions for businesses of all sizes.

5. Finnish medtech attracts $7.9 million funding

Surgify Secures $7.9 Million in Series A Funding to Drive Global Expansion of Safer Bone Surgery Technology

Helsinki, Finland – May 27, 2025 — Finnish medtech innovator Surgify Medical has announced the successful close of its €7 million (approximately $7.9 million USD) Series A funding round. The investment will fuel the company’s ambitious plans to expand its operations across Europe and the United States, bringing its groundbreaking bone-cutting technology, Surgify Halo™, to a global audience.

The round was led by ZEISS Ventures, the corporate venture arm of the Carl Zeiss Group, with strong participation from the European Innovation Council Fund (EIC Fund) and existing investors Lednil and Cascara Ventures.

Surgify’s flagship product, the Surgify Halo™, is a revolutionary surgical tool designed to cut bone while protecting surrounding soft tissues such as nerves, blood vessels, and central nervous system structures. Unlike conventional surgical drills that pose a high risk of soft tissue injury, the Halo™ system offers a safer, more precise alternative—already approved by both MDR and the FDA.

“With this funding and regulatory approvals in both the EU and the U.S., we are well-positioned to bring our unique technology to more surgeons and patients internationally,” said Visa Sippola, Co-founder and CEO of Surgify Medical.

The technology has already been used in over a thousand patient procedures and is gaining traction in key hospitals. It is particularly valuable in complex head, neck, and spine surgeries, where soft tissue injuries can lead to severe complications and contribute to over €4 billion in annual healthcare costs globally.

“Surgify’s Halo™ burrs offer exceptional control at cutting rates comparable to traditional burrs, while simultaneously safeguarding delicate soft tissues,” said Dr. Boris Hofmann, Head of ZEISS Ventures. “This makes the switch to Halo™ burrs an obvious choice for surgeons.”

With this new capital, Surgify aims to scale its commercial footprint, enhance its product offerings, and further its mission to redefine surgical safety standards worldwide.

6. Greystar enters Denmark

Greystar Confirms Entry into Danish Market with Landmark Student Housing Acquisition

June 2, 2025 – Copenhagen, Denmark

Greystar, a global leader in rental housing investment, development, and management, has officially entered the Danish market through the acquisition of a 1,758-bed student housing portfolio in Copenhagen. This strategic move marks Greystar’s debut in the Nordic region and its expansion into its eighth European market.

The portfolio, acquired from Urban Partners’ real estate arm Nrep, comprises four newly constructed purpose-built student accommodation (PBSA) assets located in key student districts: Amager, Nordhavn, Valby, and Frederiksberg. These properties were developed under Nrep’s UMEUS brand, a concept designed in collaboration with over 1,000 students to meet the evolving needs of modern student life. The UMEUS residences feature compact private studios alongside extensive shared amenities such as communal kitchens, gyms, lounges, rooftop terraces, and retail spaces.

The deal, reportedly valued at €350 million, represents one of the largest student housing transactions in the region to date.

Mark Kuijpers, Senior Managing Director for Central Europe at Greystar, described the acquisition as a “landmark moment” for the company.

“Copenhagen offers all the fundamentals we look for—strong academic institutions, a growing and diverse student population, and a clear demand for high-quality, sustainable student housing,” he said.

Thomas Riise-Jakobsen, Partner and Head of Nrep Denmark, emphasised the social and commercial alignment of the deal. “We developed the UMEUS concept to address a critical shortage of suitable student accommodation in Copenhagen. This transaction is a testament to the value of combining social responsibility with commercial viability,” he noted.

Greystar’s entry into Denmark underscores its broader European growth strategy, which focuses on delivering localised execution backed by global expertise and data-driven insights. With this acquisition, the company gains immediate operational scale in one of Europe’s most attractive student housing markets.

7. Gotion invests $2 Billion in U.S. Battery Manufacturing

Manteno, Illinois – June 2025 — In a bold move that underscores the growing momentum behind America’s clean energy transition, Gotion Inc., a global leader in advanced lithium-ion battery technology and energy solutions, has announced an investment exceeding $2 billion to establish a major battery manufacturing hub in the United States.

The centerpiece of this initiative is a state-of-the-art gigafactory in Manteno, Illinois, which is poised to become the largest battery energy storage systems investment in the state’s history. Once fully operational, the 153-acre facility will produce 35 GWh of battery cells and 25 GWh of battery packs annually, supporting the rapid expansion of electric vehicles (EVs) and renewable energy infrastructure across the country.

This investment is expected to create up to 2,600 high-quality jobs, with over 150 full-time employees already onboard and hundreds more to be hired through local job fairs and training partnerships with community colleges. Gotion’s “Local for Local” strategy emphasises sourcing materials and equipment domestically, reinforcing U.S. supply chain resilience and supporting American businesses.

“Our commitment goes beyond building factories – we are investing in people, communities, and the future of American manufacturing,” said Mark Kreusel, Vice President of Manufacturing and Head of Gotion’s Manteno plant.

The project arrives at a critical juncture in U.S.-China relations, where trade tensions have raised concerns about the reliability of global supply chains. Gotion’s expansion in the U.S. reflects a strategic pivot toward onshoring key technologies while maintaining international cooperation. The company’s leadership has emphasised that clean energy and economic collaboration need not be mutually exclusive.

In addition to the economic and environmental benefits, Gotion’s investment aligns with Illinois’ ambitious climate goals, including achieving 100% clean energy and putting one million EVs on the road by 2030. The state has backed the project with $536 million in incentives, including funding for a new manufacturing training academy and workforce development grants.

As the facility nears full operation by the end of 2025, Gotion’s investment stands as a powerful example of how innovation, sustainability, and strategic diplomacy can converge to shape a cleaner, more resilient energy future for the United States.