1. USA – Japan reciprocal wheat trade missions

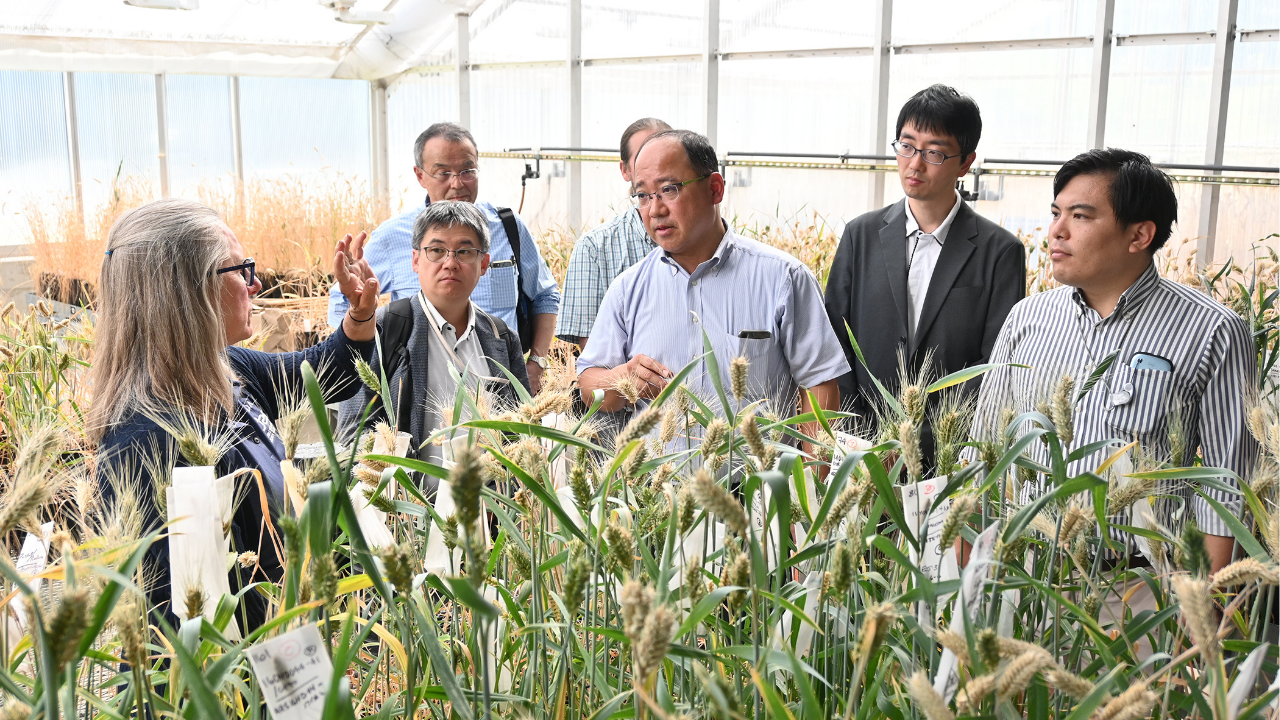

In a powerful demonstration of international agricultural cooperation, U.S. wheat farmers and Japanese millers have reaffirmed their enduring partnership through reciprocal trade missions held in the summer of 2025. These missions underscore a relationship that spans more than seven decades, built on mutual trust, shared values, and a commitment to quality.

A Partnership Rooted in History

The bond between U.S. wheat producers and Japanese millers dates back to 1949, when the Oregon Wheat Growers League organised a trade delegation to Japan. This initiative laid the groundwork for what would become one of the most stable and successful agricultural trade relationships in the world. Over the years, the collaboration evolved through the establishment of Western Wheat Associates and later the formation of U.S. Wheat Associates in 1980.

Japan has since become the largest cumulative buyer of U.S. wheat, consistently importing high-quality varieties such as hard red winter, soft white, hard red spring, and Desert Durum®. In the 2024/2025 marketing year alone, Japan imported 2.13 million metric tons of U.S. wheat—an increase of nearly 12% from the previous year.

Reciprocal Missions Strengthen Ties

This summer, two key trade missions highlighted the strength of this relationship. First, a delegation of mid-level managers from the Japan Flour Millers Association visited wheat farms and grain facilities in Montana, Washington, and Oregon. Their itinerary included tours of breeding labs, grain transportation systems, and quality assurance facilities. These visits provided Japanese millers with firsthand insights into the U.S. wheat supply chain—from seed to shipment.

Shortly after, newly appointed USW leadership embarked on their first official overseas mission to Japan. The delegation, led by USW President and CEO Mike Spier, Chairman Jim Pellman, and Vice President of Overseas Operations Brian Liedl, met with Japan’s top four flour milling companies, which together account for over 80% of the country’s flour sales. They also engaged with Japan’s Ministry of Agriculture, Forestry and Fisheries and visited the Seifun Museum, the historic home of Nisshin Milling.

Building Trust Beyond Business

These missions were not just about trade—they were about relationships. “Our relationship with Japan is more than commercial; it is a deep-seated partnership built on decades of trust,” said Spier. Pellman emphasised the importance of honest conversations, noting that both sides face economic pressures and must work together to ensure sustainability and profitability.

Liedl added, “Japanese business culture is built on the principle of harmony. To succeed in the Japanese market requires strong relationships, not just contracts. USW fits nicely into this model because we are the U.S. wheat farmer’s representation in the Japanese market.”

Looking Ahead

As global markets face increasing volatility, the U.S.-Japan wheat trade relationship stands as a model of resilience and cooperation. These reciprocal trade missions reaffirm a shared commitment to quality, transparency, and mutual respect. By continuing to invest in personal connections and technical collaboration, both nations ensure that their partnership will thrive for generations to come.

2. Minister to visit Saudi Arabia & United States for trade talks

danny postma via unsplash

New Zealand’s Agriculture, Trade and Investment Minister, Todd McClay, is set to embark on a pivotal diplomatic mission next week, with scheduled visits to Saudi Arabia and the United States aimed at strengthening bilateral trade, investment, and agricultural cooperation.

Saudi Arabia: Advancing Agritech and Food Security

Minister McClay will begin his tour in Riyadh, where he will meet with key Saudi officials including the Minister of Commerce, HE Dr Majid bin Abdullah Al-Kassabi, and the Minister of Environment, Water and Agriculture, HE Eng Abdulrahman Abdulmohsen Al-Fadley. The discussions will center on expanding trade and investment opportunities, particularly in agritech and food production—sectors where New Zealand has global expertise.

Saudi Arabia’s Vision 2030 initiative, which prioritises food security and agricultural innovation, aligns closely with New Zealand’s strengths in sustainable farming and dairy technology. The visit will also serve as a platform to explore the implementation of the recently concluded New Zealand–Gulf Cooperation Council Free Trade Agreement, which promises to unlock new export channels and reduce trade barriers.

United States: Addressing Tariff Concerns and Deepening Ties

Following his engagements in Saudi Arabia, Minister McClay will travel to Washington D.C. at the invitation of United States Trade Representative Jamieson Greer. He is scheduled to meet with Secretary of Agriculture Brooke Rollins, U.S. industry leaders, and policy think tanks to discuss the evolving trade landscape.

A key focus will be the U.S. government’s recent decision to impose a 15% or higher tariff on imports from countries with a trade surplus. New Zealand, currently running a modest surplus with the U.S., is directly impacted. Minister McClay emphasised the importance of understanding the implications of this policy shift:

“New Zealand and the United States have a long-standing, well-balanced trading relationship. I will be seeking to understand the impact of these tariffs and what they may mean for our exporters, particularly if trade flows shift,” he stated.

He also noted the disparity in tariff exposure, with U.S. exports to New Zealand facing an average tariff of just 0.3%, significantly lower than what New Zealand exporters encounter in the American market.

Strategic Outcomes and Global Positioning

The ministerial mission reflects New Zealand’s broader strategy to diversify its trade relationships and reinforce its presence in high-value markets. With both Saudi Arabia and the United States playing influential roles in global trade, the outcomes of these talks could shape New Zealand’s economic trajectory for years to come.

Minister McClay’s visit underscores a commitment to constructive dialogue, mutual growth, and the pursuit of equitable trade partnerships in an increasingly complex global economy.

3. Trump Unveils Series of Landmark Trade Agreements Across Asia

In a sweeping move to reshape U.S. trade relations in the Indo-Pacific, former President Donald Trump has announced a series of major trade agreements with Japan, South Korea, the Philippines, and Indonesia. These deals, unveiled just ahead of a self-imposed August 1 tariff deadline, reflect a strategic pivot toward reciprocal trade and industrial revitalisation.

Japan: A $550 Billion Investment and Industrial Revival

Trump’s agreement with Japan is being hailed as “the largest trade deal in history.” Japan has committed to invest $550 billion into U.S.-directed industrial projects, marking the largest foreign investment ever secured by any country. The funds will target key sectors such as:

- Semiconductor manufacturing

- Energy infrastructure

- Critical minerals

- Pharmaceutical production

- Shipbuilding

In return, Japanese imports will face a 15% baseline tariff, while American exports gain expanded access to Japan’s markets, including a 75% increase in rice imports, major purchases of U.S. aircraft, and the lifting of restrictions on American automobiles.

South Korea: $350 Billion Investment and Energy Commitments

South Korea has agreed to a $350 billion investment in U.S.-controlled assets and will purchase $100 billion in American energy products, including liquefied natural gas. The deal also includes:

- A 15% tariff on South Korean imports to the U.S.

- Full market access for American agricultural and automotive products

- A commitment to open trade and regulatory alignment

This agreement follows months of tense negotiations and marks a political win for South Korea’s newly elected President Lee Jae-myung.

Philippines: Open Market and Military Cooperation

In a meeting with Philippine President Ferdinand “Bongbong” Marcos Jr., Trump finalised a trade deal that sets a 19% tariff on Philippine goods entering the U.S., while U.S. exports to the Philippines will face zero tariffs. The Philippines has pledged to become an open market for American goods, and the deal includes provisions for military cooperation.

Trump praised Marcos as a “tough negotiator” and emphasised the strategic importance of the Philippines in maintaining regional stability.

Indonesia: Reciprocal Trade and Regulatory Reform

The U.S.-Indonesia trade agreement is designed to eliminate 99% of tariff barriers on American exports to Indonesia, while Indonesian goods will face a 19% tariff entering the U.S.

Key features include:

- Removal of non-tariff barriers such as local content requirements and import licensing

- Acceptance of U.S. safety and regulatory standards

- Commitments to digital trade and data protection

- Elimination of export restrictions on critical minerals

- Labor reforms and cooperation on steel excess capacity

Goods transshipped through Indonesia or containing content from certain countries will face a 40% tariff, aimed at curbing tariff evasion.

Strategic Implications

These agreements signal a broader shift in U.S. trade policy under Trump’s leadership—one focused on reciprocity, industrial revival, and strategic alignment. By securing massive foreign investments and opening markets for American exports, Trump aims to reduce trade deficits and bolster domestic manufacturing.

While critics question the long-term sustainability and geopolitical implications of these deals, supporters argue they represent a bold reassertion of American economic leadership in Asia.

4. South East Asia named most attractive manufacturing region – report

South East Asia has emerged as the most attractive region globally for manufacturing investment, according to a comprehensive report by risk consultancy Verisk Maplecroft. The region’s appeal is driven by a potent combination of competitive labour costs and a growing pool of skilled human capital, positioning it ahead of traditional manufacturing powerhouses like China and India.

Key Findings from the Report

The report evaluates 192 countries using two indices: the Cost of Labour Index (CLI) and the Human Capital Availability Index. These metrics assess factors such as wage levels, education, health, innovation, and productivity.

- Vietnam leads the region, ranking 13th globally. It has become a hub for electronics, textiles, and consumer goods, benefiting from the “China Plus One” strategy adopted by many companies seeking to diversify supply chains.

- Indonesia (17th), Philippines (28th), Thailand (31st), and Malaysia (35th) also rank highly, showcasing the region’s depth in manufacturing potential.

- India, despite its large labour force, lags behind at 72nd due to underinvestment in education and healthcare and the emigration of skilled professionals.

Strategic Shifts in Global Supply Chains

The COVID-19 pandemic and escalating US-China trade tensions have accelerated a restructuring of global supply chains. South East Asia has been a major beneficiary of this shift, with companies increasingly adopting the “China Plus One” strategy to reduce dependency on China.

While China remains deeply embedded in global supply chains and ranks 24th on the combined indices, its manufacturing wages have more than doubled over the past decade, making South East Asia a more cost-effective alternative.

Challenges and Opportunities

Despite its strengths, the region faces challenges:

- US Tariffs: Vietnam, for example, faces a 20% tariff on exports to the US, with even higher rates for trans-shipments. These tariffs could dampen investor enthusiasm.

- Regulatory and Infrastructure Issues: Indonesia’s complex regulatory environment and infrastructure gaps hinder its ability to attract high-value manufacturing investments.

- Political Instability: Thailand’s political landscape and slowing productivity growth pose risks to long-term investment.

Global Context

Other regions are also vying for manufacturing investment:

- Mexico is a key nearshoring destination for the US, ranking 37th, though trade uncertainties persist.

- Eastern Europe (Poland, Romania, Hungary, Bulgaria) offers low wages and strong vocational education but faces demographic headwinds.

- Sub-Saharan Africa is the most cost-competitive region but struggles with human capital development. However, its working-age population is expected to grow significantly by 2050, presenting long-term opportunities.

Conclusion

South East Asia’s rise as the top manufacturing destination reflects its strategic importance in the evolving global economic landscape. With a young, skilled workforce and competitive costs, the region is well-positioned to attract sustained foreign investment—provided it can navigate geopolitical and regulatory challenges.