1. Erdoğan-Trump meeting kickstarts USA-Turkey trade

In a high-stakes diplomatic encounter at the White House on September 25, Turkish President Recep Tayyip Erdoğan and U.S. President Donald Trump reaffirmed their commitment to a bold bilateral trade target of $100 billion, a significant leap from the current $43 billion trade volume. The meeting, hailed by Turkish business leaders as a turning point, has injected fresh momentum into Türkiye–U.S. economic relations.

Strategic Sectors Take Center Stage

The summit yielded promising developments in energy and defense cooperation, with both leaders signaling intent to deepen ties through mutually beneficial agreements. Turkish Airlines announced plans to purchase 75 Boeing 787 aircraft and negotiate for 150 737 MAX jets, underscoring the scale of commercial engagement.

Business leaders emphasised the strategic importance of these deals. Şekib Avdagiç, President of the Istanbul Chamber of Commerce, described the meeting as a “positive milestone,” noting that Türkiye maintains a trade surplus with the U.S. in 65 product categories. “We believe trade between the two countries will reach the $100 billion target with a win-win approach and mutually privileged tariffs,” he said.

Export Potential and Sectoral Opportunities

Mustafa Gültepe, Chair of the Turkish Exporters’ Assembly (TİM), highlighted the U.S. as Türkiye’s second-largest export market after Germany. He pointed to high growth potential in chemicals, automotive, ready-to-wear fashion, carpets, and electronics, sectors where Turkish manufacturers have already demonstrated competitive quality and scale.

Gültepe also stressed the importance of a free trade agreement, suggesting it could accelerate progress toward the $100 billion goal. “Trump’s praise for Türkiye’s production prowess is encouraging. An FTA would be a game-changer,” he added.

Investor Confidence and Economic Impact

Orhan Aydın, Chair of the Anatolian Lions Businesspeople Association, noted that the summit could restore investor confidence and attract foreign capital. “Normalised ties may reduce Türkiye’s credit default swap, lowering external borrowing costs and easing fiscal pressures,” he explained.

The meeting also touched on broader geopolitical issues, including defense sales and regional stability. Trump hinted at lifting the U.S. ban on F-35 fighter jet sales to Türkiye, a move that could further cement strategic alignment.

A New Chapter in Bilateral Relations

President Erdoğan described the talks as “so beautiful it cannot be stained by smear campaigns,” emphasising the constructive tone and shared vision for global peace. Both leaders agreed that while no single meeting can resolve all issues, the summit marked “meaningful progress” on trade, defense, and diplomatic fronts

As the dust settles, the business community remains optimistic. The Erdoğan-Trump meeting has not only rekindled bilateral enthusiasm but also laid the groundwork for a transformative economic partnership—one that could redefine the trajectory of U.S.–Türkiye trade for years to come.

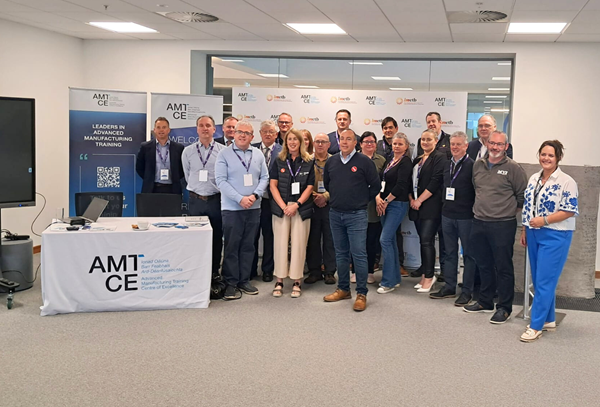

2. USA manufacturing trade visit to Ireland

Dundalk, Ireland – The Advanced Manufacturing Training Centre of Excellence in Dundalk recently played host to a landmark international event as the USA Cross Border Trade Mission arrived on the island of Ireland. The mission brought together 12 companies from Pennsylvania and a matching cohort of cross-border businesses from Ireland, marking a significant step in strengthening transatlantic trade and innovation.

Organised in partnership with Dundalk Chamber of Commerce, Newry Chamber of Commerce, Invest NI, and the Ireland Institute of Pittsburgh, the mission was designed to foster meaningful commercial relationships across sectors including advanced manufacturing, technology, life sciences, healthcare, agri-food, and food tech.

A Strategic Meeting Point

The AMTCE, operated by LMETB, served as a strategic venue for the delegation, offering a glimpse into Ireland’s cutting-edge training and innovation infrastructure. Delegates toured the facilities and engaged in a programme of networking, expert briefings, and business matchmaking, aimed at accelerating growth and collaboration across borders.

Gerard Smith, Director of AMTCE, highlighted the centre’s role as a bridge between industry, education, and international partners:

“This Trade Mission reflects the vision of AMTCE – to act as a bridge between industry, education, and international partners. The opportunities being explored this week have the potential to deliver real economic benefits across the island of Ireland.”

Building Relationships Beyond Business

The timing of the mission coincided with the NFL Game Week at Croke Park, where the Pittsburgh Steelers faced off against the Minnesota Vikings, adding cultural resonance to the Pennsylvania-Ireland connection. The delegation was led by Jim Lamb, President of the Ireland Institute of Pittsburgh, alongside Amanda Stewart (High Performance Building Alliance) and Jenna Cramer (Green Building Alliance).

Martin O’Brien, Chief Executive of LMETB, emphasised the broader impact of the initiative:

“The Trade Mission is about more than business – it is about building lasting relationships. By bringing companies from the island of Ireland together with our long-standing partners in Pennsylvania, we are opening doors for collaboration in advanced manufacturing, technology, life sciences, and beyond.”

A Platform for Growth

The event underscored the strategic importance of the Dublin-Belfast Economic Corridor, with Paddy Malone of Dundalk Chamber noting the region’s unique access to Ireland, Britain, and the US. The mission also spotlighted dual market access opportunities for US firms seeking to expand into Europe via Northern Ireland.

Elaine Curran, Director of Trade and Investment at Invest NI, added:

“US companies play a pivotal role in Northern Ireland’s economy, investing in key sectors such as financial services, technology and advanced manufacturing. Many of our leading investors decide to reinvest and grow their operations in Northern Ireland, demonstrating confidence in our highly skilled workforce and business-friendly environment.”

3. EU trade talks with Philippines, Thailand, and Malaysia

yu kato via Unsplash

The European Union is making significant strides in its pursuit of new free trade agreements with Southeast Asian nations, with negotiations advancing rapidly with the Philippines, Thailand, and Malaysia. EU Trade Commissioner Maroš Šefčovič confirmed the progress during the ASEAN-EU Business Summit held in Kuala Lumpur, signaling a strategic pivot in the bloc’s trade policy.

Speaking on the heels of the EU’s landmark agreement with Indonesia, Šefčovič stated, “We have advanced very well in our free trade negotiations with Thailand, with the Philippines, and also with Malaysia. My message to my partners in ASEAN was that we do not want to stop here.”

The EU’s renewed engagement with Southeast Asia comes amid global trade realignments, particularly in response to U.S. tariff policies under President Donald Trump. The bloc is seeking to diversify its trade partnerships and reduce dependency on traditional markets, notably China and the United States.

Building Blocks Toward a Broader EU-ASEAN Pact

The bilateral agreements under negotiation are viewed not merely as standalone deals but as foundational steps toward a comprehensive region-to-region FTA between the EU and ASEAN. Šefčovič emphasised that these agreements are “building blocks” for deeper integration and cooperation between the two blocs.

The EU already has FTAs in place with Singapore and Vietnam, and recently concluded a nine-year negotiation with Indonesia. The Indonesia-EU Comprehensive Economic Partnership Agreement (CEPA), signed on September 23, 2025, is expected to enter into force by January 2027 and will eliminate tariffs on over 90% of traded goods.

Overcoming Past Challenges

Negotiations with Malaysia, Thailand, and the Philippines had previously stalled due to political and environmental concerns. Talks with Malaysia were suspended in 2012 over disputes related to palm oil exports, while negotiations with Thailand and the Philippines were paused due to political instability and human rights issues, respectively.

However, recent geopolitical shifts and economic imperatives have prompted all parties to re-engage. Malaysia resumed talks in early 2025, and Thailand and the Philippines followed suit shortly thereafter. The EU now anticipates finalising and signing these agreements by 2026.

Strategic and Economic Implications

The EU’s push into Southeast Asia reflects a broader strategy to secure access to emerging markets and critical raw materials, particularly in sectors such as green technology, digital trade, and electric vehicles. Trade with ASEAN nations already accounts for a significant portion of EU external commerce, with the bloc being ASEAN’s third-largest trading partner.

Šefčovič’s remarks underscore the urgency and optimism surrounding the negotiations: “We’re working tirelessly to expand our network with Thailand, the Philippines, Malaysia – and progress is promising.”

As the EU continues to deepen its economic footprint in Southeast Asia, these upcoming trade agreements could reshape regional dynamics and offer new opportunities for businesses across both regions.

4. India-Oman FTA nearly complete

India and Oman are on the brink of finalising a landmark Comprehensive Economic Partnership Agreement, a deal poised to significantly deepen trade and investment ties between the two nations. However, one critical issue remains unresolved: Oman’s ‘Omanisation’ policy, a labour regulation that mandates private sector companies to hire a minimum percentage of Omani nationals.

What Is ‘Omanisation’?

The ‘Omanisation’ policy is a cornerstone of Oman’s national employment strategy. It requires companies to meet sector-specific quotas for employing Omani citizens—ranging from 15% to 30%, depending on the industry. These quotas are subject to periodic revision, and failure to comply can result in penalties, including fines and visa restrictions.

India, which has a significant expatriate workforce in Oman, is seeking guarantees that the current Omanisation quotas will be frozen for Indian businesses and professionals post-CEPA. The concern is that without such safeguards, future revisions could restrict Indian access to Oman’s labour market, particularly in the services sector.

Strategic and Economic Stakes

Oman is India’s third-largest trading partner in the Gulf Cooperation Council (GCC), with bilateral trade reaching $8.9 billion in FY 2023–24. India’s exports to Oman include gasoline, iron and steel, electronics, and machinery—many of which currently face a 5% import duty. The CEPA is expected to eliminate or reduce these tariffs, giving Indian goods a competitive edge.

In return, Oman seeks greater market access for its petrochemical products, which has raised concerns within Indian industry over potential flooding of low-cost imports. Despite these tensions, most trade-related issues have been resolved, and the CEPA promises 98% market access for Indian goods and significant liberalisation in services.

Political Momentum and Regional Implications

Negotiations began in November 2023 and gained momentum following Commerce Minister Piyush Goyal’s visit to Muscat in January 2025. The CEPA is seen not just as an economic pact but also a strategic move to expand India’s footprint in West Asia, complementing its existing FTA with the UAE.

The deal is particularly important for Indian professionals in sectors like healthcare, IT, and engineering, where Oman has traditionally relied on foreign expertise. Freezing Omanisation quotas would ensure predictable and stable access for Indian talent in the region.

What’s Next?

According to officials, negotiations have concluded, and the agreement is now undergoing legislative and administrative processing in Oman. If the Omanisation issue is resolved satisfactorily, the CEPA could be signed imminently, unlocking new trade horizons for both nations.

As India continues to pursue FTAs across the GCC, the outcome of the India-Oman CEPA will likely set a precedent for future agreements—balancing national employment policies with the need for open, mutually beneficial trade.

5. American Lithium’s Peru investment

mckayla crump via Unsplash

American Lithium Corp. has announced a significant increase in its investment for the Falchani lithium project in Peru, raising the budget by 22% to $847 million. This strategic move comes as the company relaunches the project following a favorable ruling from Peru’s top court, which resolved a long-standing legal dispute over mining concessions.

The Falchani project, located in the Andean region of Puno, is Peru’s only lithium development and is now poised to become a cornerstone of the country’s emerging role in the global battery metals supply chain. The updated investment includes plans to construct a refinery on-site, a critical step toward producing battery-grade lithium carbonate domestically.

Ulises Solis, General Manager of American Lithium’s Peruvian subsidiary, Macusani Yellowcake, confirmed the company is targeting a 2027 start for construction, with production expected to begin post-2028. The relaunch follows a late-August court decision that confirmed Macusani Yellowcake’s ownership of 32 concessions, ending a legal challenge initiated by Peruvian mining authorities in 2018.

“Investors were afraid of the outcome of the lawsuit,” Solis said at a recent mining forum. “Now that the legal uncertainty is resolved, we’re actively engaging with both Peruvian and international investors, including parties from Germany.”

The Peruvian government is also stepping in to support the project. The country’s Mining Minister is scheduled to meet with company shareholders on October 7, signaling high-level backing for the development of Falchani.

This investment surge reflects growing confidence in Peru’s potential to become a key player in the lithium market, especially as global demand for electric vehicles and energy storage solutions accelerates. With the legal hurdles cleared and infrastructure plans underway, Falchani could help reshape the regional dynamics of lithium production, traditionally dominated by the “Lithium Triangle” of Bolivia, Chile, and Argentina.

For American Lithium, the Falchani project represents not just a commercial opportunity but a strategic foothold in Latin America’s evolving energy landscape.

Featured image President of the United States Donald Trump speaking at the 2017 Conservative Political Action Conference (CPAC) in National Harbor, Maryland. Gage Skidmore