1. UAE-South Korea trade up 19%

Non-oil bilateral trade between UAE and South Korea has grown 19% in the first quarter of 2022 to $1.3 billion.

The UAE is the only country in the Middle East which has a special strategic partnership with South Korea.

South Korea invests $2 billion in the UAE and UAE invests $637 million in South Korea.

The UAE has 100 double taxation treaties and 67 bilateral investment treaties and 40 freezones with benefits such as tax incentives and exemptions, 100 per cent business ownership without the need of a national agent and long-term visas.

Trade Horizons

Trade Horizons is an award-winning market entry company, assisting ambitious companies to identify, develop and grow sustainable revenues in new geographic markets. We offer support to clients in international strategy development for their global business growth, and throughout the key phases of market entry execution – Preparation, Launch and Growth. Click here to find out more.

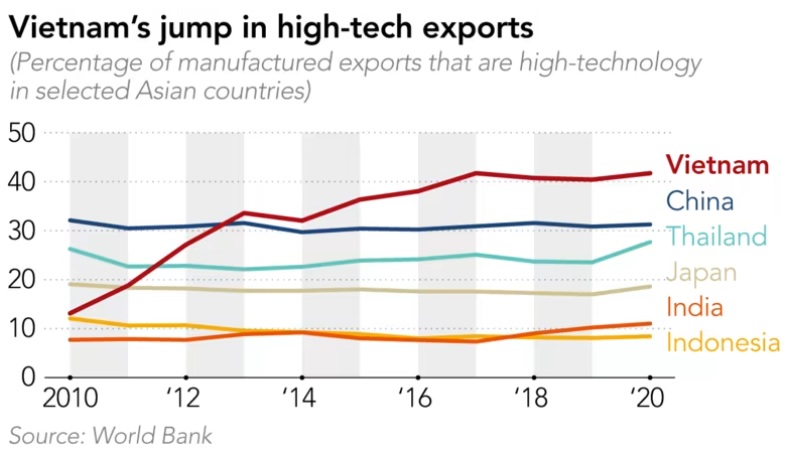

2. Vietnam struggles to transition from tech assembler to creator

Apple, Intel and Samsung are some of the global tech companies that use factories in Vietnam to assemble their products. However, Vietnam does not have any tech companies of its own and it is struggling to create value or merge into a tech hub such as China, South Korea or Taiwan have done.

Labour costs are cheap, and state industrial policy is constructive however it lacks a skilled workforce / substantial infrastructure and is struggling with the transition from being an assembler to becoming an innovator.

In addition, the ecosystem is very different to when China emerged for example supply-chains are much less stable now, there is a widespread scepticism of globalism and increased competition.

3. India-UK trade deal to be done by Diwali

India and the Uk are on track to sign a free trade agreement by Diwali Festival of light which takes place on Monday 24th October. The negotiations are complete and politicians have given their go-ahead.

The agreement is expected to boost trade by 100% by 2030 to £100 billion lowering import duties and tariffs on hundreds of goods.

India’s merchandise exports to the UK rose over 28% to $10.5 billion in 2022 while imports rose to $7 billion.

4. EU Australia trade deal

The EU is running to catch up with UK negotiating a trade deal with Australia. Primarily it is looking for lithium and rare earth suppliers for mobile phones and electric vechicle batteries as it seeks to decouple its supply chain away from China. Australia supplies around 60% of the world’s lithium and is one of the country’s with the largest deposits of lithium.

Although talks began in 2017 progress has been at a glacial pace due to bottlenecks and obstacles in the topics of environmental policy, rather absurd considering lithium is a non-renewable resource extracted by mining.

Whilst the EU would seek access to rare minerals Australia is rich in, Australia need s to guarantee not to give away the crown jewels without securing something for farmers and agricultural workers.

5. Canada-Europe trade deal still not signed 5 years after initiation

In another example of Europe’s lagging pace, the draft trade deal initiated with Canada 5 years ago is apparently still not ratified, causing some to wonder whether it will ever go ahead.

The blockage this time is a dispute over how corporations can sue governments. CETA or Comprehensive Economic and Trade Agreement was drafted back in 2017 with a 33% rise in trade since then equal to $100 billion in goods and services.

6. Does India protect foreign investors?

The recent Indian Antrix-Davis case represents a win for the Indian Government however in the case of FDI legislation providing that foreign private entities may sue sovereign nations exists to protect FDI itself. So although the Indian Government may have won this battle, the win could represent a larger loss in the war for FDI itself.

India has been sued 26 times, 23 times by American companies with a further whopping 204 initiated by US investors with the remainder pending or settled – these are sobering numbers.

The details again are intricate but commentators seems to agree that if India sets some form of strategy for FDI and create legislation around that it would be better off than firefighting the many separate incidents, especially regarding bilateral investment treaties (BITs), which was a defining factor in the Antrix-Davis case, specifically the Germany-India BIT that was activated by Deutsche Telekom.

6. Sub-Saharan African debt & FDI

The recent Indian Antrix-Davis case represents a win for the Indian Government however in the case of FDI legislation providing that foreign private entities may sue sovereign nations exists to protect FDI itself. So although the Indian Government may have won this battle, the win could represent a larger loss in the war for FDI itself.

India has been sued 26 times, 23 times by American companies with a further whopping 204 initiated by US investors with the remainder pending or settled – these are sobering numbers.

The details again are intricate but commentators seems to agree that if India sets some form of strategy for FDI and create legislation around that it would be better off than firefighting the many separate incidents, especially regarding bilateral investment treaties (BITs), which was a defining factor in the Antrix-Davis case, specifically the Germany-India BIT that was activated by Deutsche Telekom.