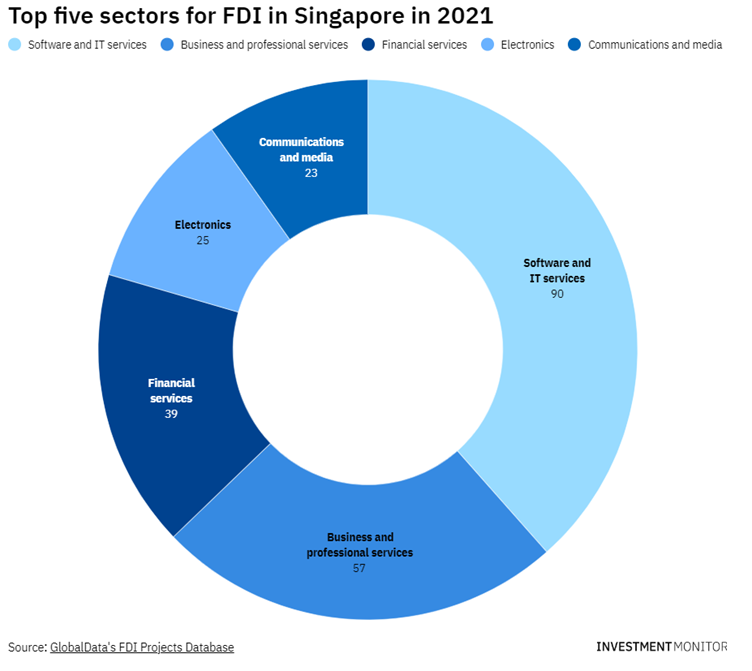

1. Singapore wins at FDI

Singapore is the second easiest country to do business in according to the OECD’s Ease of Doing Business Report and had always held top spot until being overtaken by New Zealand in 2018.

It is the third smallest country in Asia and is 8th in the world attracting FDI, the most in Asia relative to GDP.

In 2022 Singapore so far has attracted $US74 billion FDI which represents 21% of its GDP.

Regarding investor protection Singapore ranks highly compared to Asia, the US and Germany.

Singapore boasts a skilled workforce proficient in English, geographically strategic location as a gateway to Asia with well-equipped high-capacity modern ports, solid financial infrastructure and political stability with business-friendly laws and a high level of certainty with the law system based on English Common Law, and an attractive tax structure.

_____________________________________________________________________________________________

2. 15% Korean FDI in Caymans / Panama

Credit sava-bobov-via unsplash

A new expose has showed that a significant amount of FDI made by Koreans ended up in Cayman Islands and Panama amounting to $UA11.2 billion or 15% of total FDI.

South Korea has experienced very rapid growth in recent years and is now considered an advanced economy.

The negative effects of FDI leaking to tax havens is that the money may not return to the mainland or be used for the original use for which it was purportedly intended.

However, often funds are intended for corporate mergers and acquisitions. The concern is that the money would be used for illicit purposes instead such as terrorist financing, prostitution and human trafficking / slavery.

The current figure is more double the 2019 amount of 6.1% with cash transfers growing at a greater rate, indicating probable tax evasion intentions.

Tax avoidance is an accepted activity necessary when wealth planning whilst tax evasion is a criminal activity.

____________________________________________________________________________________________

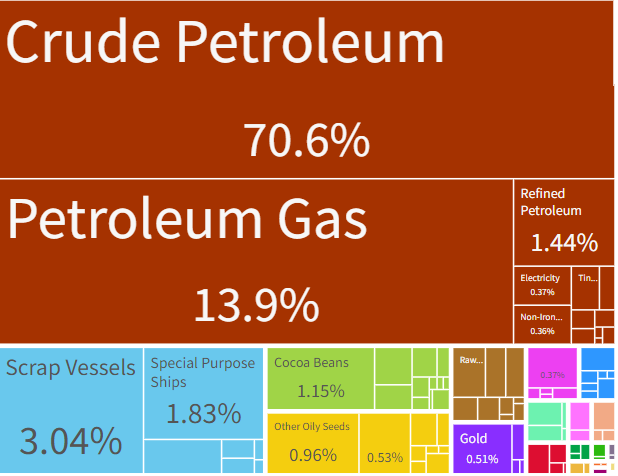

3. Nigeria attempts to diversify

Credit oec.world

Nigeria has expressed an intention to increase non-oil exports to stimulate growth.

Nigeria’s top exports are oil & gas & petroleum.

At the same time the Nigerian Government has set up an Oil & Gas Promotion Centre promoting the export of oil & gas.

Nigeria is ranked 131 out of 190 countries according to the OECD’s Ease of Doing Business Report.

It has recently signed a deal with the Netherlands to export Ginger. It also has significant coco crops and ranked number 1 globally for the export of scrap vessels.

__________________________________________________________________________________________

4. UK CPTPP membership lags whilst Commonwealth awaits

Credit Prachatai via Flickr

CPTPP members are in a hurry to confirm UK’s entry to the trade agreement seemingly in response to recent announcements to strengthen Commonwealth trading ties by Liz Truss.

A Japanese minister has apparently announced UK could enter the agreement later this year.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership includes 11 nations which represent 13% of global GDP whereas Commonwealth nations number 54 and represent 17% of global GDP.

The UK requested to join the CPTPP in February 2021 with negotiations commencing in June that year.

___________________________________________

5. Indian carmakers object to UK duty reduction

Credit Jan J George via Wikimedia Commons

India is the world’s fourth largest car market and foreign duties on cars range from 60 to 100%. Anyone who has visited India will see from the oversupply of 1960s Ambassador cars that the country is ripe for new entries.

The most popular cars sold in India are all made in India and the automotive industry maintains a protectionist view. It has lobbied against a reduction in foreign duties on imported cars to 30% which was in the proposed India-UK free trade agreement.

30% would potentially mean a sharp change to the local car industry in India however Jaguars and Land Rovers are assembled locally anyway. Carmakers are now apparently pushing for a phased reduction in import duty cuts instead of a sharp reduction.