-

Trade Minister’s Top 5

Trade Minister Kemi Badenoch recently announced her top 5 priorities for trade in her speech at Lancaster House.

- DIT will remove 100 barriers to trade. This is not a new theme with Greg Hands when he was trade minister saying that he would remove 100 trade barriers last November.

- Race to a Trillion – target of £1 trillion of exports by 2030.

- Ramp up the UK’s competitiveness in the global FDI market and continue to compete strongly to make the UK the number one FDI destination in Europe.

- Agree to India and CPTPP trade deals.

- ‘Defend free trade’ – the meaning of this phrase is not certain but she mentioned ‘standing up to protectionism.’

-

Fintech: best locations

(c) jonas leupe via unsplash

Investment Monitor has release information on the top 4 locations to set up a fintech business.

- The article rate Bahrain highly due to stable economic and political landscape and low operational cost base. With more than 20 fintech incubators the ecosystem is flourishing and there are various Government support schemes which aim to encourage the sector. Bahrain operates a regulated landscape for open banking.

- Singapore is number two due to the high growth rate of 6% and more than 1,600 fintech companies in operation. In addition there are various Government support schemes in operation and a non-for-profit industry body run by the largest tech companies.

- India ranks as number 3 due to the sheer size of the economy – the fifth largest in the world – and various Government schemes which aid foreign businesses.

- Switzerland comes in at number 4 due to economic stability and wealth. Business-friendly taxes and laws make Switzerland a high ranking location to start a fintech business.

-

Semiconductors in India

(c) jonas svidras via krnIVmo-unsplash

The global semiconductor landscape is currently experiencing a moment of change. With the US’ new ‘Chips Act’ which seeks to diversify its semiconductor supply away from China, Taiwan and South Korea, main news streams are reporting an opportunity spotted by India. India has announced its intention to partner with the US to help it diversify away from current and existing suppliers by implementing tax credits and benefits to stimulate the production of semiconductors in India.

For example, the U.S. Semiconductor Industry Association (SIA) and the India Electronics and Semiconductor Association (IESA) recently made a joint announcement on a collaboration that will strengthen the alliance between the US and India in semiconductor manufacturing.

-

UK Italy trade agreement

Credit Gov.uk

The UK has signed its first trade agreement with an EU member country since Brexit. The UK and Italy have signed an export and investment partnership which doesn’t change the existing tariffs or trade terms but is momentous and historic because the European Union seems to think that no deals can be done with individual states, only the union itself: this occasion seems to prove otherwise.

Italy is the UK’s 11th largest trading partner with goods exports totalling £16 billion and imports £28 billion. Top export is cars, top import is pharmaceutical products.

-

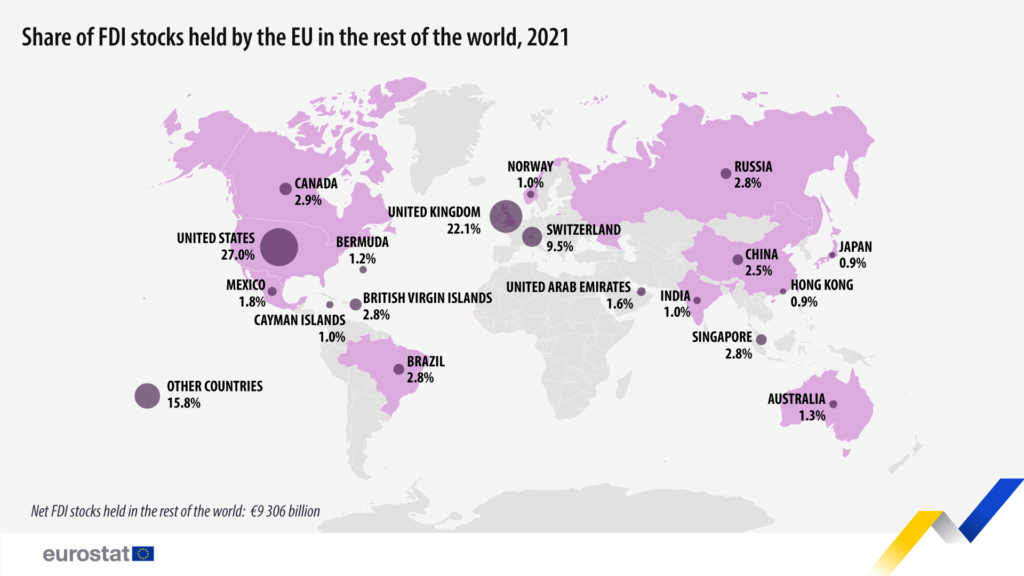

21% of Europe FDI is in UK

A recent article by the European Union says that the UK receives 22% of European outward FDI second only to the USA which receives 27%, and far ahead of the next recipient Switzerland at just 10%.

The US is the largest source of European inbound FDI at 33% followed by the UK at 19% and then Switzerland at 8%.

-

Mexico FDI up 12%

© Dennis Jarvis

Mexico has attracted 12% more FDI in 2022 than 2021 totalling $35 billion. News sources say it was Mexico’s best year since 2015 owing to new investments which make up 48% of the total.

The US is Mexico’s number one investor followed by Canada, Argentina and Japan.

Manufacturing was the most popular recipient sector followed by transport and financial services.

It is thought that near-shoring is a great catalyst for renewed vigour in Mexico as the United States looks to bring more production on or near its general region. Honeywell and Siemens have recently expanded their head offices in the region as a direct result of near-shoring.

-

UAE changes commercial agency law to encourage more foreign investment

(c) zq lee via unsplash

From 15 June the UAE will implement a new commercial law regarding agency which allows greater flexibility surrounding the duration and term of agencies for example termination. The new legislation removes the cause for material reason for termination.

The new law will make it easier for foreign companies entering the UAE as they often work with commercial agents to expand their business in the region due to local knowledge and contacts.

Only UAE citizens can act as commercial agents. The new law also includes a new dispute resolution clause where both parties can agree to arbitration.

Featured image Kemi Badenoch © Skskwekjefbbffjske via Wikimedia Commons