1. South Africa FDI energy crossroads

A new UN report states that FDI inflows to Africa fell by 44% in 2022 however that is due to a single South African transaction that took place in 2021. Excluding the transaction FDI is up 7% in 2022.

Battery storage is a hot topic in South Africa currently however a report by the International Institute for Sustainable Development (IISD) says grid storage is yet to gain ‘direction or momentum.’

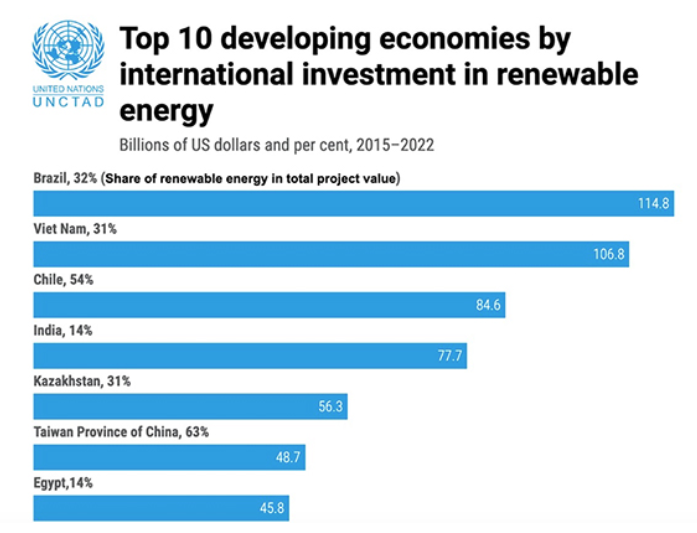

Investment Monitor says ‘mining and gas’ sectors are likely to expand FDI in 2023 however the rollout and development of the roadmap for renewable energy and battery storage set out in the Integrated Resource Plan 2019 is still delayed.

South Africa is the top African FDI attractor with $40 billion including a $4.6 billion investment by UK renewable energy company Hive Energy and a $1 billion data centre project by Denver based Vantage Data Centers.

2. Egypt tops North Africa

Meanwhile Egypt topped the North Africa FDI inflow charts attracting $11.4 billion in projects which is at the highest point since 2017.

Much of the investment is due to the Government reducing its involvement in the local economy. The aggressive privatisation programme includes the sale of 32 state-owned assets in 18 sectors to the private sector.

Egypt has a $3 billion loan agreement with the IMF.

Egypt is also carrying out legislative reforms such as reducing the cost of establishing companies, simplifying approval procedures and duration, and expanding the issuance of the Golden Licence.

The Golden Licence or Law No. 72 of 2017 shortens all regulatory requirements in a one-step approval process for foreign investors.

Recently its cabinet has passed additional legislation amending Law No.121 of 1982, allowing foreign investors to be registered as importers for a term of up to 10 years.

Trade Horizons advisors are market entry experts: our team of in-country experts assist companies to export, import and enter new locations by using strategies that have stood the test of time and evidence-based advice. Trade Horizons assists companies to plan to distribute and deliver goods or services to a new target market. Contact one of our experts today.

3. UAE tops Arab region

The UAE has attracted record-breaking FDI inflows in 2022 to the total of $23 billion, a 10% increase on 2021 and topping the region. It received the fourth most new investments globally, by number, after the US, Britain and India.

Meanwhile global FDI fell 12%.

The UAE has carried out several reforms with the aim of attracting foreign investment. For example, in September 2020 legislation was passed that allows 100% foreign ownership of certain onshore companies.

The UAE is a low tax business environment and has free zones. The main sectors attracting FDI are trade, real estate, finance and insurance, manufacturing, mining, and construction. The main investors are the United Kingdom, India, the United States, France, and Saudi Arabia.

Read the full report here https://unctad.org/publication/world-investment-report-2023

4. FDI Latin America & Caribbean up 51%

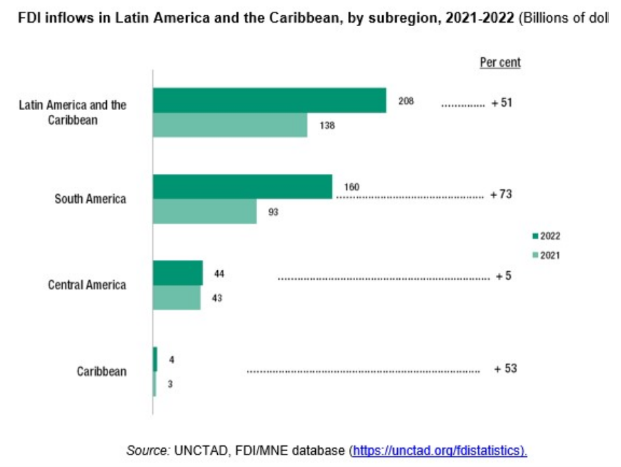

FDI into Latin America and the Caribbean increased 51% in 2022 according to the latest UNCTAD report.

Brazil was the top earner in the region attracting $86 billion up from $51 billion in 2021, followed by Mexico. FDI into Argentina and Peru doubled compared to 2021 and Colombia increased by 82%. The Dominican Republic was the top attractor in the Caribbean.

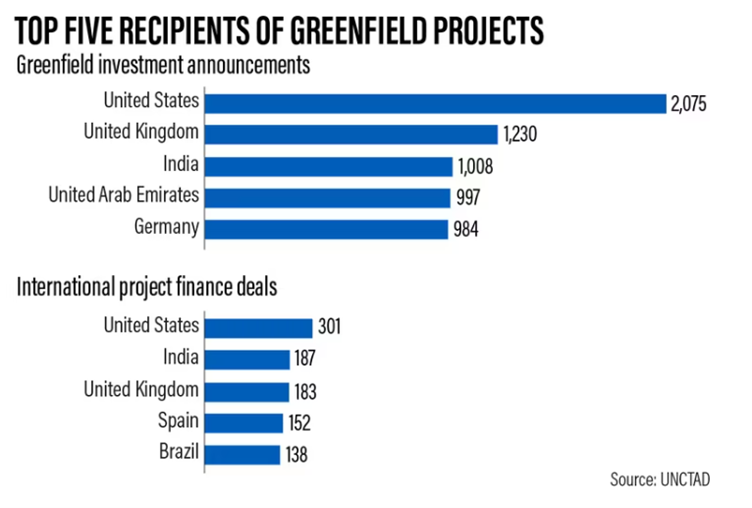

Greenfield and project finance deals increased by 30%.

The manufacturing sector led M&A with services leading overall as the largest sector.

Greenfield projects increased by 57% mostly due to extraction & automotive sectors.

The largest investors into the region were the United States, Spain and the Netherlands. In 2023, China is on a mission to replace the USA as the largest investor in the region. China is the largest trading partner of nine countries in the region: Argentina, Brazil, Bolivia, Cuba, Chile, Peru, Paraguay, Uruguay, and Venezuela.

5. US Taiwan trade deal

Image Wang Yu Chin

On 1 June the US and Taiwan signed a free trade agreement however it doesn’t reduce any tariffs only ‘pledges to reduce barriers to trade.’

In addition, there are several practical complications in implementing the trade deal, namely:

- The president has no independent constitutional authority in trade so Congress must authorise new agreements and Congress has not authorised it

- Legislation has been passed that bizarrely both overrides Congress’ authority and restricts further negotiations

- Free trade deals with United Kingdom, Kenya, and Ecuador have also been proposed however Biden has signed the Taiwan trade deal ahead of other countries. This raises the question of whether the other trade deals should be treated in the same way and signed before authorised

- Another piece of US legislation mandates that new agreements must receive congressional approval, and this new agreement has not received approval

6. UK trade is doing fine

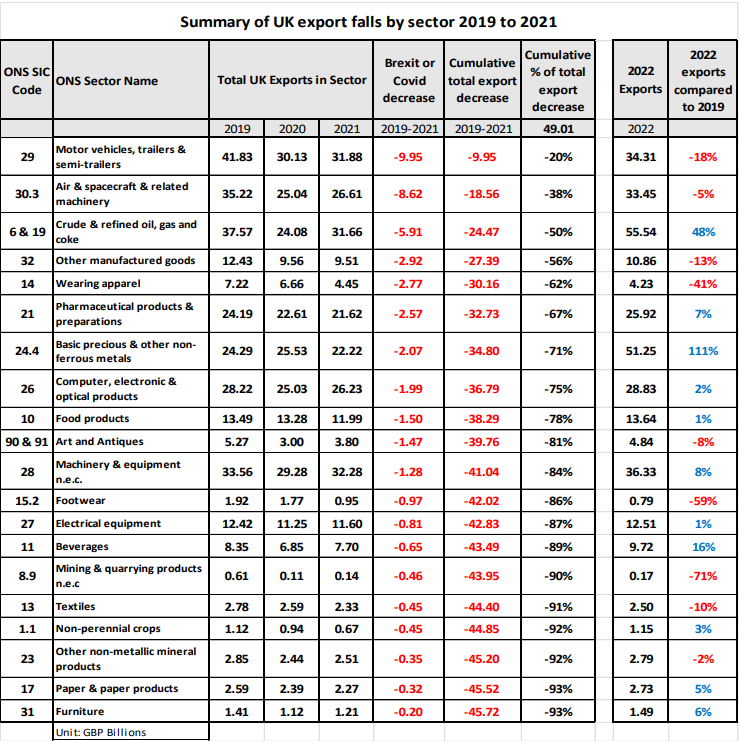

A new article says that trade between the UK and Europe remains unchanged 7 years on from the Brexit vote. It says nothing has changed and trade has not been affected by Brexit.

The report evaluates 2019 (pre Brexit) to 2021 (post Brexit) across sectors by comparing UK trade by industry to EU and non-EU destinations.

It argues that the 11% drop in trade from 2019 to 2021 was not caused by Brexit despite negative commentators ‘declinists’ at the Bank of England, BBC, and FT. Rather, COVID had a greater impact on UK industries due to the nature of the worst affected sectors.

Furthermore whilst the public is under the impression that the single European enabled free trade which is not true. The UK paid to be a member of the bloc and the public paid hefty tariffs on non-EU goods to protect the EU’s interests. In addition, the cost of implementing infinite European regulation on businesses carried an immense cost.

The UK’s contributions increased rapidly after 2008 up to 9% which offered no benefit as UK regions did not benefit from the EU’s Cohesion or Regional Funds. A 2018 report by the London School of Economics stated that ‘despite a sizeable literature examining the growth effects of Cohesion Policy, evidence of its effects in the particular case of the UK is scarce.’

Read the full report here.

Featured Image Lina Loos via Unsplash