1. Surge in US Battery Energy Storage Investments

In recent years, the United States has witnessed a remarkable surge in investments in battery energy storage systems (BESS). This trend is driven by the growing demand for renewable energy sources, the need for grid stability, and advancements in battery technology. As the country transitions towards a more sustainable energy future, battery storage is playing a pivotal role in ensuring reliability and efficiency.

The Driving Forces Behind the Surge

1. Renewable Energy Integration

As the adoption of renewable energy sources like solar and wind power increases, the need for efficient energy storage solutions becomes critical. Battery storage systems help in balancing supply and demand, storing excess energy generated during peak production times and releasing it when needed.

2. Grid Stability and Resilience

With the increasing frequency of extreme weather events and the aging infrastructure of the US power grid, there is a growing need for systems that can enhance grid stability and resilience. Battery storage provides a reliable backup during outages and helps in maintaining a steady power supply.

3. Technological Advancements

Significant advancements in battery technology, particularly in lithium-ion batteries, have led to increased efficiency, longer lifespan, and reduced costs. These improvements make battery storage a more viable and attractive option for both utility-scale and residential applications.

Key Investments and Projects

Several high-profile investments and projects have marked the recent surge in battery energy storage in the US:

Tesla’s Megapack Projects:

Tesla has been at the forefront of battery storage innovation with its Megapack systems. These large-scale battery installations are designed to support grid stability and integrate renewable energy sources. Notable projects include installations in California and Texas, which are among the largest in the world.

NextEra Energy’s Expansion:

NextEra Energy, one of the largest renewable energy companies in the US, has significantly expanded its battery storage portfolio. The company plans to add over 1,000 megawatts of battery storage capacity by 2024, supporting its extensive wind and solar operations.

Government Initiatives:

The US government has also played a crucial role in promoting battery storage investments. The Department of Energy (DOE) has launched various initiatives and funding programs aimed at accelerating the development and deployment of advanced energy storage technologies.

The Economic and Environmental Impact

The surge in battery energy storage investments is not only transforming the energy landscape but also bringing substantial economic and environmental benefits:

Job Creation:

The expansion of battery storage projects is creating numerous job opportunities in manufacturing, installation, and maintenance. This growth is contributing to the development of a skilled workforce in the renewable energy sector.

Emission Reductions:

By enabling greater integration of renewable energy sources, battery storage systems are helping to reduce greenhouse gas emissions. This shift is crucial for meeting national and global climate goals.

Energy Cost Savings:

Improved energy storage solutions lead to more efficient energy use and reduced reliance on fossil fuels. This efficiency translates into cost savings for both utilities and consumers.

Future Outlook

The future of battery energy storage in the US looks promising, with continued investments and technological advancements on the horizon. As the country strives to achieve its renewable energy targets, battery storage will remain a key component in ensuring a reliable, resilient, and sustainable energy system.

In conclusion, the surge in US battery energy storage investments marks a significant step towards a cleaner and more efficient energy future. With ongoing support from both the public and private sectors, the potential for growth and innovation in this field is immense.

2. The EU’s Chips Race Strategy

Fensterblick CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/

In recent years, the global semiconductor industry has become a focal point of geopolitical and economic strategies. The European Union (EU), recognising the critical importance of semiconductors in modern technology, has embarked on an ambitious journey to bolster its chip manufacturing capabilities. This article explores the EU’s strategic initiatives, the potential outcomes, and the implications for the global semiconductor landscape.

The Strategic Imperative

Semiconductors are the backbone of contemporary technology, powering everything from smartphones to advanced medical devices and autonomous vehicles. The COVID-19 pandemic highlighted the vulnerabilities in global supply chains, particularly in the semiconductor sector. The EU, traditionally reliant on external suppliers, has identified the need to enhance its self-sufficiency in chip production.

The European Chips Act

In response, the European Commission introduced the European Chips Act in 2022. This legislative framework aims to mobilise over €43 billion in public and private investments by 2030. The Act focuses on three main pillars:

1. Strengthening Research and Innovation:

Investing in cutting-edge research to develop next-generation semiconductor technologies.

2. Ensuring Security of Supply:

Building state-of-the-art fabrication plants (fabs) within Europe to reduce dependency on foreign suppliers.

3. Supporting a Resilient Ecosystem:

Fostering a robust semiconductor ecosystem by supporting startups and SMEs, and enhancing workforce skills.

Potential Outcomes

1. Technological Leadership

If successful, the EU could emerge as a leader in semiconductor technology. By investing in advanced research and development, Europe could pioneer innovations in areas such as artificial intelligence, quantum computing, and 5G/6G communications. This would not only enhance the EU’s technological sovereignty but also position it as a key player in the global tech arena.

2. Economic Growth and Job Creation

The semiconductor industry is a significant driver of economic growth. The establishment of new fabs and research centers could create thousands of high-skilled jobs across Europe. Moreover, a thriving semiconductor sector could stimulate growth in related industries, such as electronics, automotive, and telecommunications.

3. Geopolitical Influence

By reducing its dependency on external suppliers, particularly from Asia and the United States, the EU could gain greater geopolitical leverage. A self-sufficient semiconductor industry would enhance Europe’s strategic autonomy, allowing it to navigate global supply chain disruptions more effectively.

Challenges and Considerations

While the EU’s ambitions are commendable, several challenges must be addressed to realise these outcomes:

Investment and Funding:

Mobilising the required €43 billion will necessitate significant public and private sector collaboration. Ensuring sustained investment over the long term is crucial.

Technological Catch-Up:

The EU must bridge the technological gap with leading semiconductor manufacturers in Asia and the US. This requires not only financial investment but also fostering a culture of innovation and agility.

Global Collaboration:

While striving for self-sufficiency, the EU must also engage in global partnerships. Collaborating with international players can enhance technological exchange and mitigate risks associated with isolationism.

Conclusion

The EU’s chips race is a strategic endeavour with far-reaching implications. By planning for different outcomes and addressing potential challenges, the EU can position itself as a formidable player in the global semiconductor industry. Success in this venture will not only bolster Europe’s technological and economic landscape but also enhance its geopolitical standing in an increasingly interconnected world.

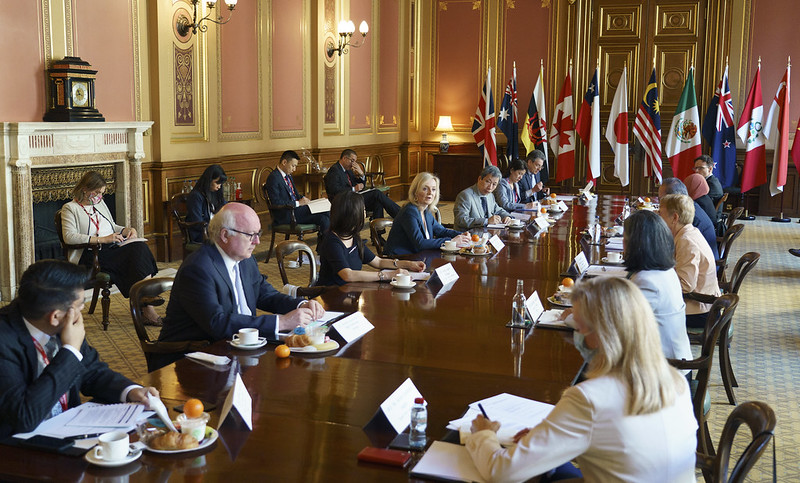

3. UK to join CPTPP by 15 December

Number 10 CC BY-NC-ND 2.0 https://creativecommons.org/licenses/by-nc-nd/2.0/

The United Kingdom is set to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) by 15 December 2024. This milestone follows the ratification of the agreement by Peru, the sixth and final member needed to trigger the UK’s accession.

What is CPTPP?

The CPTPP is a significant free trade agreement that spans five continents and includes nearly 600 million people. It aims to reduce tariffs and foster trade among its member countries, which currently include Japan, Singapore, Chile, New Zealand, and Vietnam, among others.

Benefits for the UK

Joining the CPTPP is expected to bring numerous benefits to the UK:

Tariff-Free Exports:

Over 99% of current UK goods exports to CPTPP members will be tariff-free, making it easier and more cost-effective for UK businesses to export their products.

Economic Growth:

The agreement is projected to boost the UK economy by around £2 billion annually by 2040.

Global Influence:

As the first country to accede to the CPTPP, the UK will have a unique opportunity to shape the future development of the agreement, including influencing the rulebook and championing the expansion to new economies.

Government’s Role and Business Opportunities

The UK government has been actively working to secure ratifications from CPTPP members. With the final ratification from Peru, the agreement will officially enter into force by mid-December 2024. The government encourages UK businesses to explore the opportunities that CPTPP membership will bring and to contact the Department for Business and Trade for more information on how to benefit from the agreement.

Conclusion

The UK’s accession to the CPTPP marks a significant step in its trade policy, opening up new markets and opportunities for businesses. As the agreement comes into force, it promises to enhance the UK’s economic growth and global trade influence.

4. Rigol opens its first Malaysian manufacturing plant in Penang

Pexels Kenny Foo

Penang, Malaysia – Rigol Technologies, a leading manufacturer of electronic test and measurement instruments, has officially inaugurated its first manufacturing plant outside of China in Penang. This significant milestone marks a pivotal moment in Rigol’s global expansion strategy.

Investment and Infrastructure

The new facility, Rigol Technologies (Malaysia) Sdn. Bhd., represents an investment of approximately $23 million (RM100 million). Spanning 8,365 square meters (90,040 square feet), the site includes a state-of-the-art research and development (R&D) center and a comprehensive service center. The plant is designed to enhance production capabilities, drive innovation, and improve customer service.

Strategic Importance

Wang Ning, CEO of Rigol, emphasised the strategic importance of this expansion: “This new facility is a testament to our commitment to delivering exceptional service to our international customers. By enhancing our service capabilities in overseas markets, we are positioning ourselves to better meet the growing demands of our clients while ensuring agility and responsiveness”.

Economic Impact

The establishment of the Penang plant is expected to create 150 high-value jobs, contributing to the local economy and nurturing a new generation of professionals in the technological field. Datuk Sikh Shamsul Ibrahim Sikh Abdul Majid, CEO of the Malaysian Investment Development Authority (MIDA), highlighted the broader implications: “This investment not only creates high-value jobs but also provides Malaysia with an opportunity to ascend the supply chain ladder. It aligns perfectly with the New Industrial Master Plan (NIMP) 2030, which aims to drive innovation and growth in the electronics and electrical (E&E) sector”.

Penang: The Silicon Valley of the East

Penang, often referred to as the Silicon Valley of the East, has a rich history of industrialisation and a well-established infrastructure. Dato’ Loo Lee Lian, CEO of InvestPenang, noted, “Penang’s strategic location, skilled workforce, and robust infrastructure have consistently attracted leading global companies. This new facility reinforces Penang’s reputation as a premier destination for high-tech manufacturing and innovation”.

Future Prospects

The new plant will initially focus on the production of electronic test and measurement instruments, with plans to expand its capabilities in the second phase. This phase will include additional production lines and the establishment of an advanced R&D center and a comprehensive overseas service center.

Rigol’s expansion into Malaysia underscores its dedication to maintaining steady growth and innovation within the industry. As the company continues to build on its legacy of excellence, the new Penang facility is poised to play a crucial role in its global operations.

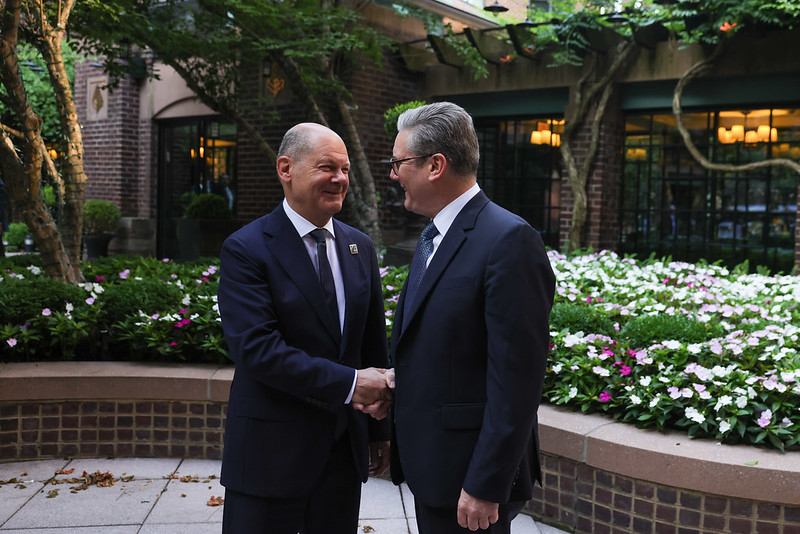

5. Prospects of a New Trade Deal Between the UK and Germany

Number 10 CC BY-NC-ND 2.0 https://creativecommons.org/licenses/by-nc-nd/2.0/

Introduction

The United Kingdom and Germany, two of Europe’s largest economies, are exploring the potential for a new trade agreement. This prospective deal aims to strengthen economic ties, enhance trade flows, and foster mutual growth in a post-Brexit landscape.

Background

Since the UK’s departure from the European Union, it has been actively seeking new trade partnerships to replace and enhance its previous EU trade relationships. Germany, as Europe’s economic powerhouse, represents a significant opportunity for the UK to secure a robust trade agreement.

Key Areas of Focus

1. Automotive Industry

– The automotive sector is a critical component of both economies. Germany’s renowned car manufacturers, such as BMW and Volkswagen, could benefit from reduced tariffs and streamlined regulations when exporting to the UK.

– Conversely, the UK’s automotive industry, including brands like Jaguar Land Rover, could gain easier access to the German market, boosting sales and collaboration.

2. Technology and Innovation

– Both nations are leaders in technology and innovation. A trade deal could facilitate joint ventures, research collaborations, and the exchange of cutting-edge technologies.

– Enhanced cooperation in areas such as artificial intelligence, renewable energy, and digital infrastructure could drive significant advancements and economic benefits.

3. Financial Services

– The UK’s financial sector, particularly in London, is a global hub. A trade agreement could ensure continued access to German markets for UK financial services, maintaining London’s status as a leading financial center.

– Germany’s financial institutions could also benefit from greater integration with the UK’s financial ecosystem, fostering investment and growth.

Potential Challenges

– Regulatory Alignment

– One of the main challenges will be aligning regulatory standards. Both countries will need to negotiate terms that respect their respective regulatory frameworks while promoting trade.

– Political Considerations

– Political dynamics within both countries and the broader EU context could influence the negotiations. Ensuring that the deal is beneficial and acceptable to all stakeholders will be crucial.

Economic Impact

– Trade Volume

– A successful trade deal could significantly increase the trade volume between the two nations. This would not only boost GDP but also create jobs and foster economic stability.

– Investment Opportunities

– Enhanced trade relations could lead to increased investment opportunities, with businesses from both countries more likely to invest in each other’s markets.

Conclusion

A potential trade deal between the UK and Germany holds promise for both nations. By focusing on key sectors such as automotive, technology, and financial services, and addressing regulatory and political challenges, the two countries can forge a partnership that drives economic growth and innovation. As negotiations progress, the world will be watching to see how these two economic giants shape their future relationship.

6. Southern Corridor Secures 30% of India’s FDI Inflows

Evonne CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

In a significant development for India’s economic landscape, the Southern Corridor has emerged as a major hub for foreign direct investment (FDI), securing an impressive 30% of the country’s total FDI inflows. This milestone underscores the region’s growing appeal to international investors and its pivotal role in driving India’s economic growth.

A Magnet for Investment

The Southern Corridor, comprising states like Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, and Kerala, has consistently attracted substantial foreign investments. This trend can be attributed to several factors:

- Robust Infrastructure:

The region boasts well-developed infrastructure, including world-class ports, airports, and road networks, which facilitate seamless business operations and logistics.

- Skilled Workforce:

With a strong emphasis on education and skill development, the Southern Corridor offers a highly skilled and tech-savvy workforce, making it an attractive destination for industries such as IT, manufacturing, and biotechnology.

- Pro-Business Policies:

State governments in the Southern Corridor have implemented investor-friendly policies, streamlined regulatory processes, and offered incentives to attract foreign investments.

Key Sectors Driving FDI

Several sectors have been instrumental in attracting FDI to the Southern Corridor:

Information Technology (IT):

Cities like Bengaluru, Hyderabad, and Chennai are renowned IT hubs, hosting numerous multinational companies and startups. The region’s IT sector continues to draw significant foreign investments.

Manufacturing:

The Southern Corridor is a manufacturing powerhouse, with a strong presence in automotive, electronics, and textiles. The establishment of special economic zones (SEZs) and industrial parks has further bolstered this sector.

Biotechnology and Pharmaceuticals:

The region is home to leading biotech and pharmaceutical companies, benefiting from a conducive ecosystem for research and development.

Impact on Economic Growth

The influx of FDI into the Southern Corridor has had a profound impact on the region’s economic growth. It has led to the creation of numerous job opportunities, enhanced technological capabilities, and increased export potential. Additionally, the investments have spurred infrastructure development, contributing to the overall socio-economic progress of the region.

Future Prospects

Looking ahead, the Southern Corridor is poised to maintain its momentum in attracting FDI. Continued investments in infrastructure, innovation, and skill development will be crucial in sustaining this growth trajectory. Furthermore, the region’s strategic location and connectivity make it an ideal gateway for international trade and investment.

Conclusion

The Southern Corridor’s success in securing 30% of India’s FDI inflows is a testament to its dynamic economic environment and investor-friendly policies. As the region continues to evolve and adapt to global economic trends, it is set to play an increasingly vital role in shaping India’s economic future.

Featured image Pillswood-BESS-270223-House of Commons Library