1. Cimpor cement’s UK expansion

London, March 17, 2025 – Portuguese cement producer Cimpor has announced its ambitious plans to expand into the UK market, following a significant change in ownership and a substantial capital investment. This move marks a pivotal step in Cimpor’s strategy to strengthen its global presence and diversify its product offerings.

In April 2024, Cimpor registered Cimpor UK Limited, establishing its office in Cheadle. The company has committed €50 million to develop a state-of-the-art import terminal at the port of Bristol. This terminal is expected to enhance Cimpor’s supply chain capabilities and facilitate the distribution of its products across the UK.

Berkan Fidan, Cimpor’s Global Chief Technology Officer, emphasized the strategic importance of this expansion. “With the ports and terminals we own and operate, we leverage our export globally, strengthening our supply chain and continuing to explore new market opportunities,” Fidan stated.

The investment in the Bristol terminal is just the beginning. Cimpor plans to introduce a broader range of products to the UK market in the coming years, aiming to meet the growing demand for high-quality construction materials. This expansion is expected to create numerous job opportunities and contribute to the local economy.

Cimpor’s decision to target the UK market comes at a time of increased infrastructure development and construction activity in the region. The company’s expertise and innovative solutions are well-positioned to support these projects, ensuring sustainable and efficient construction practices.

As Cimpor continues to explore new markets and expand its global footprint, its commitment to quality and innovation remains unwavering. The UK expansion is a testament to Cimpor’s vision of becoming a leading player in the global cement industry.

2. Thailand food producer targets Vietnam

Thailand’s leading meat producer and exporter Charoen Pokphand Foods Public Company Limited, is expediting the IPO and market debut of its largest overseas unit in Vietnam to bolster its global expansion efforts. CEO Prasit Boondoungprasert revealed that the company has seen positive movements from Vietnamese authorities regarding the IPO for C.P. Vietnam Corporation, following years of paused actions.

Strategic Importance of Vietnam

Vietnam has been a key contributor to CP Foods’ offshore sales, generating roughly 21% $3.6 billion last year. The country’s robust economic expansion and significant population are set to be major growth catalysts for CP Foods in the coming years. The planned listing in Vietnam is anticipated to unlock fresh financial resources while simultaneously enhancing the company’s brand visibility in the region.

Global Expansion Plans

Amidst challenges of decelerating growth and an aging population in Thailand, CP Foods has significantly increased its investment in animal feed, farming, and food processing facilities around the world. The company operates in 18 international markets, including major presences in the US, Brazil, Russia, and China. In 2024, CP Foods rebounded to a profit of 19.6 billion baht after incurring a net loss of 5.21 billion baht the previous year. This resurgence was largely driven by successful pork operations in Vietnam and China.

Future Projections

CPF projects a 5% to 8% increase in total revenue through 2025, with further profit enhancements predicted for overseas operations, particularly in Vietnam and China. Additionally, the anticipated US reciprocal tariff plan is expected to exert minimal effect on the company’s financial performance since most of the US product supply originates from domestic operations. Last year, CPF’s US ventures contributed $700 million to the company’s overall revenue.

Conclusion

The accelerated IPO of C.P. Vietnam Corporation is a strategic move by CP Foods to fuel its global expansion. With Vietnam’s economic growth and CP Foods’ robust international presence, the company is well-positioned to achieve its ambitious growth targets in the coming years.

3. Emirati coffee roaster investment

ROR Coffee Solutions, an Emirati-owned specialty coffee roaster, has announced a landmark USD$8 million investment to accelerate its expansion and innovation strategy over the next five years. This significant funding aims to support the company’s strategic growth across the Middle East and North Africa region and Europe, transforming the specialty coffee market through substantial investments in infrastructure, advanced roasting technology, and workforce development.

Strategic Expansion and Innovation

The investment will enable ROR Coffee Solutions to strengthen its presence in existing markets while diversifying into new business verticals, such as corporate coffee solutions, premium retail offerings, and immersive event-based experiences. The company plans to enhance its operational capabilities by establishing new roasting and production facilities designed to improve efficiency and consistency. Additionally, operational hubs and training centers will be set up across target regions, offering barista training, quality assurance programs, and consumer education to elevate industry expertise.

Commitment to Sustainability

Sustainability remains central to ROR Coffee Solutions’ long-term vision. The company is focusing on eco-friendly packaging, waste reduction programs, and the introduction of electric delivery fleets to minimize carbon emissions. ROR Coffee Solutions is also deepening its direct-trade partnerships with coffee farms to promote ethical sourcing and sustainable farming practices. Initiatives such as a coffee packaging recycling program and a commitment to achieving carbon-neutral operations further reinforce its environmental responsibility.

Empowering the Coffee Community

Aaron Marshall, General Manager of ROR Coffee Solutions, emphasized the broader impact of this investment. “Our goal extends beyond delivering exceptional coffee – we are creating an ecosystem where innovation, sustainability, and craftsmanship thrive. By expanding into new markets, integrating advanced roasting technology, and reinforcing ethical sourcing practices, we are not just elevating coffee quality but empowering businesses and professionals to grow alongside us. This is more than expansion; it’s about reshaping how coffee is sourced, brewed, and experienced,” he said.

Future Prospects

With MENA and Europe identified as high-growth markets, the investment will support ROR Coffee Solutions’ strategic expansion, particularly in Saudi Arabia and key European countries. The company aims to make premium specialty coffee more accessible to businesses and consumers, ensuring every cup meets the highest standards of craftsmanship and sustainability. Beyond infrastructure and sustainability, ROR Coffee Solutions is strengthening collaborations with coffee farms and leading equipment manufacturers to deliver premium solutions.

This landmark investment marks a defining moment for ROR Coffee Solutions and the future of specialty coffee in the region. As global demand for high-quality, responsibly sourced coffee continues to rise, ROR Coffee Solutions is set to transform the market and elevate the coffee experience for consumers worldwide.

4. Uzbekistan twin capital debut

In a bold move that underscores its growing ambitions, Uzbekistan has made its debut at the prestigious Mipim conference in Cannes with the unveiling of its twin capital city project, New Tashkent. This ambitious urban development aims to create a fully-fledged city adjacent to the existing capital, Tashkent, and is set to transform the urban landscape of the Central Asian nation.

A Vision for the Future

Officially launched in 2023, the New Tashkent project is designed to accommodate the needs of a rapidly growing population and economy. The first phase of the project covers 6,000 hectares and is expected to host up to 600,000 residents. It will feature all main national government and presidential buildings, alongside a diverse array of economic assets, including universities, parks, business districts, and waterways.

Investment and Sustainability

The total investment for phase one is estimated at $20 billion, a significant sum for a country with a GDP just over $100 billion. Foreign investment will be crucial in bringing this vision to life. Temur Akhmedov, a senior consultant on the project, emphasized the importance of large investors willing to develop plots of 100+ hectares, all in compliance with strict energy and water efficiency requirements.

Innovative Planning

London-based firm Cross Works has been appointed as the lead consultant for the masterplan, which will expand Tashkent by an additional 25,000 hectares. The project includes a digital twin of the new city, allowing for real-time evolution and flexibility in urban planning. This innovative approach sets a new benchmark for city-scale stakeholder engagement.

A New Era for Uzbekistan

Since President Shavkat Mirziyoyev took office in 2017, Uzbekistan has undergone rapid reforms, opening up to trade and investment while upgrading local governance and institutions. The New Tashkent project is a testament to these changes, reflecting the country’s ambition to become a significant player on the global stage.

Conclusion

Uzbekistan’s debut at Mipim with the New Tashkent project marks a significant milestone in its urban development journey. As the country continues to attract foreign investment and implement innovative planning strategies, New Tashkent promises to be a landmark addition to Uzbekistan’s urban real estate portfolio.

5. Ford’s $5 billion German investment

In a bold move to strengthen its European presence, Ford Motor Company has announced a substantial investment of up to around USD$5 billion into its German subsidiary, Ford-Werke. This strategic injection aims to revitalise the struggling unit and enhance its competitiveness in the challenging European automotive market.

Addressing Financial Struggles

Ford-Werke has been grappling with significant financial challenges, including a debt burden of €5.8 billion. The new investment will address these financial woes by recapitalising the subsidiary and funding a multi-year business plan focused on cost reduction and efficiency improvements. This move replaces a previous agreement, in place since 2006, under which Ford guaranteed to absorb any losses incurred by its German operations.

Strategic Transformation

The investment is part of a broader strategic transformation aimed at reducing costs and increasing competitiveness. John Lawler, Vice Chair of Ford Motor Company, emphasised the importance of this transformation, stating, “By recapitalising our German operations, we are supporting the transformation of our business in Europe and strengthening our ability to compete with a fresh product portfolio.”

Challenges in the European Market

The European automotive industry is currently facing high costs, weak demand, and rising competition from Asian manufacturers. These challenges have led to plant closures and job cuts across the sector. Ford’s decision to bolster its German arm comes at a time when the adoption of electric vehicles in Europe is progressing more slowly than anticipated.

Future Outlook

Ford’s commitment to its European business is clear, but the company also calls for a collaborative effort from industry stakeholders, policymakers, and trade unions to secure the future of the European car industry. Lawler highlighted the need for a clear political agenda in Europe that promotes the acceptance of electric cars and aligns consumer demand with European emission targets.

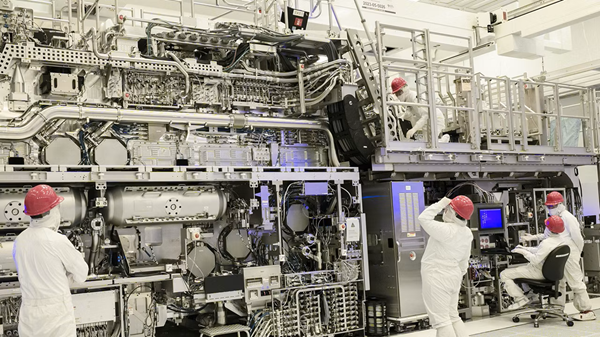

6. TSMC approaches US chipmakers

In a significant move within the semiconductor industry, Taiwan Semiconductor Manufacturing Company (TSMC) has reportedly approached several major US chipmakers to discuss taking stakes in a joint venture that would manage Intel’s foundry operations. This proposal, which is still in its early stages, involves TSMC overseeing Intel’s foundry division while holding no more than a 50% ownership stake.

The Proposal

According to sources, TSMC has pitched this JV idea to prominent US chip designers, including Nvidia, Advanced Micro Devices, Broadcom, and Qualcomm. The joint venture would see TSMC running the operations of Intel’s foundry division, which manufactures custom chips for various clients. This move comes as part of broader efforts to revitalize Intel’s foundry business, which has faced significant operational challenges in recent years.

Strategic Implications

The potential JV is seen as a strategic effort to bolster Intel’s position in the competitive semiconductor market. Intel has struggled with declining stock prices and operational setbacks, reporting a net loss of $18.8 billion for 2024. The involvement of TSMC, a global leader in chip manufacturing, could provide the necessary expertise and resources to turn around Intel’s foundry division.

Government Involvement

The proposal has garnered attention from the US government, which is keen to ensure that Intel remains a largely US-owned entity. Any final agreement on the venture’s structure would require government approval, particularly given the strategic importance of the semiconductor industry. The Trump administration has been actively involved in discussions, seeking to support Intel’s turnaround and boost American advanced manufacturing.

Industry Reactions

The news of TSMC’s proposal has sparked interest and speculation within the industry. Multiple companies have expressed interest in buying parts of Intel, although Intel has reportedly rejected proposals to sell its chip design business separately from its foundry operations. Qualcomm, initially part of the discussions, has since withdrawn from talks regarding a full or partial acquisition of Intel.

Future Prospects

As discussions continue, the potential JV between TSMC and US chipmakers represents a significant development in the semiconductor industry. If successful, it could reshape the competitive landscape and strengthen the US’s position in global chip manufacturing.