1. Saudi Aramco partners with BYD to advance vehicle technology

In a significant move towards sustainable transportation, Saudi Aramco has partnered with BYD, a leading Chinese manufacturer of new energy vehicles and power batteries. This collaboration aims to accelerate the development of innovative vehicle technologies that enhance efficiency and reduce emissions.

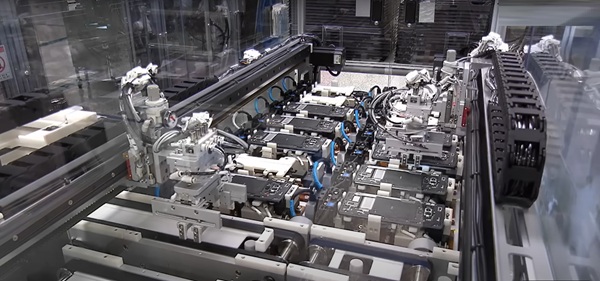

The partnership was formalised through a Joint Development Agreement between Saudi Aramco Technologies Company, a wholly owned subsidiary of Aramco, and BYD. This agreement leverages the extensive research and development capabilities of both companies to achieve breakthroughs in new energy vehicle technologies.

Driving Innovation and Sustainability

Aramco’s Senior Vice President of Technology Oversight and Coordination, Ali A. Al-Meshari, emphasised the importance of this collaboration in supporting practical energy transition. “The collaboration between SATC and BYD aims to support improvements and builds on Aramco’s extensive research and development of new energy solutions. Aramco is exploring several ways to optimise transport efficiency, from innovative lower-carbon fuels to advanced powertrain concepts,” Al-Meshari stated.

BYD’s Senior Vice President, Luo Hongbin, echoed this sentiment, highlighting the potential for this partnership to break geographical and technological boundaries. “We expect that SATC and our cutting-edge R&D capabilities in new energy vehicles will incubate solutions that combine highly efficient performance with a lower carbon footprint,” Hongbin added.

A Step Towards a Greener Future

This partnership is a testament to the commitment of both Aramco and BYD to address global climate challenges. By combining their expertise, the two companies aim to develop technologies that not only improve vehicle efficiency but also contribute to a more sustainable and environmentally friendly future.

As the world continues to seek solutions for reducing carbon emissions and enhancing energy efficiency, collaborations like this one between Aramco and BYD are crucial. They represent a proactive approach to tackling some of the most pressing issues in the automotive and energy sectors today.

2. Google Shifts Pixel Manufacturing to India Amid Tariff Changes

In a strategic move to navigate the complexities of global trade, Google is set to shift a significant portion of its Pixel smartphone manufacturing from Vietnam to India. This decision comes in response to the evolving tariff landscape, which has made Vietnam a less competitive option for production.

Background and Context

Since 2019, Google has been manufacturing its Pixel devices in Vietnam, having moved production from China to avoid the tariffs imposed during the Trump administration. However, recent developments have prompted another shift. The United States has announced potential tariff hikes on Vietnamese imports, with rates as high as 46%, compared to 26% for goods from India. This disparity has made India a more attractive manufacturing hub for Google.

Strategic Shift to India

Google’s parent company, Alphabet Inc., is in discussions with its contract manufacturing partners in India, including Dixon Technologies and Foxconn. The goal is to relocate a portion of the global Pixel production to India, particularly for devices destined for the US market. This move is part of a broader strategy to diversify Google’s manufacturing base and reduce dependency on any single country.

Localising Component Production

In addition to shifting assembly lines, Google plans to localise the production of key components such as fingerprint sensors, batteries, chargers, and enclosures in India. This localisation effort aims to cut costs and enhance competitiveness by leveraging India’s growing manufacturing capabilities.

Impact on Supply Chains

The decision to move Pixel production to India is a direct response to the shifting tariff landscape, which has significant implications for global supply chains. Tariffs increase the cost of imported goods, affecting everything from production costs to consumer prices. By relocating production to India, Google aims to mitigate these costs and maintain its competitive edge in the premium smartphone market.

Conclusion

Google’s move to shift Pixel manufacturing to India underscores the dynamic nature of global supply chains and the impact of tariffs on business strategies. As companies navigate these challenges, diversification and localisation become critical components of their operational playbook. This strategic shift not only positions Google to better manage costs but also strengthens its presence in one of the world’s fastest-growing smartphone markets.

3. Nissan to Export China-Made Electric Cars Globally

In a bold move to strengthen its global presence, Japanese automaker Nissan Motor Corporation is set to export electric vehicles manufactured in China to international markets. This strategic decision underscores Nissan’s commitment to leveraging China’s advanced technology and competitive manufacturing capabilities.

Expansion Strategy

Nissan’s global expansion strategy is part of its broader vision, Nissan Ambition 2030, which aims to achieve carbon neutrality and make electric vehicles accessible to everyone. The company plans to roll out 10 new-energy vehicles by mid-2027, including pure electric and hybrid cars. This initiative is a significant increase from the previously planned eight NEVs by the end of the 2026 financial year.

New Models Unveiled

At the recent Shanghai Auto Show, Nissan unveiled two new models: the N7 electric sedan and the Frontier Pro plug-in hybrid electric pickup truck. Both vehicles are designed and manufactured in China, marking a first for Nissan’s Chinese brands. The N7, developed in partnership with Dongfeng, features advanced driving technologies and impressive range options, while the Frontier Pro is Nissan’s first electrified pickup truck, tailored for the Chinese market.

Investment in China

Nissan has committed $1.4 billion to its Chinese operations, emphasising the importance of the Chinese market in its global strategy. This investment will support the development of new models and enhance Nissan’s competitiveness in one of the world’s most dynamic auto markets.

Global Impact

By exporting China-made EVs, Nissan aims to capitalise on China’s rapid advancements in automotive technology and manufacturing efficiency. This move is expected to bolster Nissan’s position in key markets such as the United States and Europe, where demand for electric vehicles is growing.

Conclusion

Nissan’s decision to export China-made electric cars is a testament to its adaptive strategy and commitment to sustainable growth. As the company navigates the competitive landscape of the global auto industry, its focus on innovation and strategic investments will likely drive its success in the coming years.

4. Kenya and Ethiopia Sign Free Trade Agreement

In a significant move to bolster economic ties and enhance regional trade, Kenya and Ethiopia have signed a landmark free-cross border trade agreement. The agreement, formalised during a bilateral meeting in Mombasa, aims to fast-track the implementation of the African Continental Free Trade Area (AfCFTA) through a simplified trade regime.

Key Highlights of the Agreement

The agreement was signed by senior government officials from both countries, including Kenya’s Cabinet Secretary for Investments, Trade and Industry, Lee Kinyanjui, and Ethiopia’s Minister of Trade and Regional Integration, Kassahun Gofe. The primary goal is to facilitate smoother trade operations at the Moyale border, addressing long-standing commercial bottlenecks that have impacted local communities.

Economic Benefits

Lee Kinyanjui emphasised the importance of the agreement in promoting free trade, allowing goods produced in either country to move freely across the border. He highlighted that Ethiopia supplies vital commodities needed in Kenya, while Kenya produces manufactured goods that are of interest to the Ethiopian market. This reciprocal trade relationship is expected to boost the economies of both nations.

Infrastructure and Investment

The Kenyan government has invested significantly in transport and trade infrastructure to support this new trade regime. Kinyanjui urged local traders to capitalise on the improved systems and invest boldly to reap the benefits of the agreement.

Operational Details

The agreement includes specific provisions to facilitate cross-border trade. Ethiopia’s border trade coverage will extend 50 kilometers from the shared frontier, while Kenya’s will stretch up to 100 kilometers. The trade value threshold for small-scale traders is set at $1,000, allowing cross-border trade up to four times a month based on a common list of approved goods.

Future Prospects

Kassahun Gofe described the agreement as a critical turning point in operationalising AfCFTA at the grassroots level. He commended the technical teams from both sides for their dedication over two years of negotiations. The focus now shifts to implementing the agreed terms and starting trade under the new regime.

This agreement marks a significant step towards deeper economic integration and cooperation between Kenya and Ethiopia, promising a brighter future for cross-border trade and regional development.