Blog Category: General

Trade Update August #4: USA, Georgia, Southeast Asia, Trump, Italy, India

German industrial packaging company Schütz Container Systems has officially opened its new $166 million production facility in Kenosha, Wisconsin, marking a major milestone in its North American expansion strategy. The 370,000-square-foot facility is designed to enhance Schütz’s operational efficiency and sustainability across the Midwest, one of the fastest-growing regions in the U.S. market. The investment is expected to create 185 jobs over the next five years, reinforcing Kenosha’s position as a hub for advanced manufacturing.

Trade Update August #3: USA, Asia, New Zealand

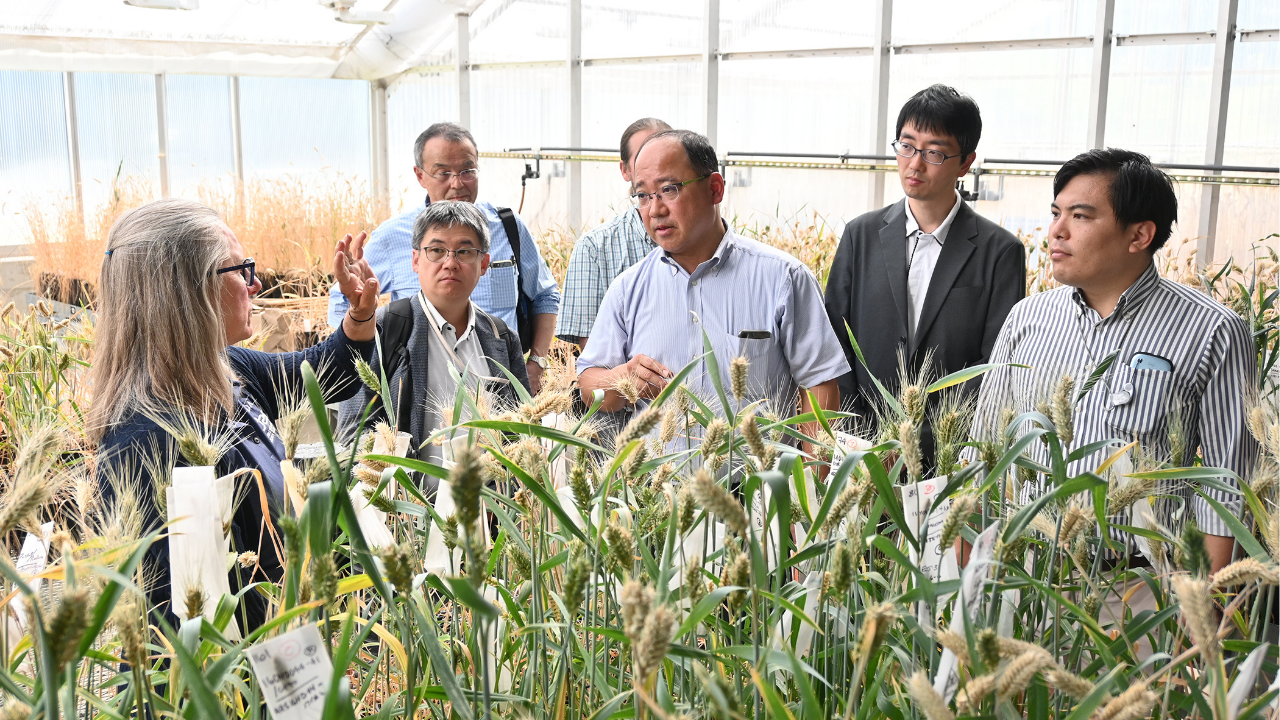

U.S. wheat farmers and Japanese millers have reaffirmed their enduring partnership through reciprocal trade missions held in the summer of 2025. These missions underscore a relationship that spans more than seven decades, built on mutual trust, shared values, and a commitment to quality.

Trade Update August #2: Uzbekistan, Poland, Glasgow, East Anglia, Australia

Since Donald Trump’s return to the presidency in January 2025, the United States has seen a remarkable boom in foreign direct investment, signaling a renewed global confidence in America's economic trajectory. International investors have announced a total of 1,049 new projects, marking an 8.6% increase compared to the equivalent period under President Joe Biden’s leadership.

Trade Update August #1: US FDI, Google India, Hollywood Glasgow, UK FDI

Since Donald Trump’s return to the presidency in January 2025, the United States has seen a remarkable boom in foreign direct investment, signaling a renewed global confidence in America's economic trajectory. International investors have announced a total of 1,049 new projects, marking an 8.6% increase compared to the equivalent period under President Joe Biden’s leadership.

Trade Update July #4: EU US trade deal, US investment, Agribusiness to Mexico, OpenAI

The United States and the European Union have finalised a trade framework that imposes a 15% tariff on most European exports to America, averting a potentially destabilising trade war between two of the world’s largest economies. The deal was brokered during a high-stakes meeting between U.S. President Donald Trump and European Commission President Ursula von der Leyen at Trump’s Turnberry golf resort in Scotland. The agreement comes just days before the U.S. was set to implement a much steeper 30% tariff on EU goods.

Trade Update July #3: Panasonic, DP World, Ireland, Turkey Georgia

De Soto, Kansas – July 14, 2025 — Panasonic Energy Co., Ltd., a core company of the Panasonic Group, has officially launched mass production at its new state-of-the-art electric vehicle (EV) battery facility in De Soto, Kansas. This milestone marks a significant expansion of Panasonic’s U.S. manufacturing footprint and a major step forward in the global transition to sustainable transportation. The De Soto factory, located just outside Kansas City, is now one of the largest automotive battery plants in North America. Built on a sprawling 300-acre site—equivalent to more than 225 American football fields—the facility is designed to produce Panasonic’s advanced 2170 cylindrical lithium-ion batteries, with a planned annual production capacity of approximately 32 gigawatt-hours (GWh).

Trade Update July #2: Maersk, Wrisk, Groq, MeetEngland

Global logistics giant A.P. Moller – Maersk has officially launched a state-of-the-art packing and cold chain logistics hub in Olmos, Peru, marking a significant expansion of its operations in Latin America. Strategically located in the Lambayeque region—one of Peru’s most dynamic agricultural zones—the new facility is poised to transform the country’s agro-export landscape.

Trade Update July #1: Dynisma, Jabil, London, Mercosur FTA, Ireland

Bristol-based Dynisma, a cutting-edge racing simulator company trusted by Formula 1 giants Ferrari and McLaren, has landed a €10.7 million export contract, marking a major milestone in its global expansion. Founded in 2017 by former F1 driving simulation engineer Ash Warne, Dynisma has rapidly become a leader in high-fidelity motion simulation technology. The company’s simulators are renowned for their ultra-low latency and high bandwidth, offering an unmatched level of realism for motorsport teams and automotive manufacturers alike.

Trade Update June #4: Morocco, US-UK FTA, India, Taiwan

Benteler, the German automotive supplier, has officially commenced construction of its new manufacturing facility in Kenitra, Morocco, marking a significant milestone in the company’s global expansion strategy. The groundbreaking ceremony, held on June 24, was attended by key dignitaries including Morocco’s Minister of Industry and Trade, Ryad Mezzour, and Matthias Siemer, President of Benteler Automotive Components Europe.

Trade Update June #3: Amazon, Chips, Modi, Sweden, AI Sweden

Amazon has announced a $10 billion investment in North Carolina to expand its data center infrastructure and establish a new AI innovation hub. The investment, one of the largest in the state’s history, will be centered in Richmond County and is expected to create at least 500 high-skilled jobs. These roles will span data center engineering, network operations, security, and AI infrastructure management, with thousands more jobs supported indirectly through construction and the broader AWS supply chain.