Blog Category: General

Trade Update 2025 #2: Mexico, JATCO, Infineon, Enfield partners

In a significant move to bolster its economy and strengthen trade ties with North America, Mexico has announced a series of tax and financial incentives aimed at encouraging nearshoring and reducing dependence on Chinese imports. President Claudia Sheinbaum unveiled the country's new industrial policy, known as Plan Mexico, during a presentation at the National Museum of Anthropology in Mexico City. Key Incentives and Benefits The incentives include accelerated depreciation of assets, allowing companies to deduct a substantial portion of the cost of machinery and equipment purchased in 2023-2024 as a tax write-off much sooner than usual. Additionally, businesses can benefit from a 25% deduction on training expenses for workers over three years, promoting workforce upskilling.

Trade Update 2025 #1: Cambodia, Micron, Rubrik, Intouch

The launch of the FTA portal is part of Cambodia's Pentagonal Strategy – Phase One, a key policy framework designed to drive economic growth and improve the business environment. Commerce Minister Cham Nimul highlighted the importance of this initiative during a recent review meeting, emphasising that detailed information about FTAs is crucial for businesses to maximise their benefits and leverage new opportunities.

Final Trade Update 2024 : Nvidia, CIP, Chery, Indovance

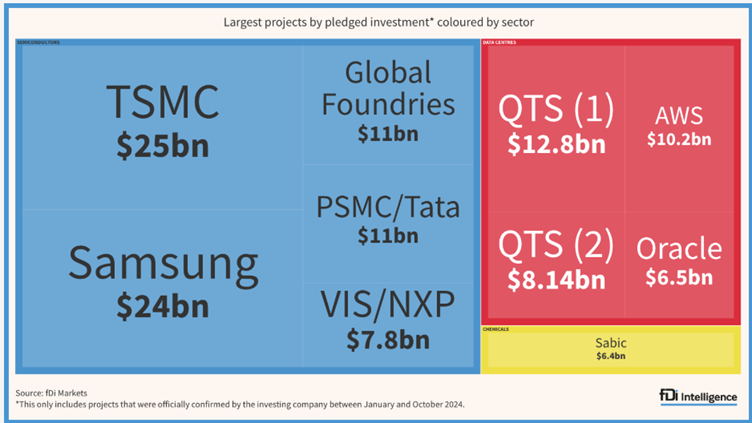

1. Top 10 FDI projects of 2024 2024 has been a remarkable year for foreign direct investment (FDI), with significant projects announced across various sectors. Here are the top 10 FDI projects that have made headlines this year: TSMC's Semiconductor Fab in Phoenix, Arizona Investment: $25 billion Sector: Semiconductors Details: Taiwanese chipmaker TSMC announced its third semiconductor fab in Phoenix, Arizona, marking the largest greenfield FDI in US history

Trade Update December #4: FDI 2024, 2025, MapmyIndia, GKN Aerospace, Thai PM

1. Top 10 FDI projects of 2024 2024 has been a remarkable year for foreign direct investment (FDI), with significant projects announced across various sectors. Here are the top 10 FDI projects that have made headlines this year: TSMC's Semiconductor Fab in Phoenix, Arizona Investment: $25 billion Sector: Semiconductors Details: Taiwanese chipmaker TSMC announced its third semiconductor fab in Phoenix, Arizona, marking the largest greenfield FDI in US history

Trade Update December #3: Hyundai, Northern Ireland, JDR Cables, CPTPP, Lawhive

In a significant move towards expanding its electric vehicle footprint, Ford Motor Company has announced plans to invest in an EV manufacturing plant in Indonesia. This strategic investment is set to commence in 2025, marking a pivotal step for both Ford and the Indonesian automotive industry.

Trade Update December #2: Indonesia, US, Trump, Brazil, India

In a significant move towards expanding its electric vehicle footprint, Ford Motor Company has announced plans to invest in an EV manufacturing plant in Indonesia. This strategic investment is set to commence in 2025, marking a pivotal step for both Ford and the Indonesian automotive industry.

Trade Update December #1: Nigeria, US, Japan, London, Europe

In recent years, Nigeria has embarked on an ambitious journey to transform its economic landscape through the establishment of digital Special Economic Zones (SEZs). These zones are set to become the cornerstone of Africa's burgeoning tech and services sectors, positioning Nigeria as a leader in innovation and economic growth.

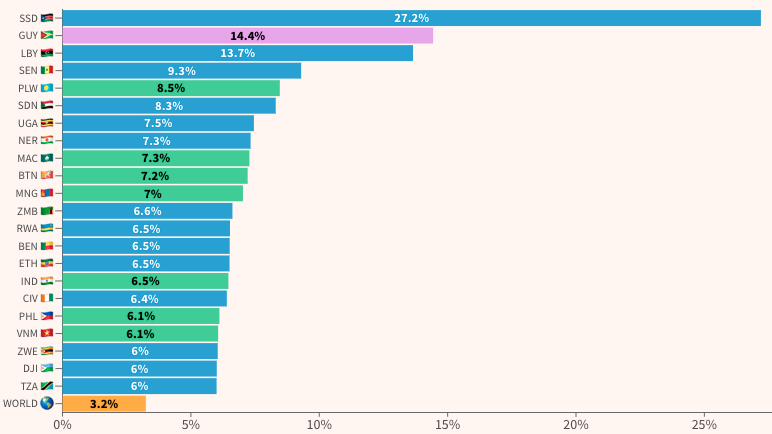

Trade Update November #4: 2025, Microsoft, Thailand, Apple, Qatar

As we look ahead to 2025, several economies are poised for significant growth, driven by various factors such as natural resource discoveries, political stability, and economic reforms. According to the latest forecasts from the International Monetary Fund and the World Bank, the global economy is expected to grow by 3.2% in 2025.

Trade Update November #3: Milan, Hong Kong-Peru, Thailand-South Korea, India-US, Azerbaijan

In recent years, the tech industry's insatiable demand for energy has led to a surprising resurgence in nuclear power, particularly through the development of small modular reactors (SMRs). Companies like Google, Amazon, and Microsoft are at the forefront of this movement, investing heavily in these advanced nuclear technologies to power their vast data centers and support their AI ambitions.

Trade Update November #2: Nuclear, Hyundai, EVs, Vietnam, South Korea, Turkey

In recent years, the tech industry's insatiable demand for energy has led to a surprising resurgence in nuclear power, particularly through the development of small modular reactors (SMRs). Companies like Google, Amazon, and Microsoft are at the forefront of this movement, investing heavily in these advanced nuclear technologies to power their vast data centers and support their AI ambitions.