International business expansion guidance and advice

Trade Horizons’ Market Entry Blog

Our market entry blog covers a range of topics relating to international business expansion. Articles tackle many different subjects, including the initial planning and preparation stages of growing your business, advances in technology you can take advantage of, through to sales & marketing, packaging and branding advice. Written by leading experts in their field, you’ll be sure to find something of interest and real-world practical advice if you are looking to grow your business around the world.

Latest Articles

Trade Update September #4: Trump in UK, Philippines, meat, Palfinger, Swiss-South America

In a significant move to bolster bilateral trade and investment, Florence Eshalomi MP, the UK Trade Envoy to Nigeria, concluded a four-day strategic visit aimed at deepening economic ties between the United Kingdom and Nigeria. The visit reaffirmed the UK’s commitment to the UK-Nigeria Enhanced Trade and Investment Partnership, with a focus on unlocking opportunities across fintech, agriculture, and manufacturing.

Trade Update September #3: UK US, Belgium, France

In a significant move to bolster bilateral trade and investment, Florence Eshalomi MP, the UK Trade Envoy to Nigeria, concluded a four-day strategic visit aimed at deepening economic ties between the United Kingdom and Nigeria. The visit reaffirmed the UK’s commitment to the UK-Nigeria Enhanced Trade and Investment Partnership, with a focus on unlocking opportunities across fintech, agriculture, and manufacturing.

Trade Update September #2: UK Nigeria, Vietnam, India Israel, USA Japan, 3top Aviation

In a significant move to bolster bilateral trade and investment, Florence Eshalomi MP, the UK Trade Envoy to Nigeria, concluded a four-day strategic visit aimed at deepening economic ties between the United Kingdom and Nigeria. The visit reaffirmed the UK’s commitment to the UK-Nigeria Enhanced Trade and Investment Partnership, with a focus on unlocking opportunities across fintech, agriculture, and manufacturing.

Trade Update September #1: Texas, CPTPP, Asia, Loch Lomond, Singapore

German industrial packaging company Schütz Container Systems has officially opened its new $166 million production facility in Kenosha, Wisconsin, marking a major milestone in its North American expansion strategy. The 370,000-square-foot facility is designed to enhance Schütz’s operational efficiency and sustainability across the Midwest, one of the fastest-growing regions in the U.S. market. The investment is expected to create 185 jobs over the next five years, reinforcing Kenosha’s position as a hub for advanced manufacturing.

Trade Update August #4: USA, Georgia, Southeast Asia, Trump, Italy, India

German industrial packaging company Schütz Container Systems has officially opened its new $166 million production facility in Kenosha, Wisconsin, marking a major milestone in its North American expansion strategy. The 370,000-square-foot facility is designed to enhance Schütz’s operational efficiency and sustainability across the Midwest, one of the fastest-growing regions in the U.S. market. The investment is expected to create 185 jobs over the next five years, reinforcing Kenosha’s position as a hub for advanced manufacturing.

Trade Update August #3: USA, Asia, New Zealand

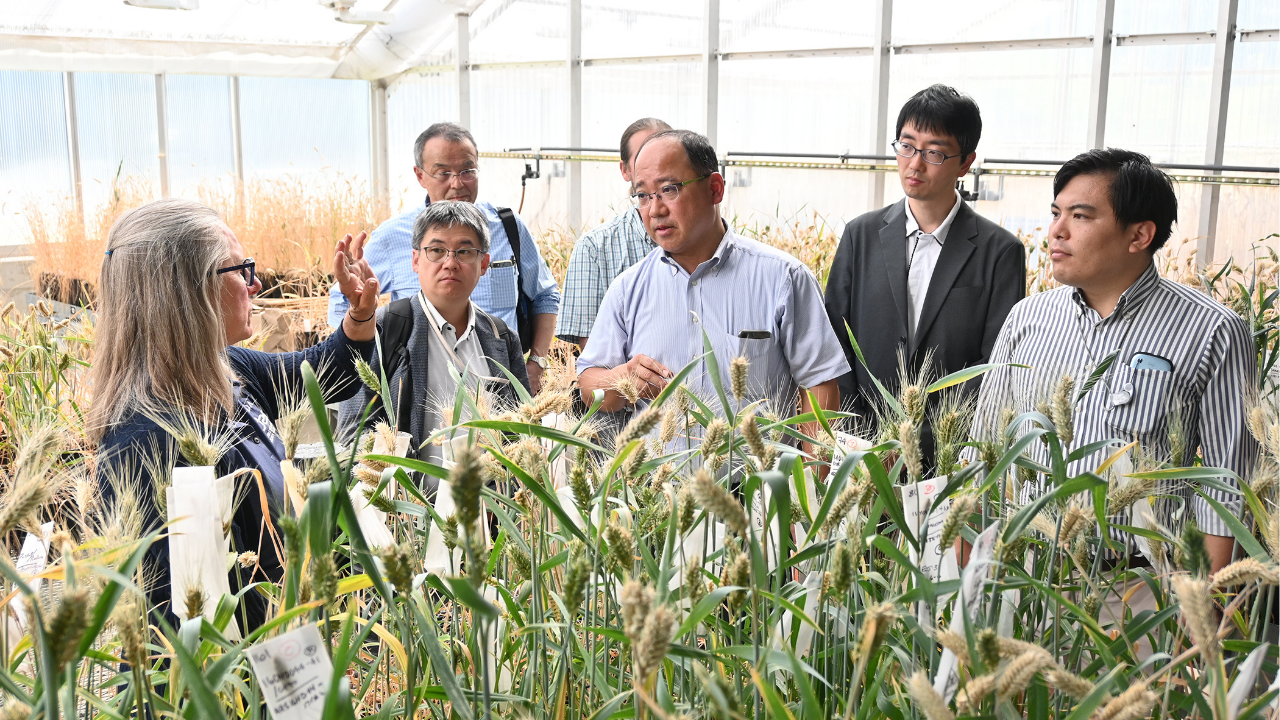

U.S. wheat farmers and Japanese millers have reaffirmed their enduring partnership through reciprocal trade missions held in the summer of 2025. These missions underscore a relationship that spans more than seven decades, built on mutual trust, shared values, and a commitment to quality.