1. Global foreign direct investment up 77% in 2021

Global foreign direct investment was up 77% in 2021 breaking the forecasted records. Developed countries achieved the strongest rebound at three times 2020 levels. The US soared at double the previous year driven by mergers and acquisitions. Even developing economies experienced 30% increase with South East Asia, Latin America and the Caribbean and West Asia leading the way.

International project finance in infrastructure sectors is expected to fuel growth in 2022 again however supply chain bottlenecks, energy prices and inflation may have a corrective effect.

2. China Foreign Direct Investment up 20% in 2021

Foreign direct investment in China was up 20% in 2021 on 2020. The source is probably from western multinationals with survey results indicating that 60% of multinationals based in China increased investment in the past year. These results are higher than forecasted and indicate Western interest in China continues. Upgrades in manufacturing, the new Foreign Investment Law and free port pilots are devices used by the Chinese to encourage increased foreign investment.

Trade Horizons

Trade Horizons is an award-winning market entry company, assisting ambitious companies to identify, develop and grow sustainable revenues in new geographic markets. We offer support to clients in international strategy development for their global business growth, and throughout the key phases of market entry execution – Preparation, Launch and Growth. Click here to find out more.

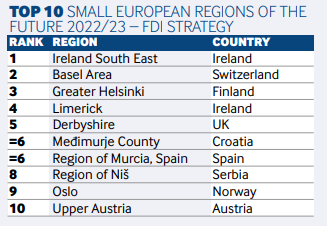

3. Derbyshire ranks #5 in UK & Europe for Investment

Derbyshire ranked fifth overall and first in UK in the top ten small regions Financial Times European Cities of the Future rankings.

London ranked first in the large cities ranking. The results were based on: economic potential, business friendliness, connectivity, human capital and lifestyle, and cost effectiveness.

Read the full report here

4. UK’s Green Industrial Revolution ready to go

The UK is expected to grow at 5% in 2022 up 0.7% on Europe at 4.3%. The Government has created the Office for Investment to assure this growth and backing the ‘Green Industrial Revolution’. The new office will facilitate investment into new areas as set out in the Green Industrial Revolution Ten Point Plan such as climate change – reaching carbon net zero by 2050, green energy and infrastructure, transport, and finance. £12 billion has been pledged to create 250,000 highly skilled green jobs. One year after the plan was announced, the Government has banned the sale of petrol vehicles from 2030. Other plans have been written on cycling & walking routes and greener buildings however the the rise in energy prices due to happen soon might force some changes before implementation by the Government is underway.

5. Ethiopia launches sovereign wealth fund

Ethiopia has launched a sovereign wealth fund Ethiopian Investment Holdings which will allow foreign private investment to boost the country’s recovery from COVID-19 and the war in Tigray. The new fund will allow private investors to own public infrastructure in Ethiopia and is a recoil from the infrastructure investment from China that did not lead to the envisioned amount of investment going back into the country. It aims to revamp the economy and follows 24 other African nations that have sold off public assets to private investors including Botswana. The fund may enable more efficient delivery of services to be contracted with strong governance from the office of the Prime Minister, to which it reports.

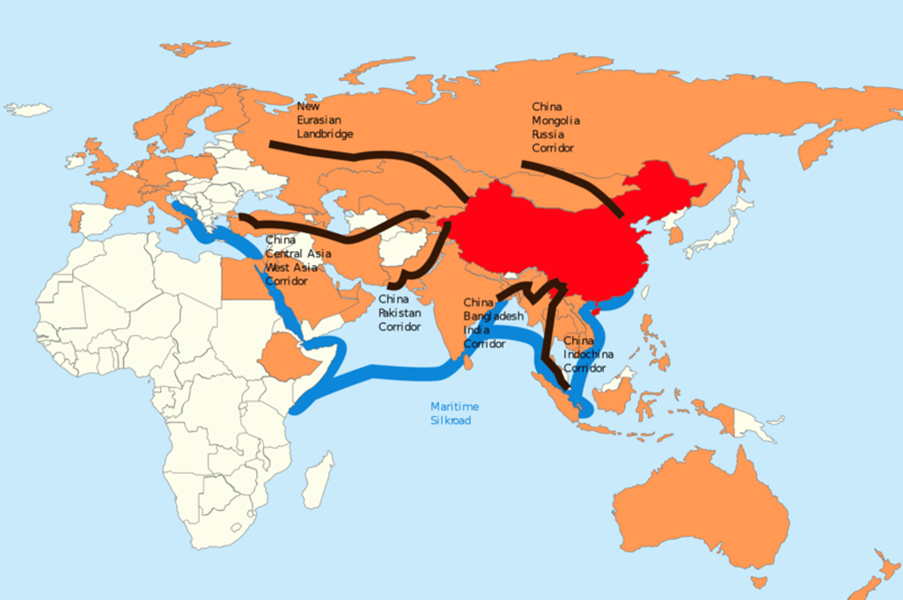

6. UK launches fund to counter China

The UK has launched the British International Investment (BII) as an investment alternative to China’s global infrastructure project investments. The new fund replaces The Commonwealth Development Corporation (CDC). It is owned by the Foreign Office and will be an investment vehicle for UK Government money and private investment as well as seeking foreign investment to apply to infrastructure projects in Caribbean, Asia and Africa. It will implement green economy and sustainability projects in developing nations in digital infrastructure, technology, and renewable energy. It aims to mobilise public and private money to deliver £8 billion a year of public and private sector investment in international projects by 2025. It will also partner with capital markets and sovereign wealth funds to scale up financing and crowd in private investment.

7. UK takeovers: major law change

The new National Security and Investment Act which came into force in 2022 gives the Government more power to intervene on foreign investment deals. The biggest change is that the Government must be notified of local or foreign investment in 17 sensitive sectors. It applies not only to companies based in the UK but also companies that deal in the UK. With no lower threshold, one major question would be how one might aim to police foreign deals in foreign countries between foreign parties of whatever size. Given the previous relaxed regime we might seem to the untrained eye to be lurching between extremes when it comes to takeover rules – it might be a prerogative however uncertainty regarding foreign investment rules is seldom perceived as a smart move, especially when transaction numbers are in the region of 1,000-1,800 per year!