1. India EU trade deal

The EU is set on a free trade deal with India to counter China and has set a target of end of 2023 to secure a deal. German Chancellor Olaf Scholz has rated the deal as one of his top priorities. The European Union has announced its intention to develop closer relations with the Indo-Pacific Region to counterbalance China’s influence in the region.

India purchases most of its military hardware and oil from Russia and has not criticised Russia for the invasion instead calling for dialogue and diplomacy to end the war.

Sholz met with Indian Prime Minister Modi recently and is intent on selling six conventional submarines to the nation. China is Germany’s largest customer of machine tools and Russia is Germany’s key energy supplier. Soon India will be the most populous nation in the world.

2. Mexico Turkey FTA

Ebrard Cavasoglu © Turkish Ministry of Foreign Affairs

Mexico and Turkey have reportedly resumed free trade negotiations. A Memorandum of Understanding was signed a decade ago in 2013 between the two countries to establish a high level binational commission with the remit to exchanging information for the avoidance of income tax evasion, agreement on air services and credit cooperation.

In 2020 Mexican exports to Turkey were valued at $802m with the top 3 products being wheat, cotton and medical instruments. In the same year, Turkey exported $576m of trucks, motor vehicles and jewellery to Mexico.

3. Brazil record FDI

Brazilian Carnival Parade © John Foxx via Wikimedia Commons

Foreign Direct Investment in Brazil reached its highest value in 5 years last year according to central bank data. FDI in 2022 was reported at $90.6 billion, the highest in ten years.

The largest investment projects were in oil and gas. In 2021 Brazil opened its natural gas industry to private investors. Although the number of projects has decreased the size of projects has increased. Brazil was an automotive manufacturing hub however Ford has exited and the auto industry may be giving way to fossil fuel extraction we suppose due to the global energy shortage brought about by the war in Russia. Brazil has one of the world’s largest reserves of natural resources.

Main origins include Netherlands, the United States, France, Spain, and Canada.

4. US 5 year survey results

By Terabass – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=11848631

The US conducts a survey every 5 years on foreign direct investment to produce statistics on the scale and effects of foreign-owned business activities in the United States. The last BEA-12 Benchmark Survey was conducted in 2018 and the next BEA report is due in May for 2022. The BEA is The US Department of Commerce’s Bureau of Economic Analysis and reports on US affiliates overseas and also collects information on US inbound foreign direct investments.

BEA contacts foreign owned entities and requests a number of forms to be completed by 31 May 2023. Entities can subscribe to email updates on the BEA website which emails subscribers when forms are released. https://www.bea.gov/surveys/be12

5. 2023: more foreign controls and investment screening

© Sigmund via Unsplash

Some sources expect FDI controls and restrictions to increase further in 2023 along with stricter monitoring and more investments being curtailed. Twenty transactions globally were blocked in 2022 of which most were of Chinese origin. Transactions in energy and semiconductors are deemed to be higher risk and subject to increased monitoring controls.

The US is expected to monitor third party relationships of foreign investors including commercial ties more closely to countries of concern being China and Russia. Committee on Foreign Investment in the United States (CFIUS) is expected to increase allies and partner countries in this area with more decisions on Excepted Foreign States (EFS). Australia, Canada, the UK and New Zealand are currently EFS status.

The UK Investment Security Authority (ISU) is the body that monitors transactions under the UK National Security & Investment Act (NSIA) which has monitored 14 cases since it came into effect in January 2022 with 5 reversals.

The EU has blocked around 1-2% of transactions with 23% subject to monitoring with the majority of investors choosing to withdraw their investments rather than have them blocked. 3% of investments were withdrawn.

Foreign investors should prepare for multi-jurisdictional review of overseas investments in 2023.

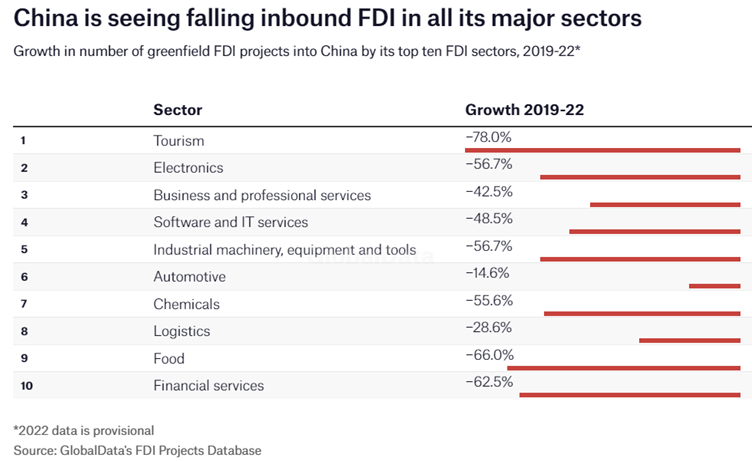

6. China’s inbound FDI plummets

Chinese FDI levels have decreased by half since 2019 with M&A also in decline and companies looking to diversify away from China. Most companies cite supply chain and geopolitics as concerns. India, Malaysia and Vietnam are the main benefactors of reduced global reliance on China.

Tourism is reportedly down by 78%; food and financial services are down by 66% and 63% respectively. Manufacturing and sales sectors which account for 50% of total FDI are down by 50% on 2019.

Tightening regulations mean that Chinese M&A is also down significantly on pre-COVID levels.

With labour costs rising, the slowing of the economy due to the zero COVID policy (construction) and trade tension increasing, geopolitical tension has risen and has led to further decline. China’s relationship with Russia has also deterred investors.

Large companies including Sony, Dell and Daikin have exited with more exits planned such as HP.

Meanwhile FDI in Asia Pacific is expected to grow annually at around 30%, driven by India.

Featured image Narendra Modi and Olaf Sholz © MEAphotogallery 2022 via Flickr