1. EU Mercosur trade deal stalled

Brazil’s President Luis Lula went to Europe to discuss the long delayed EU- Mercosur trade deal that will Brazil will apparently respond on in the coming weeks. Negotiations started all the way back in 1999. A deal was agreed in principle in 2019 but never ratified. The new deal will remove 91% of trade tariffs and lead to additional access to the EU especially for Mercosur beef, poultry, sugar and ethanol.

The Mercosur countries are Argentina, Brazil Paraguay and Uruguay. The EU is Mercosur’s top trade partner and foreign investor.

99 more tonnes of extra beef will be imported leading to Irish farmers being up in arms about the deal saying it will irrevocably alter Ireland’s farming landscape.

France is concerned about deforestation and Lula wants to retain control over public procurement / does not want to give access to European companies to bid for state contracts.

2. UK Turkey: new FTA

Varda viaduct in Adana province Istanbul-Baghdad railway Zeynel Cebeci via Wikimedia commons

The UK’s Secretary for Trade Kemi Badenoch travelled to Turkey to commence discussions on a new free trade agreement. The current trade agreement was negotiated post Brexit however only covers goods and not services.

The UK is a net importer of Turkey’s goods. Total trade was £23.5 billion in 2022 of which £6.4 billion was UK exports and £15 billion was imports. This is an increase of 30% compared to 2021.

The UK Government through its credit agency UK Export Finance has underwritten a £781 million loan to build a high-speed railway in Turkey.

IN 2021 the UK invested £8.9 in FDI in Turkey. Inbound FDI from Turkey to the UK was £720 million.

3. Dutch agritech in Chicago

Dutch sky and Dutch cows at Deelen and Park Deelerwoud.. by Henk Monster via Wikimedia Commons

A Dutch public private partnership organisation hosted a delegation of tech startups from Netherlands to Chicago to complete an ‘accelerator programme’ in food.

The 4-week programme sees 10 Dutch tech companies travelling to Chicago to ‘interact with industry experts, possible partners, investors, and mentors.’

The trip was funded by Netherlands Enterprise Agency which is funded by the Dutch Government.

Dutch farmers have been protesting the Government’s plans to close farms due to ‘environmental concerns.’

4. Houston – Africa trade mission

Houston Mayor Sylvester Turner is leading a trade mission to three countries in West Africa Nigeria, Cote D’Ivoire and Ghana. It is Mayor Turner’s second visit to Africa since he took office in 2016.

The trade mission consisted of government and business representatives and aimed to strengthen ties between Houston and the countries by finding new economic opportunities, encouraging civic engagement, establishing consulates in all three countries and campaigning for direct flights between Houston and Nigeria.

Houston is the energy capital of the world and the most diverse city in America. Houston is Africa’s largest urban trade partner.

The City of Houston has celebrated Africa day for the past 6 years and hosted the first ever Africa Energy summit that brought together energy advisors and ministers from 20 African nations to Houston.

5. Employee share options by country

Image Joshua Rawson-Harris via Unsplash

Employee share options are taxable in Malaysia whereas in the UK no income tax or National Insurance contributions is charged on the difference between what is paid for the shares and what they’re actually worth (NB capital gains tax may apply). However, in the UK not all companies qualify for tax-advantaged share option schemes. For those companies that don’t, income tax is charged on the exercise of non tax-advantaged option on the difference in value between market value & amount paid.

In the US the rules are even more complex. Tax could be charged on the difference between buy and sell price as a short-term capital gain (0-37% federal) if the shares are sold within 12 months of purchase.

The UK leads the way in employee share options. Janet Cooper OBE developed the UK’s only training course on the subject ICSA Certificate in Employee Share Plans. Janet helped British Airways offer share plans to employees globally in the 80’s, developed the Long Term Incentive Plan for BP in the 90’s which is now used by companies around the world. Janet co-founded the Global Equity Organisation in 1999 a not-for-profit organisation aimed at promoting knowledge and understanding of employee share options. She also co-founded ProShare a lobbying organisation that promotes better legislation around share options.

For more information on employee stock options by country, go here.

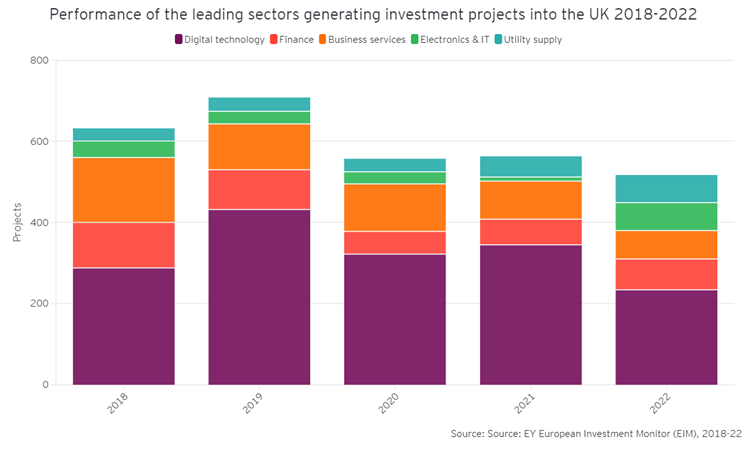

6. UK FDI by sector over time

UK inbound FDI in the automotive and aerospace sectors have risen whilst life sciences and tech have decreased.

The United Kingdom’s top FDI sectors are digital technology, financial services, professional services, utilities and agriculture.

The UK remains second in EY’s UK Attractiveness Survey in attracting FDI beaten by France however the UK attracts more new projects than France, more total jobs and jobs per project than Germany and France.

7. Spanish Royal Decree on FDI

Two weeks ago, Spain enacted a royal decree regarding the FDI screening regime which aims to make investing in Spain easier for foreign investors. Review time has been reduced from 6 to 3 months and more clarity is provided around analysis questions.

Last week a ruling by the European Court of Justice reminded countries that national FDI regimes must respect the EU fundamental right of establishment. It concerned a Bermudan owned Hungarian company, the decision being that just because the parent company is based in a third country does not mean the regulation automatically applies. The Royal Decree aims to identify the beneficial owner for screening purposes and it provides more information about when management companies are considered beneficial owners.

Featured image Subtle Cinematics via Unsplash