1. The future of supply chain

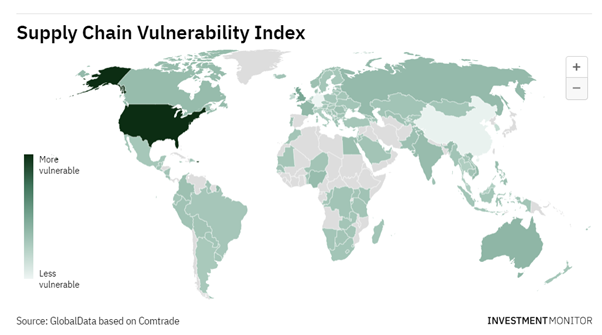

Supply chain issues caused by the pandemic touched every area of business and personal lives. GlobalData created the supply chain vulnerability index map showing US as most vulnerable and Germany as least vulnerable. GlobalData is headquartered in the United Kingdom so that should clear up any doubts about independence. The UK is apparently somewhere towards the lower end of vulnerability.

Since the pandemic we have seen nations wholesale decoupling their supply chain from China to avoid overreliance on it and a repeat of the troubles during COVID.

We have seen trade and investment policy shifting away from openness to protectionism for example increased scrutiny on foreign transactions, the foreign subsidies regime and a widening in sector scope of existing foreign transaction monitoring legislation.

Advances in technology particularly supply chain tracking and sustainability initiatives may increase supply chain reliability and robustness in future. The digitisation of customs and transport systems for example bills of lading will vastly revolutionise the transport of goods. Combined together these 2 advances could propel logistics into a sort of next industrial revolution.

ESG and sustainability standards will inevitably usher in a new wave of tracking and monitoring systems and policies that will make illicit trade more difficult. As routes and shipments become more transparent there are implications for financial crime advances such as terrorist financing, money laundering and drug running.

The dilution of places of origin for example less reliance on China will being more security in supply chains of the future with lesser potential for disruption.

Trade Horizons

Trade Horizons is an award-winning market entry company, assisting ambitious companies to identify, develop and grow sustainable revenues in new geographic markets. We offer support to clients in international strategy development for their global business growth, and throughout the key phases of market entry execution – Preparation, Launch and Growth. Click here to find out more.

2. New law zero tariffs on imported goods

The UK Government has just announced the Developing Countries Trading Scheme which cuts tariffs to zero on products from 65 developing nations. Under the scheme 99% of goods from Africa will be duty free. Some of the poorest countries in Africa, Asia, Oceania and the Americas will be able to export goods to the UK with reduced tariffs. This will benefit UK consumers with lower food prices to aid with the cost of living, and hopefully not just the supermarkets with higher margins.

In addition, country of origin rules have been relaxed to allow the producer greater freedom when sourcing primary materials.

Full country list here https://www.gov.uk/government/publications/developing-countries-trading-scheme-dcts-new-policy-report/developing-countries-trading-scheme-government-policy-response

3. Confusion reigns: HMRC guidance on electric car charging reimbursement

The Government has stated that company reimbursements to employees on electricity used for charging an electric vehicle that is available for private use are subject to tax and NICs.

However, the Institute of Chartered Accountants of England and Wales (ICAEW) claims this guidance and tools provided conflict with the law and has raised the point with HMRC.

Two sections of ITEPA 2003 (Income Tax Earnings and Pensions Act), s239(2) and 149(4) state that reimbursements of this type are classed as expenses making them tax and NIC exempt.

Due to the early stage of electric vehicles, tax implications of electric fleets are complicated with wide-ranging issues. This article is interesting https://www.autocar.co.uk/car-news/advice-company-cars/how-claim-charging-electric-company-car

4. FDI performance by country

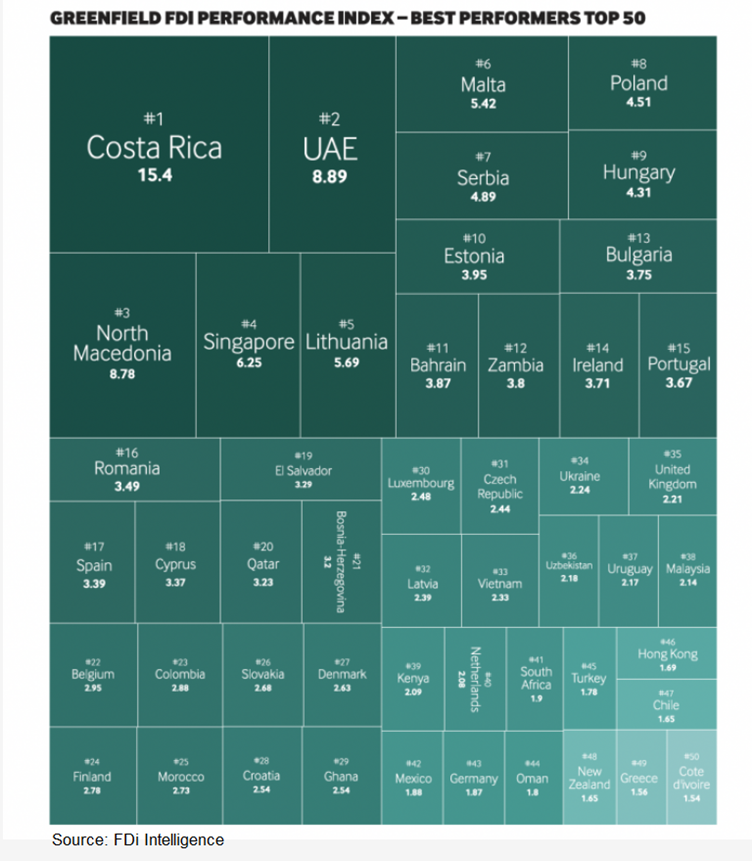

FDi Intelligence has ranked countries by incoming FDi compared to economy size with Costa Rica topping the list followed by UAE and North Macedonia.

Pre-pandemic the list showed 5 African countries in the top ten but the latest data shows Zambia as the best performer in Africa only at #12 as investors flee to OECD safety.

China is at the bottom of the list with the lowest score due to FDI dropping to record low levels following the pandemic.

Emerging Europe dominates the top ten.

5. Lithuania FDI growth

Lithuania comes in at number five in the above ranking and has reported growth in FDI during the first half of 2022.

It reported 40% more projects during this timeframe than the same time last year. The new projects are split between greenfield and expansion of existing ones.

Technology is the strongest sector with fintech as the largest subsector in the tech sector. Lithuania has the most licensed fintech companies in the EU due to preferable policy and licensing rules (not sure how this compares to Estonia which was a fintech hub).

The manufacturing sector is also reported as growing in Lithuania.

Lithuania is the first country to have completely severed ties with Russian gas making it energy independent and therefore very attractive as more stable than Russia reliant countries in the region.