1. India New Zealand trade discussions called off

Credit: @IndiainNZ

New Zealand and India have decided to cease free trade agreement discussions in favour of ‘business collaborations.’ Indian External Affairs Minister Jaishankar said that they wanted to now encourage more business collaborations without a free trade agreement. New Zealand Foreign Minister Nanaia Mahuta said the fta was no longer on her Government’s list of priorities.

______________________________________________________________________________________

2. UK FTAs off the cards

Kemi_Badenoch via Wikimedia Commons

With the mini-budget causing BofE chaos and Chancellor Kwasi Karteng’s u-turn on tax cuts, other Government news has taken a backseat. The new international trade secretary Kemi Badenoch said that there would be less focus on free trade agreements, indicating that the India deal may not include services, and a higher focus on ‘mini trade deals’ with 50 US states rather than a US FTA that’s been off the cards since Biden took office. She also mentioned an investment partnership with Norway whose main export is oil & gas.

______________________________________________________________________________________

3. Call for Bids: Australia UK Supply Chains Project

Credit UK Gov via Flickr

The British high Commission in Australia is calling for bidders to strengthen the supply chain resilience between the two countries. Based on the Innovation Chapter 20 of the FTA signed in 2021 Australia and the UK will embark on a project to engage interested countries to develop public sector approaches to managing supply chain risk in critical sectors such as semiconductors, telecoms and critical minerals. Potential ideas include bids for alternative supply of critical goods, third country sources, supply chain risk surveys, policy proposals. More info

______________________________________________________________________________________

4. Reviving Britain and the Commonwealth

Credit Commonwealth Secretariat via Flickr

The Commonwealth consists of 54 nations with a population of 2.5 billion and a combined GDP of $10 trillion or around 14% of global GDP and set to reach $19.5 trillion in 2027. Liz Truss has expressed her desire for a ‘New Commonwealth Deal’ to counter China’s “grave threat to our values and way of life.”

The Commonwealth deal is somewhat in competition with the CPTPP talks set in motion under Boris which deals with most Asian nations.

______________________________________________________________________________________

5. Backtrack on services in the India-UK trade deal

Credit British High Commission via Flickr

Boris may have set the Diwali deadline for the India-UK free trade deal but the Government is backtracking on the detail including a possible exclusion of services. Secretary of State for International Trade Kemi Badenoch indicated that services may not be part of the original deal but could be added later.

The fifth round of negotiations concluded in August with the goal of signing the FTA by end October.

______________________________________________________________________________________

6. Korea breaks FDI records

Credit daniel-bernard-via unsplash

The Korean Ministry of Trade, Industry and Energy has announced that South Korea has attracted more than $20 billion FDI in the first 9 months of the year for the first time ever. Most investment is in the manufacturing sector specifically semiconductors, electric vehicles and batteries.

US is the top investor followed by Japan and these are up. Europe and China are down.

The invest in Korea the investment must be reported under the Foreign Investment Promotion Act (FIPA) or the Foreign Exchange Transaction Act with the fast-tracked process under FIPA requiring $USD70,000. For more info see Invest Korea.

______________________________________________________________________________________

7. Beijing’s zero COVID policy only harms China

Credit denny-ryanto-via unsplash

Chinese investors are struggling with China’s ‘zero COVID policy’ and are looking to divert investment away from China as they deal with lower revenues, ad-hoc policymaking, limited market access and shifting supply chain strategies.

Amazon, LinkedIn, Tesla, Adidas and Yahoo are just some of the major players that have exited China with a further one in four European firms considering exit.

Bettina Schoen-Behanzin, a vice president of the European Chamber, said

“The only thing predictable about China today is its unpredictability, and that is poisonous for the business environment.”

______________________________________________________________________________________

8.US cities fight to attract foreign investors’ money

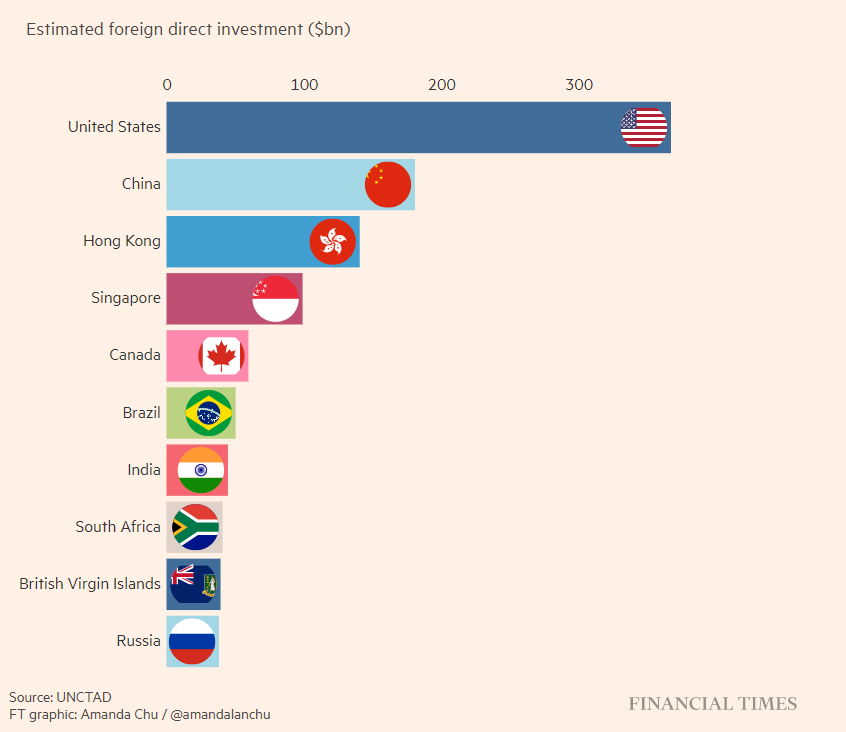

The US tops global charts for FDI inflows in 2021 and has announced 12 megaprojects worth more than $1 billion each already in 2022.

The FT and Nikkei compiled a ranking of the best US cities to invest in with Miami topping the list. There is an interactive chart where you can see the best city for you by toggling your priorities. View https://ig.ft.com/us-cities-index/.

______________________________________________________________________________________

9. US considers regulating outward investment

Credit swapnil-bhagwat-via-unsplash

The US may create another Committee on outward US foreign investment which would scrutinise investments from US into foreign companies.

Similar to The Committee on Foreign Investment in the United States which monitors and vets inward investment into US companies, legislation may enact such a review mechanism for US persons or entities looking to invest overseas.

We recently wrote about India’s rule on roundtripping – the prevention of Indian firms investing in a foreign company which invests or already has investments in India, so the idea is not exactly new, but due to the scale of inward and outward US FDI such legislation is bound to cause global changes to the way countries and companies invest in foreign entities and countries.