-

Sunak v Johnson: what’s the difference for trade?

Sunak is taking his time with trade deals, and it’s said he prefers detail over speed. Whereas Johnson had the remit to do as many trade deals as quickly as possible to fulfil UK’s independent status after Brexit, now things are appearing to slow down.

The much talked about India UK trade deal is now in focus. Sunak met with Indian Prime Minister Modi last Wednesday and hinted he was after improved terms rather than fix it by a deadline. This is a change of approach from the original ‘deal by Diwali’ headlines we saw under Johnson and Truss.

Primary stopping blocks with the India deal include visas and movement of people, but Sunak guaranteed 3,000 places for two-year visas for Indian young professionals.

Chinese President Xi Jinping cancelled a scheduled meeting with Sunak over Britain’s failure to rule out military help for Taiwan in case of an invasion by China.

Sunak also met with US President Joe Biden at G20 in Bali.

Johnson in his reign negotiated 4 trade agreements; 35 trade continuity agreements and started conversations to enter the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

IN a no-holds-barred comment Sunak said that China is the “biggest… threat to our economic security.”

-

China to speed up free trade agreement talks with S.Korea- Xi

One meeting China did not miss at the G20 was with South Korea with the announcement that China and South Korea will apparently ‘accelerate negotiations’ and ‘boost cooperation’ in a bid against the West.

The 2 leaders met last Tuesday and vowed to ‘broaden security’ in an apparent swing at the US which blocks economic deals with China on the basis of national security.

The US has recently pressured the Netherlands, South Korea, Taiwan and Japan to comply with microchip rules to block the flow of microchip technology to China for fears it could be used in weaponry.

Taiwan Semiconductor Manufacturing Company (TSM) is the world’s most valuable semiconductor company. In announced in 2020 it would stop the shipment of silicon wafers to Chinese telco Huawei. Its main plant is in Phoenix, Arizona.

The UK Government last week blocked a takeover of Britain’s largest semiconductor manufacturer by a Chinese company on grounds of national security.

South Korea wants China to confirm it will help in the fight against North Korea and missile testing. South Korea recently said it plans to apply Thaad (Terminal High Altitude Area Defense), a US-made anti-missile shield which China objects to due to a potential threat that the shield could spy on Chinese missile systems.

-

Irish TECHxodus

With the announcement that Meta will cut 11,000 jobs in the face of efficiency problems the Irish tech sector is facing an existential fork in the road.

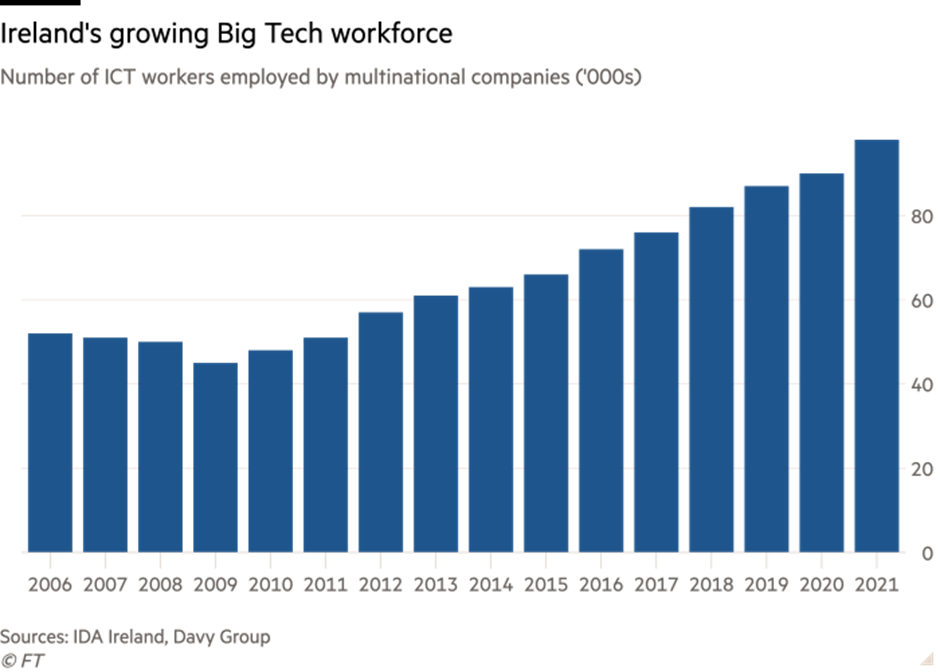

Whilst 20% of jobs in Ireland are attributed to inbound FDI and an increase since the pandemic of 25,000 additional jobs in the tech sector, IDA Ireland has warned of toughening circumstances in the next 2 years with a 6% drop in FDI so far this year.

Meta employs 3,000 people in Ireland and although the number of Irish jobs at risk has not been confirmed the layoff represents 13% of total staff, extrapolated that would mean 400 jobs.

Meta isn’t the only one laying off people – many tech multinationals have made redundancies in the past few months, indicating the tech bubble is about to burst. Massive job cuts at Twitter and Stripe have been cause for concern with IDA Ireland asked to intensify discussions with major employers in an effort to prevent additional loss.

Twitter and Stripe did not abide by statutory legislation that companies must inform the Government prior to cutting staff.

Ireland’s current tax rate is 12.5% but it has agreed to join the global minimum tax rate of 15% although it is not know when that would take effect.

-

$30bn Saudi Korean investment forum

26 agreements worth $30 billion were signed at the Saudi Korean investment forum held last week in Seoul covering sectors such as hydrogen, chemicals, auto, pharma and transport.

The Crown Prince of Saudi visited South Korea to agree MoUs on trade for bilateral cooperation and investment.

Technology and AI were the focus along with energy and primary resources.

South Korea and Saudi Arabia trade ties date back to the 7th century. Korea is the world’s 10th largest economy and has transformed in the past decade to become a modern nation.

Saudi Arabia’s Vision 2030 and National Investment Strategy aims to increase the private sector’s contribution to the economy to 65% and diversify away from oil.

Agreements were between Governments and Businesses.

The IMF states that Saudi Arabia is expected to be the fastest growing G20 economy this year.

UK Prime Minister Rishi Sunak met the Saudi Prince at the G20 summit to discuss cooperation on security and trade. Sunak welcomed ‘strong trade relations’ with the Kingdom.

-

Milan’s record-breaking FDI

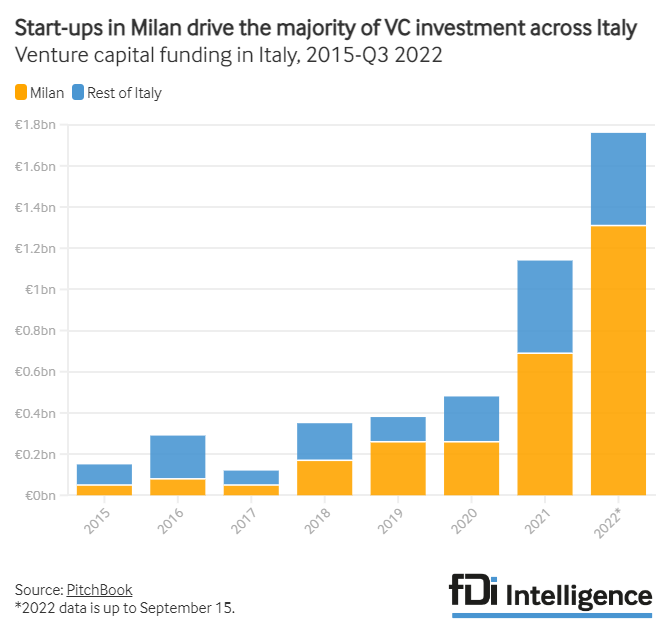

Milan has attracted almost 100% increase on FDI in 2022 amounting to €1.3bn which breaks all previous records.

Fintech is the fastest growing sector with the City home to 2 home-grown unicorns (companies valued >$1bn) and the number of fintech companies growing 30% yoy for the past 8 years. Not a bad track record!

In the past week Macquarie Asset Management has purchased an office building in central Milan for €119mn. Milan is home to 3,300 startups and 70 incubators.

Deemed as the ‘Palo Alto of Italy,’ Milan is located in the region of Lombardy which attracts the most foreign investment of all 20 regions in Italy.