1. Japan FDI

Recently we’ve been writing about foreign investment screening rules which most countries have in place in the interests of national security and protecting valuable national assets.

Japan implemented Foreign Exchange and Trade Act (FEFTA) in 2019 which came into force in 2020. This Act was wider in scope than the Act it replaced and lowered the financial threshold for screening to 1% for public companies.

Japan attracts a relatively low amount of inbound FDI compared to the rest of the developed world. FDI declined by 30% in 2020 according to UNCTAD’s 2021 World Investment Report. Japan is a significant investor in other countries and outward FDI also increased during COVID.

The largest inbound investments in Japan originate in the USA, Singapore, France, the Netherlands and UK in main industries such as financial services, transport equipment manufacturing, communications, pharmaceuticals and healthcare.

Japan inbound and outbound FDI both bounced back in 2021. It is ranked 29 out of 190 countries in in the World Bank’s Ease of Doing Business Report 2020.

2. Uzbekistan FDI promotion plan

Credit snowscat-via-unsplash

Uzbekistan created its Investment Promotion Agency in 2019 which aims to develop inbound FDI in Uzbekistan by providing information to investors along with legal support and assistance when investing in Uzbekistan.

Uzbekistan is the most densely populated country in central Asia and is the second largest producer of cotton in the world. It is rich in natural resources. Its other exports include oil, gas and gold. It became independent in 1991 and has since adopted legislation at a rapid pace to encourage development via foreign investments and local growth.

Uzbekistan’s goals include developing the production industry and in 2020 it implemented a programme to commission large production facilities and capacities.

Uzbekistan has also targeted investment projects by underpinning foreign loans with a state guarantee.

3. Saudi Arabia’s Sovereign Wealth Fund

Credit ekrem-osmanoglu-via-unsplash

Saudi Arabia owns the Public Investment Fund, $600bn sovereign wealth fund which is being used to advance development in sectors such as engineering, clean energy, infrastructure and tourism. It is the sixth largest sovereign wealth fund in the world preceded by China, Norway, Abu Dhabi, Kuwait and Singapore.

The Kingdom of Saudi Arabia under Crown Prince Mohammed Bin Salman is implementing a plan called Vision 2030 which aims to stimulate inward investment to aid the country’s diversification from oil.

The kingdom is developing several interesting projects. The most prominent project, Neom, will fund the world’s largest green hydrogen fund.

Saudi Arabia has recently seen a huge six-fold increase in expatriates from Q2 to Q3 last year.

Trade Horizons advisors are market entry experts: our team of in-country experts assist companies to export, import and enter new locations by using strategies that have stood the test of time and evidence-based advice. Trade Horizons assists companies to plan to distribute and deliver goods or services to a new target market. Contact one of our experts today

4. Attracting FDI into Egypt

Egypt received the second most FDI in Africa in 2022 according to UNCTAD’s World Investment Report.

Egypt has announced its intention to increase inbound FDI to develop a manufacturing hub that can be used by the region.

The war in Ukraine has negatively affected Egypt as Egype imports 62% of its wheat.

An announcement early in 2023 said that its sovereign wealth fund attracted 43% of total foreign investment since 2018 with the funds being spent on 14 projects in sectors such as green hydrogen production, water desalination and education.

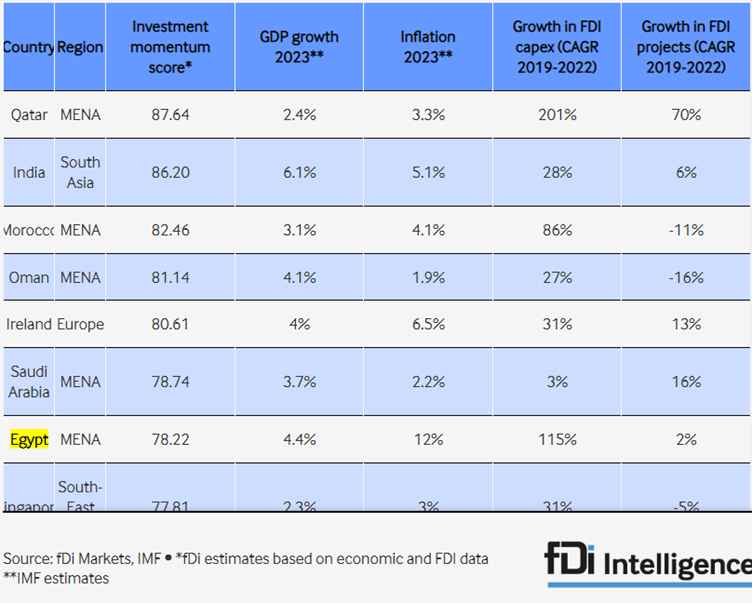

A recent report by fDi intelligence ranks MENA as an attractive destination for FDI in 2023. The FDI Standouts Watchlist 2023 says that Egypt is 7 out of the 50 assessed countries to attract inbound FDI in 2023, after Saudi Arabia and before Singapore.

5. Switzerland FDI destination

Credit ricardo-gomez-angel-via-unsplash

Switzerland is reputed to have a stable macroeconomic and political landscape and attracts a high amount of FDI from a variety of sources in sectors such as banking. Switzerland’s attractive tax regime makes it an attractive place to invest and work.

Although Switzerland is known to have no formal FDI screening Act or process, foreign investors in key sectors such as nuclear, banking or real estate may require permissions or approvals.

Switzerland is ranked 36 out of 190 countries in the World Bank’s Doing Business Report which ranks countries according to how easy it is to do business there.

6. Philippines fastest growing ASEAN nation

The Philippines hosted an Economic Outlook event in London last week attended by Trade Horizons CEO Nick Jordan where it announced 7.6% growth in the past year.

This growth rate makes the Philippines the fastest growing economy in Asia.

High growth rates are expected to continue for the next several years.

The Philippines has implemented a growth plan to attract foreign direct investment to stimulate social and economic development, and the outlook is seen to be very positive for investors and locals based on recent growth results.

Philippines number one trading partner is Japan followed by the United States.

7. Is Europe still competitive?

Credit christian-lue-via-unsplash

Several companies have decided to divest in Europe and have criticised it for being anti-competitive. Several chemical companies have recently announced their decision to leave Europe and a senior chemical company employee stated on a panel at the recent Davos event in Switzerland in January that Europe is at risk of deindustrialisation.

The EU has recently criticised Joe Biden’s Inflation Reduction Act in the US for being anti-competitive and it has caused worry that it will lead to the US attracting more investment away from Europe to the US.

Since then, there have been calls from Europe to increase subsidies for industry too. Europe has recently announced that it’s preparing green legislation which will allow more new sustainable energy projects to be approved faster.