1. Semiconductor FDI

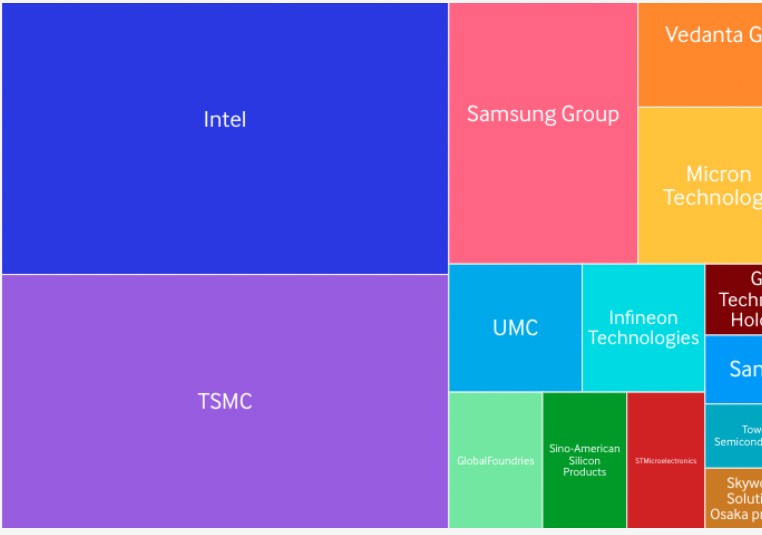

Three companies outweigh the remainder globally of semiconductor investors over the past decade. American Intel, Taiwanese TSMC and South Korean Samsung collectively invested $146 billion from 2013-2022 with 60% of investment occurring in the past year (since 2021).

Countries are vying to domesticate the chip industry with America pledging $52 billion and India $10 billion to attract factories to set up shop. Semiconductors are a key part of electronics devices including computers and electric vehicles.

Before 2020 China had attracted the lion’s share of global investment in semiconductors but that has transitioned as countries seek to onshore manufacturing capabilities for security and commercial reasons.

The global semiconductor market is forecast to double between now and 2030.

2. Canada sponsors Volkswagen EV

Source: PowerCo

The Canadian Government is offering twice the amount of investment pledged by Volkswagen in incentives to open an electric vehicle battery plant in Canada. At $10.6 billion, the subsidy is the largest incentive of its kind ever recorded. It eclipses the $9 billion incentive offered to Ford for the Detroit factory in 2015.

Volkswagen has announced the subsequent cars will be eligible for the Inflation Reduction Act $7,500 credit.

The new battery plant PowerCo will be built on a 370 acre site in Ontario and will have an annual production capacity of 90GWh which could produce up to 1 million cars annually.

3. Biden launches Indo-Pacific scheme

Gage Skidmore via Wikimedia Commons

Biden launched the Indo-Pacific Economic Framework for Prosperity (IPEF) in an apparent effort to compete with the CPTPP.

Some analysts liken the deal to the TPP deal that Trump abolished in 2017, but without lower tariffs. There are 14 ‘members,’ those are: India (partly opted out), Japan, United States, Australia, Fiji, New Zealand, Brunei, Indonesia, South Korea, Malaysia, Philippines, Singapore, Thailand, Vietnam.

CPTPP members enjoy reduced access tariffs to goods and services. Signatories include Canada, Mexico, Peru, Chile, New Zealand, Australia, Brunei, Singapore, Malaysia, Vietnam and Japan.

4. Indonesia positive investment list

President of the Republic of Indonesia Joko Widodo, 2014. Source Wikimedia Commons

Indonesia’s positive investment list includes sectors which are open to 100% foreign ownership. Incentives such as tax rebates and subsidies are available on some activities.

Indonesia’s main exports are oil & gas, rare minerals, palm oil and electrical appliances. Indonesia is rich in nickel which is the fifth most abundant element on earth and used in electric vehicle manufacturing.

Trade Horizons advisors are market entry experts: our team of in-country experts assist companies to export, import and enter new locations by using strategies that have stood the test of time and evidence-based advice. Trade Horizons assists companies to plan to distribute and deliver goods or services to a new target market. Contact one of our experts today.

5. Photonics blockchain solution

Source Rafael Garcin via Unsplash

Stanford University have made a breakthrough invention processing transactions on the blockchain using photonics. LightHash uses ten times less energy than traditional blockchain transaction processing methods.

Traditional blockchain transaction processing methods have been attacked for inefficiency due to the amount of energy each transaction requires to process (however it is debatable how much more energy it requires than the traditional banking system. Vested interests may bring blockchain into disrepute in order to prolong the outdated traditional system in order that old banks and organisations retain control over decentralised ledgers available in the blockchain).

Cryptocurrency mining is currently only efficient for users who pay less than $0.05/kWh which is a heavily discounted energy price. The new low energy photonics chip will make mining available to users all over the world.

6. Tunisian FDI up

Source H

Tunisia has reported a 15% increase in FDI in the first quarter of 2023. The EU is Tunisia’s largest trading partner accounting for 71% of exports (2020). Main exports include goods, food, machinery and transport equipment, textiles and clothing. France is Tunisia’s number one trading country partner followed by Libya.

Tunisia’s is party to the Association Agreement with the EU which was ratified in 1996iff free trade on industrial products. It allows tar. It also has the Agadir agreement between Egypt, Jordan and Morocco which allows for free trade between these countries.

Tunisia is ranked 78 in the World Bank’s Ease of Doing Business Report (2020).

7. Indian FDI in US

Source shalender kumar via Unsplash

India ranks as the 11th recipient of global FDI with the number one investor Mauritius followed by Singapore and the USA.

The USA is the world’s top recipient of FDI with Japan investing the most followed by Netherlands, Canada, and the UK.

A new article published by the Confederation of Indian Industries says that India has invested $40 billion in the US and created 425,000 jobs. Texas is the number one state recipient of Indian FDI followed by Georgia, New Jersey, New York and Massachusetts.

Featured image: FDI Intelligence