International business expansion guidance and advice

Trade Horizons’ Market Entry Blog

Our market entry blog covers a range of topics relating to international business expansion. Articles tackle many different subjects, including the initial planning and preparation stages of growing your business, advances in technology you can take advantage of, through to sales & marketing, packaging and branding advice. Written by leading experts in their field, you’ll be sure to find something of interest and real-world practical advice if you are looking to grow your business around the world.

Latest Articles

July #4 Trade News: Mercosur, Turkey, Netherlands, Houston, UK, Spain

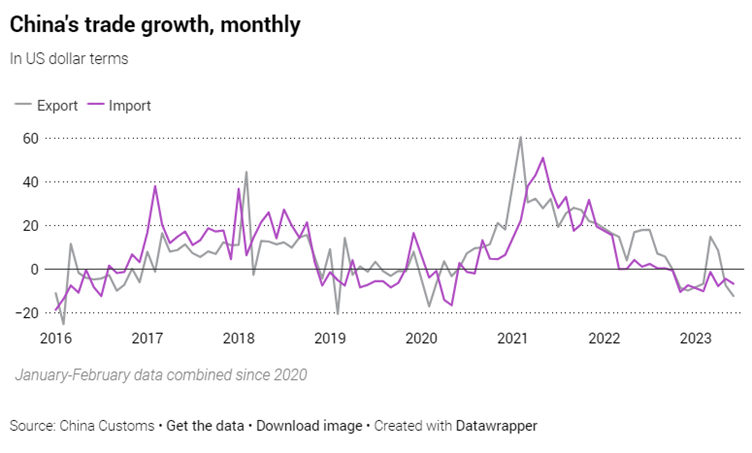

India China trade is down almost 1% in the first half of 2023 with China’s overall foreign trade dropping 5% in the same period. Exports were down 12.4% to June 2023 compared with the same period in 2021. Trade in goods is down 56m with the US in the first 5 months of 2023 compared to the same period last year. The US is China’s largest trading partner. UK exports to China were up 37.7% in 2022 whilst imports were up only 10% in the same period. The EU’s imports from China were down in 2022 while exports remained flat.

July #3 Trade News: China, Israel Arab, Twitter, Illinois, Philippines, Turkey

India China trade is down almost 1% in the first half of 2023 with China’s overall foreign trade dropping 5% in the same period. Exports were down 12.4% to June 2023 compared with the same period in 2021. Trade in goods is down 56m with the US in the first 5 months of 2023 compared to the same period last year. The US is China’s largest trading partner. UK exports to China were up 37.7% in 2022 whilst imports were up only 10% in the same period. The EU’s imports from China were down in 2022 while exports remained flat.

Geschäftsanbahnung in das Vereinigte Königreich im Bereich Health- und Medtech

Vom 11. bis zum 14. März 2024 führt Trade Horizons Limited, im Auftrag des Bundesministeriums für Wirtschaft und Klimaschutz, eine Geschäftsanbahnungsreise im Bereich Gesundheitswirtschaft nach London durch. Das Projekt richtet sich vorwiegend an kleine und mittlere deutsche Unternehmen, Selbständige der gewerblichen Wirtschaft sowie fachbezogene Freie Berufe und wirtschaftsnahe Dienstleister in den Bereichen der Medizintechnik, Diagnostik und Krankenhauseinrichtung wie z.B. Lieferanten und Hersteller von chirurgischen und labortechnischen Geräten, Implantaten oder Prothesen, sterilen Verpackungen für Krankenhausverfahren sowie Dienstleistende im Bereich der Gesundheitstechnologie (HealthTech) usw.

Geschäftsanbahnung in den USA im Bereich Luftfahrt

Vom 05. bis zum 09. Februar 2024 führt Trade Horizons Limited, im Auftrag des Bundesministeriums für Wirtschaft und Klimaschutz, eine Geschäftsanbahnungsreise im Bereich Luftfahrt in die USA (Seattle) durch. Das Projekt richtet sich vorwiegend an kleine und mittlere deutsche Unternehmen, Selbständige der gewerblichen Wirtschaft sowie fachbezogene Freie Berufe und wirtschaftsnahe Dienstleister im Bereich der Luft- und Raumfahrtnachhaltigkeit. Dazu gehören nachhaltige Flugkraftstoffe, neue Elektro- und Wasserstofftechnologien, Infrastruktur und betriebliche Effizienz, Kompensationen, Kohlenstoffabscheidung und mehr.

July #2 Trade News: South Africa, Egypt, UAE, LatAm, US Taiwan, UK

Uzbekistan located in Central Asia has been a model country when it comes to attracting FDI in the past 6 years when it stopped being a Soviet state. The incoming President at the death of long-time autocrat in 2016 set about opening up the country to the West, liberalising the economy and becoming a free market.

Trade Mission: German US e-mobility delegation

Trade Horizons Limited hosted a a business delegation of German SMEs operating in the E-Mobility industry to Detroit (MI) and Columbus (OH), on instruction from the German Federal Ministry for Economics and Climate Action. 9 German SMEs, operating in various subsectors of EV ⛽️ (charging systems and charging infrastructure, batteries and IT-specific services, drive systems of electric vehicles and for the electrification of infrastructure, thermal management) met with American businesses and institutions, buyers and market experts to develop German-American relationships, expand market activities and learn about the American EV ecosystem.