International business expansion guidance and advice

Trade Horizons’ Market Entry Blog

Our market entry blog covers a range of topics relating to international business expansion. Articles tackle many different subjects, including the initial planning and preparation stages of growing your business, advances in technology you can take advantage of, through to sales & marketing, packaging and branding advice. Written by leading experts in their field, you’ll be sure to find something of interest and real-world practical advice if you are looking to grow your business around the world.

Latest Articles

Nov #5 Update: Indianapolis grows, FDO outlook 2030, Colombia tax reform, India healthcare, Australia India FDI, India healthcare

Global FDI is forecast to decrease further as countries enter into recessions caused by high cost of living, global food shortages, inflation, rising energy prices and massive national debt. The Bank of England expects a UK recession of 5 quarters long with a retraction of 2% on the economy starting later in 2022. Unctad says the global FDI decline is likely to continue until 2023. Global FDI flows in the second quarter of 2022 were down 31% on the first quarter. Investor uncertainty is very high now leading to a reduction in investing.

Nov #4: UK at G20, China South Korea, Irish exodus, Saudi, Milan fintech

Sunak is taking his time with trade deals, and it’s said he prefers detail over speed. Whereas Johnson had the remit to do as many trade deals as quickly as possible to fulfil UK’s independent status after Brexit, now things are appearing to slow down. The much talked about India UK trade deal is now in focus. Sunak met with Indian Prime Minister Modi last Wednesday and hinted he was after improved terms rather than fix it by a deadline. This is a change of approach from the original ‘deal by Diwali’ headlines we saw under Johnson and Truss.

Nov #3 Update: Fintech’s future, Red Latin America, Kenya South Africa, El Salvador, ASEAN, Cold Chain, Ireland, Australia, Semiconductors, Medica

Global FDI is forecast to decrease further as countries enter into recessions caused by high cost of living, global food shortages, inflation, rising energy prices and massive national debt. The Bank of England expects a UK recession of 5 quarters long with a retraction of 2% on the economy starting later in 2022. Unctad says the global FDI decline is likely to continue until 2023. Global FDI flows in the second quarter of 2022 were down 31% on the first quarter. Investor uncertainty is very high now leading to a reduction in investing.

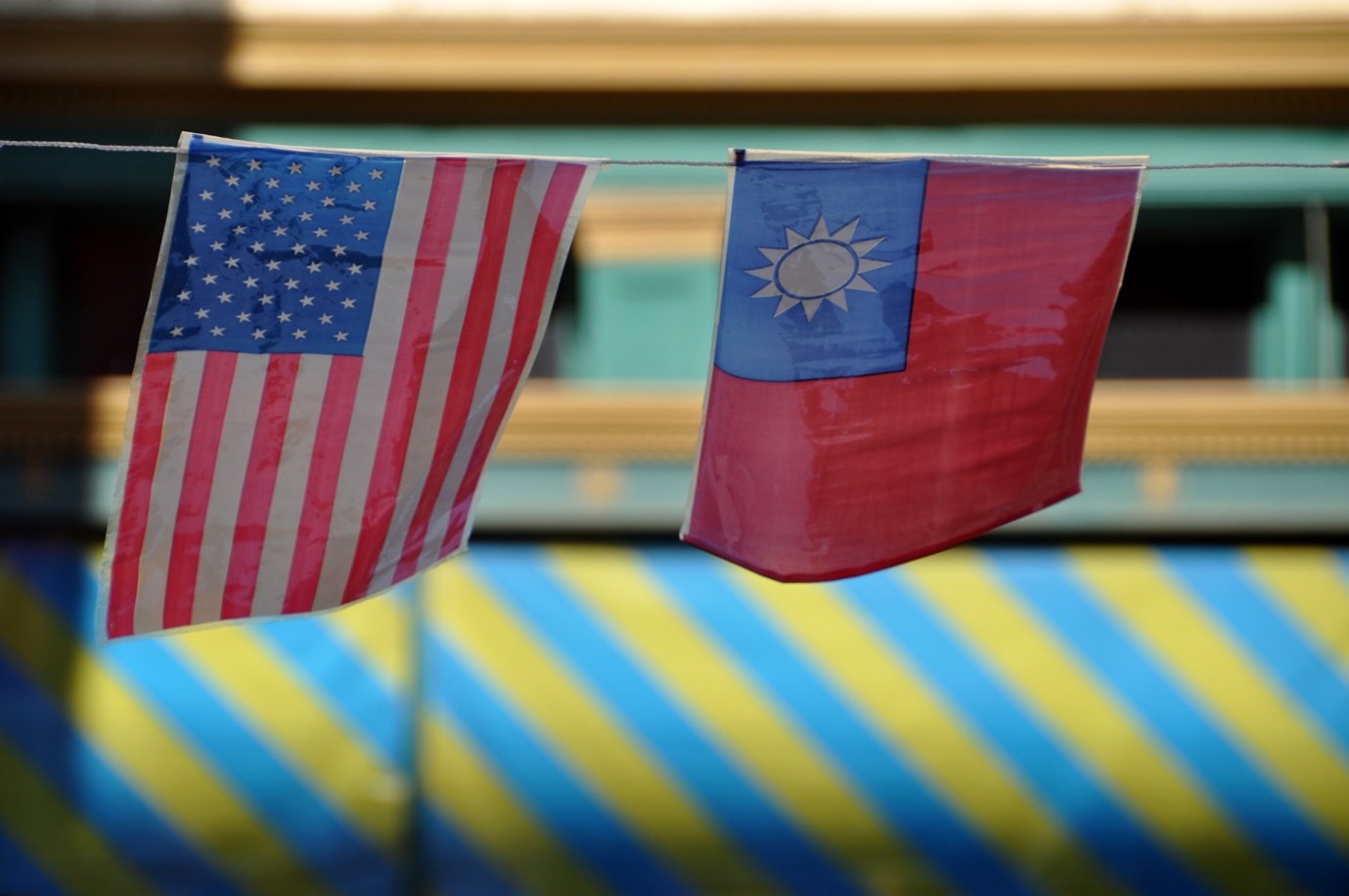

Nov#2 Update: Taiwan America FTA, Amazon £53m female tech fund, Latin America currency, Best countries, Japan India FDI, San Jose contraction

Global FDI is forecast to decrease further as countries enter into recessions caused by high cost of living, global food shortages, inflation, rising energy prices and massive national debt. The Bank of England expects a UK recession of 5 quarters long with a retraction of 2% on the economy starting later in 2022. Unctad says the global FDI decline is likely to continue until 2023. Global FDI flows in the second quarter of 2022 were down 31% on the first quarter. Investor uncertainty is very high now leading to a reduction in investing.

Trade Horizons hosts German e-mobility pioneers in the UK!

From October 24th to 27th, 2022, Trade Horizons conducted a business development trip for German SMEs in the field of e-mobility & autonomous driving to the West Midlands, UK's center of electromobility. The trip is part of the Market Development Program arranged by the German Federal Ministry for Economic Affairs and Climate Action (BMWK).

“On the Ground” Commercial Due Diligence: Middle Eastern market.

International clients increasingly question the need to undertake the commercial due diligence process when addressing a potential distributor partnership agreement. They tend to skip the due diligence process and go straight to the preparation of the transaction contract, arguing that it is time consuming and costly, and they can rely on publicly available information on the target’s business as well as with the inclusion of broad indemnities in the transaction documents.