International business expansion guidance and advice

Trade Horizons’ Market Entry Blog

Our market entry blog covers a range of topics relating to international business expansion. Articles tackle many different subjects, including the initial planning and preparation stages of growing your business, advances in technology you can take advantage of, through to sales & marketing, packaging and branding advice. Written by leading experts in their field, you’ll be sure to find something of interest and real-world practical advice if you are looking to grow your business around the world.

Latest Articles

US Inflation Reduction Act to prompt FTAs with EU and Japan

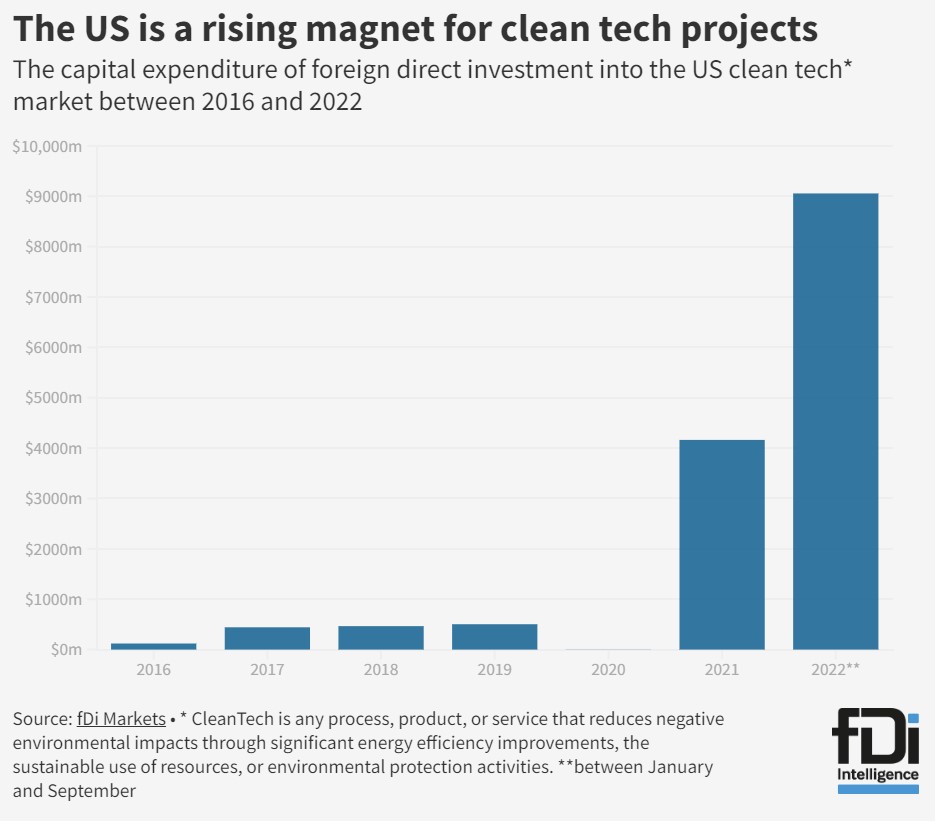

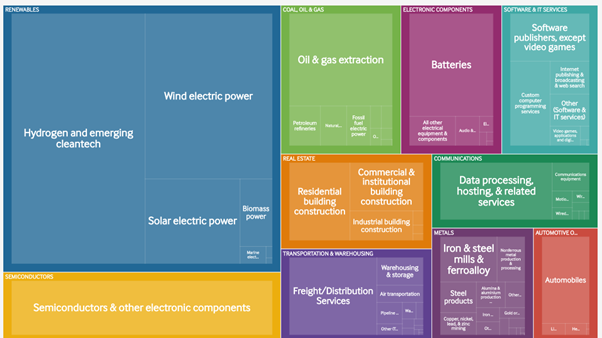

Neither the EU nor Japan have current trade deals with the US. US Treasury Secretary Janet Yellen recently announced that she would expect both those countries to have to negotiate new deals if they are to be considered for tax credits under the new Inflation Reduction Act (IRA). The new flagship legislation commits $369bn in tax credits and subsidies to boost clean energy projects however it is not without its limitations, or requirements of manufacturers.

Feb #3 Trade News: Startups, Bogotá, DIT closes, Indonesian nickel, Europe, Global investment summit

It’s no surprise that the US is ranked top for startup companies in terms of ecosystems globally. Access to funding, expertise, knowhow and infrastructure makes famous the US and San Francisco in particular for excelling at growing young companies. The second most attractive destination for startups is the UK. The UK’s legal system, language, timezone and ease of doing business make it a great location for young companies to grow and prosper, especially those doing business internationally.

Feb #2 Trade News: Trade Priorities, Fintech, UK Italy, Europe FDI, Mexico, UAE

2023 is set to be a big year for Photonics, the science and technology of light. Applications extend to lasers, screens, lamps, semiconductors and medical instruments. Laser can be used to cut or stencil hard or uneven surfaces to minute detail with functions in manufacturing, technology and medicine. Optical fibres communicate sound and binary data across distances in our communication networks. Lidar in the robotics world is light that is used to remote control robots for equipment maintenance and virtual reality training.

What just happened in the UK?

Was it a cabinet reshuffle? No. It’s an opportunity for growth absent a fiscal stimulus. Be part of it! Was it a cabinet reshuffle, not at all, it was a reshuffle in key government departments involved in growing the British economy indicating, I believe, the British Government is desperately searching for the dynamic entrepreneurial leadership to make an actual strategy for growth a reality. Particularly so absent the tax cutting route of fiscal stimulus, in fact the opposite! UK Corporation Tax goes up in the spring from 19% to 25% after many years of steady reductions.

Feb #1 Trade News: 2022 FDI, Photonics, Cambridge Tech, Job creators, Electric vehicles, UK FTAs, Europe Mercosur, Sicily solar panels

2023 is set to be a big year for Photonics, the science and technology of light. Applications extend to lasers, screens, lamps, semiconductors and medical instruments. Laser can be used to cut or stencil hard or uneven surfaces to minute detail with functions in manufacturing, technology and medicine. Optical fibres communicate sound and binary data across distances in our communication networks. Lidar in the robotics world is light that is used to remote control robots for equipment maintenance and virtual reality training.

Consider Vietnam!

Why Consider Vietnam and Asia Pacific for your International Expansion Plans and Corporate Growth? I have been coming to Vietnam and Asia Pacific for over 10 years from Washington State USA, first as a traveller enthralled with the people and dynamic cultures, second as a business representative for other companies, and now in 2023, as a permanent resident of the country. I’ve chosen to open my own Vietnam based company and field representative office for Trade Horizons.