International business expansion guidance and advice

Trade Horizons’ Market Entry Blog

Our market entry blog covers a range of topics relating to international business expansion. Articles tackle many different subjects, including the initial planning and preparation stages of growing your business, advances in technology you can take advantage of, through to sales & marketing, packaging and branding advice. Written by leading experts in their field, you’ll be sure to find something of interest and real-world practical advice if you are looking to grow your business around the world.

Latest Articles

Embrace it Africa!

The world population will reach 9.1 billion in 2050 from the present 7.9 billion feeding that number of people with increasing global prosperity we will need to produce 70% more food. That’s a huge expanding market for the agricultural sector. So how do we attract African youth with the right entrepreneurial mindset to succeed into their agricultural sector? With a focus on productivity! t. Applications extend to lasers, screens, lamps, semiconductors and medical instruments. Laser can be used to cut or stencil hard or uneven surfaces to minute detail with functions in manufacturing, technology and medicine. Optical fibres communicate sound and binary data across distances in our communication networks. Lidar in the robotics world is light that is used to remote control robots for equipment maintenance and virtual reality training.

Jan #5: Japan, Uzbekistan, Saudi, Egypt, Switzerland, Philippines, Europe

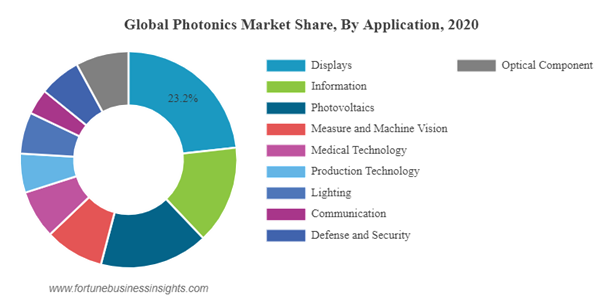

2023 is set to be a big year for Photonics, the science and technology of light. Applications extend to lasers, screens, lamps, semiconductors and medical instruments. Laser can be used to cut or stencil hard or uneven surfaces to minute detail with functions in manufacturing, technology and medicine. Optical fibres communicate sound and binary data across distances in our communication networks. Lidar in the robotics world is light that is used to remote control robots for equipment maintenance and virtual reality training.

Jan #4: Photonics, USMCA, AfCFTA, Europe India FTA, CPTPP, IRA, Saudi FDI, Wrap up

2023 is set to be a big year for Photonics, the science and technology of light. Applications extend to lasers, screens, lamps, semiconductors and medical instruments. Laser can be used to cut or stencil hard or uneven surfaces to minute detail with functions in manufacturing, technology and medicine. Optical fibres communicate sound and binary data across distances in our communication networks. Lidar in the robotics world is light that is used to remote control robots for equipment maintenance and virtual reality training.

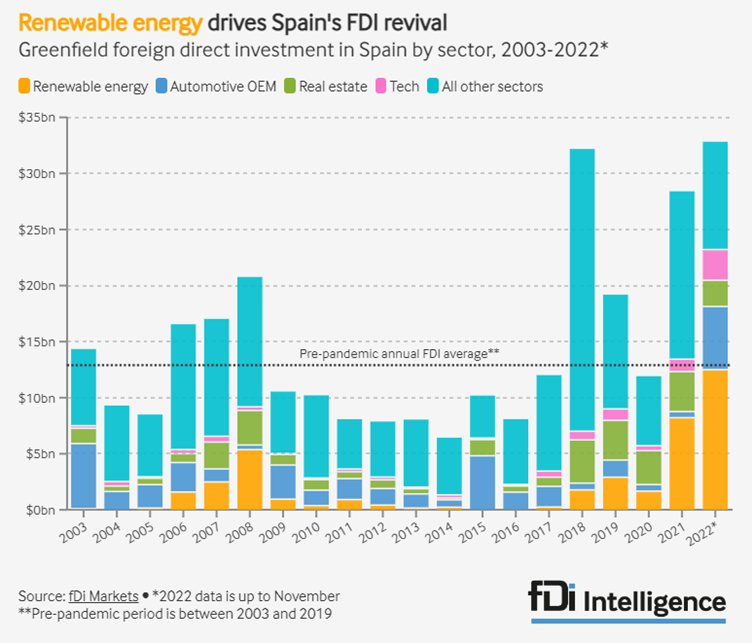

Jan #3: Spanish hydrogen, 2023 Outlook, US FTA, Chinese EVs in Thailand, Highlights, Legislation load

2022 broke records for Spain for greenfield foreign investments due to sustainability and green energy projects. Spain’s economy had the largest contraction in the Euorozone due to COVID at 11% in 2020 but grew 5.1% in 2021 funded by €140bn from Next Generation EU recovery funds. Spain has a high level of public debt and a large pension load due to the ageing population. Spain permits up to 100% of foreign ownership in a company. It reported 827 greenfield projects in 2021. Its largest investor is Switzerland followed by the US, the UK and France. A green economy remains high on Spanish priority lists and renewable energy projects accounted for the bulk of investments in 2022. Hydrogen production was announced in Spain’s National Energy and Climate Plan (“NECP”) as a key focus due to the topical landscape of sunny & windy hillsides being perfect for hydrogen production plants.

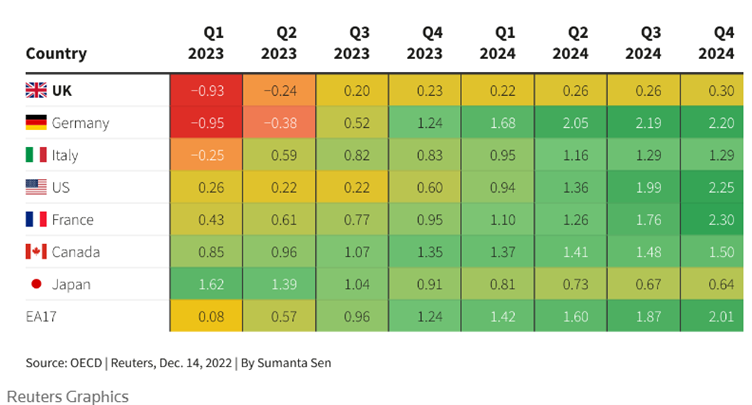

Jan #2: 2023 outlook, M&A, Green hydrogen, Australia EU deal, UK trade deals

Reuters says that Britain will lag behind global competitors in 2023 due to the recession, lack of Brexit recovery and inflation. UK’s GDP is forecast to grow slower than all the other G7 nations. 2022 was the worst year for Government debt since 1994 for Britain. The UK attracted 1,589 FDI projects in 2021-22 of which 38% were new investments with the remainder being mergers & acquisitions or expansions of existing projects. The number of projects has basically remained stagnant since 2018 but is a decrease from 2017-18. However, 85,000 new jobs were created out of inward FDI projects in 2021-22 which is more jobs than other years (data since 2017). The most projects went to London (444) with 444 to the rest of England, 119 to Scotland, 43 to Wales and 32 to Ireland. Britain’s largest investor is the United States followed by India and then Germany.

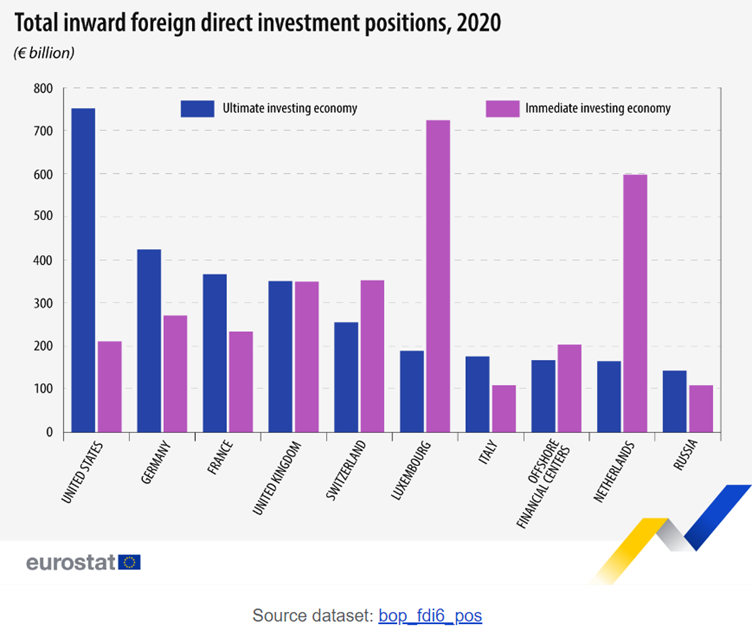

Jan #1: US, EU, Ireland, 2023, Hybrid working, India, Bangladesh, Australia

The United States topped inward investment into Europe charts in 2020 with US investments accounting for a quarter of foreign inward investment in Europe. The US invested €752 billion out of a total €2 990 billion in 2020. The next largest investor was Germany followed by France and the United Kingdom. In 2021, Netherlands was the second largest recipient of outward FDI from the United States, with Japan topping the list at number 1. Canada was third followed by the UK then Germany, Luxembourg, Switzerland and France.