Blog Category: News

Trade Horizons hosts German e-mobility pioneers in the UK!

From October 24th to 27th, 2022, Trade Horizons conducted a business development trip for German SMEs in the field of e-mobility & autonomous driving to the West Midlands, UK's center of electromobility. The trip is part of the Market Development Program arranged by the German Federal Ministry for Economic Affairs and Climate Action (BMWK).

“On the Ground” Commercial Due Diligence: Middle Eastern market.

International clients increasingly question the need to undertake the commercial due diligence process when addressing a potential distributor partnership agreement. They tend to skip the due diligence process and go straight to the preparation of the transaction contract, arguing that it is time consuming and costly, and they can rely on publicly available information on the target’s business as well as with the inclusion of broad indemnities in the transaction documents.

Nov#1 Update: Global FDI, Kenya Spain trade, Private Equity, Romania, Egypt, Korean tax, UK India FTA

Global FDI is forecast to decrease further as countries enter into recessions caused by high cost of living, global food shortages, inflation, rising energy prices and massive national debt. The Bank of England expects a UK recession of 5 quarters long with a retraction of 2% on the economy starting later in 2022. Unctad says the global FDI decline is likely to continue until 2023. Global FDI flows in the second quarter of 2022 were down 31% on the first quarter. Investor uncertainty is very high now leading to a reduction in investing.

Oct #4 Update: Indonesian cars, Malta FDI, India UK FTA, EU investing, Panama China, Kazakhstan

Japan currently manufactures Toyota, Daihatsu, Honda and Mitsubishi in Indonesia. Recently there has been a drive by Indonesia to attract car manufacturers to the country. For example, it hosted Tesla founder Elon Musk recently but he declined to comment on his visit. Indonesia is the worlds fourth most populous nation but only 4 out of every hundred people are car owners in country. The Indonesian automobile manufacturers association says that vehicle sales were up 19% in September 2022. Citroen is the latest manufacturer to announce operations in Indonesia with first models due to roll out in 2023.

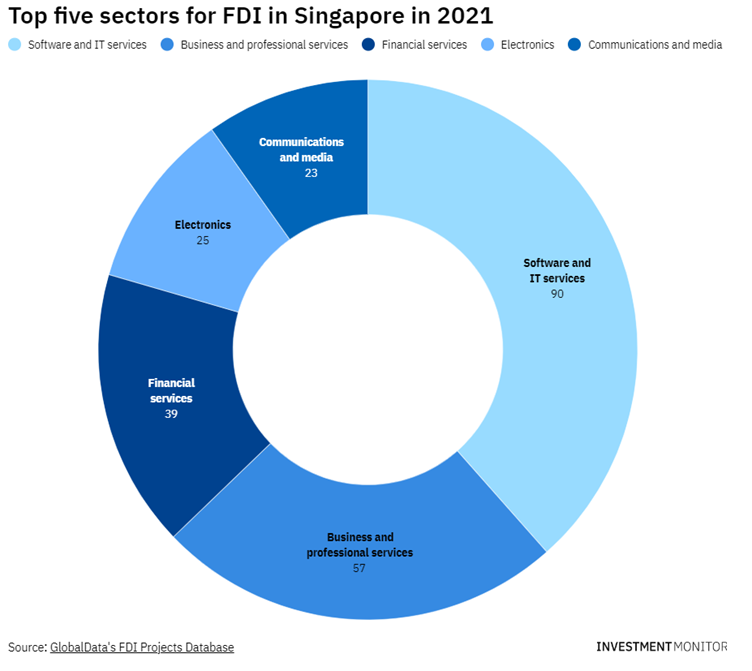

Oct #3 Update: Singapore FDI, Korean FDI to tax havens, Nigeria diversification, UK CPTPP, Indian carmakers

Singapore is the second easiest country to do business in according to the OECD’s Ease of Doing Business Report and had always held top spot until being overtaken by New Zealand in 2018. It is the third smallest country in Asia and is 8th in the world attracting FDI, the most in Asia relative to GDP. In 2022 Singapore so far has attracted $US74 billion FDI which represents 21% of its GDP. Regarding investor protection Singapore ranks highly compared to Asia, the US and Germany.

Oct #2 Update: No India NZ FTA, No UK FTAs, Australia UK supply chain partnership, Reviving the Commonwealth, UK India FTA backtrack, Korean FDI, China suffers, US cities, US regulates outward investment.

New Zealand and India have decided to cease free trade agreement discussions in favour of ‘business collaborations.’ Indian External Affairs Minister Jaishankar said that they wanted to now encourage more business collaborations without a free trade agreement. New Zealand Foreign Minister Nanaia Mahuta said the fta was no longer on her Government’s list of priorities.

Oct #1 Update: French employment rules, US electric vehicles, FDI North England, India FDI, Truss and net zero

Currently French law says that French employers must reimburse employees for 50% of the cost of travel between their residence & place of work. Apparently since COVID 30% of HR Directors have received requests from employees to move further from their place of work. A decision in July reinstated the rule that no matter the place of residence, 50% of travel costs must be reimbursed.

#4 September Update: UAE-South Korea trade, Vietnam transition, India-UK FTA, EU_Australia trade, Canada-EU trade, India investor protection, Sub-Sarahan African debt, South Africa MFN clause

Non-oil bilateral trade between UAE and South Korea has grown 19% in the first quarter of 2022 to $1.3 billion. The UAE is the only country in the Middle East which has a special strategic partnership with South Korea. South Korea invests $2 billion in the UAE and UAE invests $637 million in South Korea. The UAE has 100 double taxation treaties and 67 bilateral investment treaties and 40 freezones with benefits such as tax incentives and exemptions, 100 per cent business ownership without the need of a national agent and long-term visas.

#3 September Update: Lithium demand, ESG in Asia, Crypto tax, Fortress China, Cyprus FDI regs, Vietnam FDI

China currently processes 90% of the world’s rare earths and 60% of lithium. Lithium is a crucial component in electric car battery manufacturing. Europe is implementing the European Critical Raw Materials Act to avoid falling into the oil & gas trap where it is completely dependent on other countries for its energy. But at the same time has decided to deem three lithium salts as “known human reproductive toxicants,” which makes things even more complicated. China dominates global lithium processing and therefore supply. Prices have risen 50-90% in the past year. Europe has decided to take action to diversify the supply chain away from China to avoid future reliance.

#2 September Update: UK Australia FTA, Ireland’s top 10 foreign investors, Cuba opens, Portugal Golden Visa Changes, Detroit motor revamp

The UK has signed a free trade deal with Australia since leaving the European Union. It was the first free trade deal to be signed. It is expected to increase trade with Australia by 53% boosting the economy by £2.3 billion. Australian exports already support more than 100,000 UK jobs and demand is expected to grow by 30% over the next decade. UK food and drink exports to Australia will be tariff free. Biscuits, whisky, gin and cheese are expected to grow in demand due to high quality UK produce. Australia is already the 8th largest market for UK whisky exports.