Blog Category: News

#5 August Update: Global Chemicals FDI, Algeria analysis, Min tax to hurt US FDI, London global hub, UK International Trade Week.

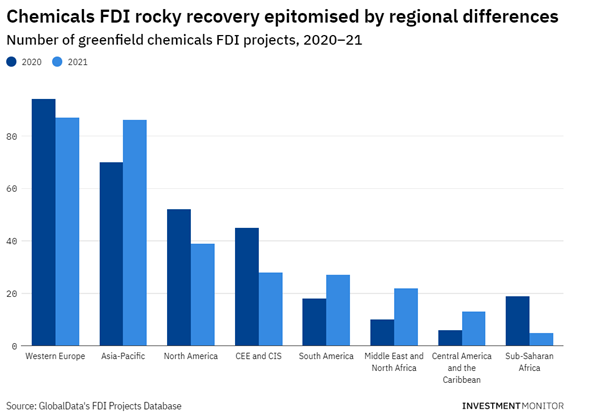

Investment Monitor says that FDI in the chemical sector is slow to recover after the pandemic with other sectors gaining pace back to pre-pandemic levels faster. The number of chemical projects in Asia Pacific dropped by 27% in 2020 compared to 2019 but regained in 2021, still slightly down on 2019 pre-pandemic levels. Western Europe and Asia-Pacific account for half of global chemical FDI. China overtook US as the leading country to attract inbound investment into chemical projects but UAE is the fastest growing region. Manufacturing sector accounts for two thirds of operations for chemical use.

#4 August Update: Future of supply chain, Developing Countries Trading Scheme, EV reimbursement tax shambles, FDI by country, Lithuania FDI,

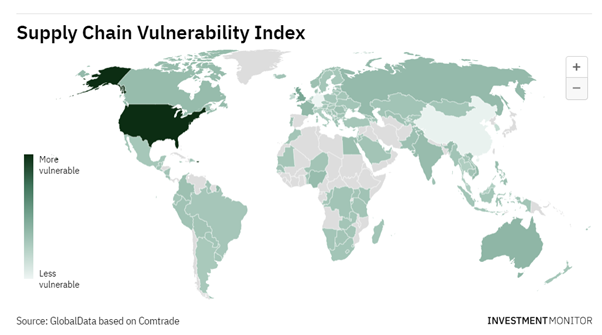

Supply chain issues caused by the pandemic touched every area of business and personal lives. GlobalData created the supply chain vulnerability index map showing US as most vulnerable and Germany as least vulnerable. GlobalData is headquartered in the United Kingdom so that should clear up any doubts about independence. The UK is apparently somewhere towards the lower end of vulnerability. Since the pandemic we have seen nations wholesale decoupling their supply chain from China to avoid overreliance on it and a repeat of the troubles during COVID.

#3 August Update: ESG Sustainable FDI, Restrictiveness Index, UK graduate visas, Portuguese speakers, UK R&D startups suffer, Japan startup ecosystem

A new study has shown that projects that mention Environment, Social & Governance are driving FDI at an increasing rate across the globe. Sustainable investing can bring about sustainable development especially in emerging economies. Usually, the result of FDI is a degradation of natural resources or ecosystems. The race to net zero brought about by climate change research resulting in organisations and countries committing to reduce their damage to the atmosphere and environment has accelerated DI as it gives the world a new topic to develop and invest in. GlobalData’s Company Filings Analytics Trends & Signals Q1 2022 report measures mentions of the UN’s Sustainable Development Goals (SDGs) in FDI projects which was 23% higher in 22Q1 that 21Q4.

#2 August Update: Nigeria FDI decline, Global FDI 2022, London top for expansion, US Climate Bill, Egypt tech sector, SME export

You may have seen the headlines – Nigeria won $223m FDI in the first 5 months of 2022. The real picture, as usual, is a little more complex. Although this figure is up on the 2021 amount in the same period, it is down almost 30% on the same period in 2020. Now whilst global FDI is declining across the board, in 2021 Africa itself reported $44bn increase in 2021 from 2020. West Africa FDI, where Nigeria is located, increased by $5bn from $9bn to $14bn. Whereas Nigeria reported a decline from 2020 to 2021. Predictions for 2022 are dire due to political instability and rising interest rates leading to a loss of benefit for portfolio investors who use arbitrage when interest rates are low at home, to invest in emerging economies. That opportunity now becomes lost because high interest rates in the home country deletes any benefit.

#1 August Update: Technology arbitration, UK FDI, MENA regions, Dubai real estate, UK Visa changes, Spanish digital nomads, Ireland FDI law

Investor state arbitration is when a company claims a breach of a state’s obligation to protect the investment it made when the company entered the country. A claim can be made if a bilateral investment treaty exists between the headquarter country and host country, and in some cases if a free trade agreement exists. If you enter a country that has a bilateral or free trade agreement with your home country, you may be able to enact investor state arbitration if the host country does not fulfil its obligations to you which is cheaper faster and less public than litigation.

#4 July Update: Pakistan, Indonesia, Australia fees, Costa Rica, Kenya fintech Korea cuts tax, EU startup funding

In June 2022 Pakistan has attracted the highest level of FDI since October 2020 according to a report. The results indicate recovery after the pandemic. Pakistan has had a troubled few years what with the latest development Prime Minister Imran Khan forced out of the position to be replaced by the brother of the Pakistan Muslim League-N (PMLN) candidate accused of corruption and the economic crisis including dwindling foreign currency reserves and higher fiscal and current account deficits.

#3 July Update: Chile FDI, Euro FDI crash, Data Reform Bill, Global minimum tax, Sovereign tax changes, Training & innovation linked

The Chilean Central Bank has reported record-breaking FDI levels in the first 6 months of 2022 with levels 66% above the same period in 2020. US$13.7 billion is the highest level ever recorded. Most popular sectors are retail, manufacturing and wholesale. Around 65,000 companies in Chile are financed by foreign capital which equates to around 10%. One United Nations report says that the increase is fuelled by several large acquisitions and renewed interest in mining projects.

July #2 Update: Ireland FDI, Cyprus tax reform, How to fund robotic startups webinar, EU foreign subsidies regulation, UK energy security bill, UAE NextGen FDI, Eu, Africa, India entry

Cyprus has launched an action plan to increase tax certainty and attractiveness to foreign investors. Currently is takes less than 2 weeks to setup a business in Cyprus and open a bank account however the regulatory environment is complex and uncertain, making it a high-risk destination. The country has one of the lowest costs of doing business and is strategically located. The reforms are designed to improve the environment for investors and increase foreign direct investment. The most notable reform regards transfer pricing: the Cypriot Government has recently passed legislation to bring it into line with OECD standards. This development will increase transparency and therefore decrease risk of doing business in Cyprus. Previously, no detailed documentation existed on this topic in particular the arms-length principle.

July #1 Update: National Manufacturing Day, Bahrain diversifies, Lain America FDI, Belgian foreign investment rule changes, Europe outlaws arbitration, Investors exit China, Developing Asia FDI, HSBC £250 startup fund

The first National Manufacturing Day will be held on 7 July. Initiated by MAKE UK, the UK’s Manufacturing industry body, the day will host a number of events nationally hosted by member companies. So far 109 employers have pledged to open their doors to the local community so people can see how things are made, and are hosting their own events including RNLI opening its doors to its Lifeboat Centre in Poole Dorset where lifeboats are manufactured.

June #3 Update: Global EV industry, Taiwan tech hub, Best startup cities, Romania FDI, New UK digital strategy

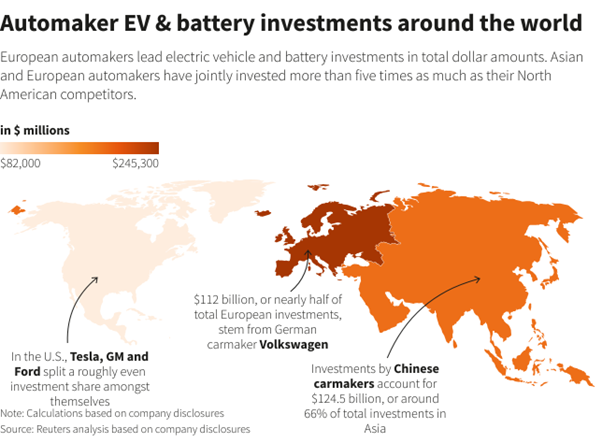

Global automobile manufacturers plan to spend more than half a trillion dollars on vehicles and batteries by 2030 according to the Global EV Outlook report. Zero carbon and ultra low emission zones in major cities have increased the previous estimate over the past three years by almost 100%. Electric vehicle sales doubled in 2021 spurred on by rising fuel prices, improved infrastructure and emissions charges from governments. Electric vehicle sales are up 75% in the first quarter of 2022 on 2021.